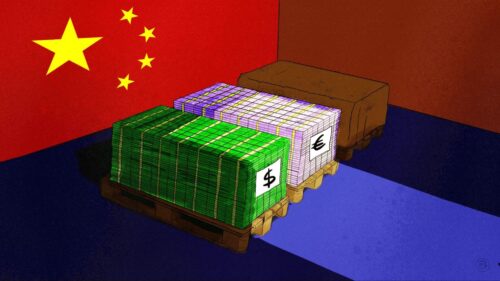

People’s Daily: A ‘currency cold war’ is brewing among developed countries

A curious theory on currency manipulation from the Party's in-house newspaper.

Accusing China of manipulating its currency to compete unfairly with the U.S. has been a feature of American politics since the 1990s, when the U.S. Treasury last officially designated China a “currency manipulator.” More recently, Donald Trump made it a key issue during his 2016 presidential campaign, and vowed to label China a currency manipulator on the first day of his presidency (this did not happen).

It is remarkable, therefore, that an article published earlier this week in Party mouthpiece newspaper the People’s Daily ran a story (in Chinese) on a brewing “currency cold war” between developed countries. The term “currency cold war” was coined by the Pacific Asset Management Company to refer to secret or hidden attempts by a country’s national central bank to devalue the national currency. The “war” is fought like this: While on the surface, Western developed countries are actively negotiating economic trade deals, behind the scenes, they may be discreetly engaged in policies such as quantitative easing (i.e., adding new money to the money supply so that the value of currency will gradually decline) or implementing negative interest rates (a policy also associated with declining currency value). These hidden actions, the People’s Daily reports, have been widely condemned and are so contentious that they could even develop into a “hot war” (i.e., a real, violent war).

Examples of a “currency cold war” cited by the article include close to 0 percent interest rates on 10-year Japanese bond yields, and the European Central Bank quietly lowering the threshold for asset buys — a form of economic stimulus the EU had put in place to boost European economies, which it is now rolling back.

The article explains that the U.S. has repeatedly accused Japan and Germany of lowering the exchange rate. It observes that it is possible that under Donald Trump’s strict leadership, Germany and Japan may not dare to continue their currency manipulation practices. However, as long as these countries feel the need to engage in these policies to boost their economies, the article warns, even Trump may have no power to stop them.

In conclusion, the People’s Daily suggests that whether these practices remain a “cold war” or develop into a true “hot war,” the fact of currency manipulation among developed countries will certainly cause harm to the current order of international finance and trade. The current system of global trade, it warns, can be destroyed in a day. The risks must not be underestimated.

From the vantage point of the U.S., it is worth noting that this article did not mention the word “China” once.