Is America’s bright spot in agricultural trade with China fading?

American farmers have done well from trade with China, but there are signs of problems to come.

President Donald Trump signed two executive orders on March 24 in an attempt to reduce the U.S.’s long-standing trade deficits and deliver on his vow to “start winning again” on trade. But in an era when the phrase “trade with China” has become synonymous with “lost American jobs,” the opposite may actually be true for the U.S. farm industry.

Devoting one-third of planted acres to exports and boasting a trade surplus since 1960, America’s trade-reliant agriculture industry sends most of its exports to China. China’s agricultural imports from the U.S. have more than tripled in the past decade, reaching $21 billion dollars in 2016. However, this bright spot in U.S.-China relations may be fading. And in the face of mounting disagreements on the foreign and domestic policy fronts, China is increasingly looking elsewhere for suppliers.

The United States has long been the leading supplier of China’s agricultural imports, but its market share has been shrinking. From 2012 to 2013, roughly a quarter of China’s imported agricultural products came from the U.S. — more than from any other country. But since growth in exports peaked in 2012 at $25.9 billion, U.S. agricultural exports to China have leveled off and dropped by 17 percent to $21.4 billion in 2016. Brazil replaced the U.S. as the number one exporter of soybeans to China in market year 2012-2013 and is now responsible for around 50 percent of Chinese imports. Meanwhile, Ukraine has overtaken the U.S. as the largest exporter of corn to China. What forces are behind America’s loss in market share?

On paper, the U.S. and China make a good match. “When we do the numbers on China — when we do the numbers on demand, rise in population, and particularly the rise in per capita income — China is a natural market,” said Tom Sleight, president of the U.S. Grains Council, who has worked on U.S. agricultural exports to China since 1983. “The opportunities are clear.”

China’s rising middle class and a growing demand for meat have made the nation hungry for some of the top U.S. exports: grains and soy for livestock feeds. As the largest agricultural importer in the world, China takes in over 60 percent of global soybean exports. Meanwhile, nationwide food safety scares in recent years have provided American companies with an opportunity to offer their technology and management expertise to ensure better food regulation. Additionally, China’s plan to modernize its agricultural industry is taking lessons from core strengths of U.S. industry — including expertise in industrial scale production, processing, and storage. So, with complementary supply and demand, and a good sync in capability requirements, why not a brighter outlook on agricultural trade ties?

Signs of trouble?

“Agricultural trade is usually the first casualty when the relationship starts to sour,” said Sleight. Not only is Sleight concerned about distorting price mechanisms in China’s domestic agriculture industry, but also about mounting trade and foreign policy tensions, such as the territorial disputes in the South China Sea. “We have to let rational economics play out,” said Sleight. “We have the opportunity to get this straightened out now before it gets any worse.”

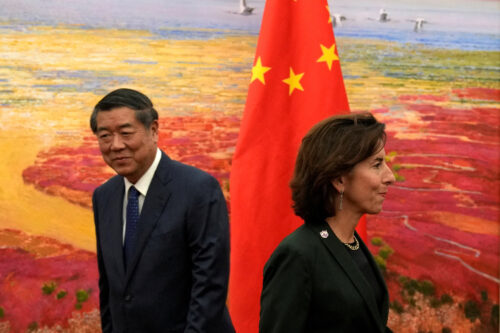

Tomorrow’s meeting between President Trump and Chinese President Xi Jinping, to be held at Trump’s Mar-a-Lago resort getaway, will be a chance for parties to rebalance political and economic incentives. It’s common practice for countries to favor the market’s lowest-cost bidders while seeking to diversify their import partners, but Chinese officials are especially cautious of overrelying on the U.S. “The Chinese fear hegemony and if the U.S. would ever hold food security over their heads,” said Jim Lambert, a trader with decades of experience in China’s agricultural commodities.

Lambert also noted that political mandates create incentives beyond price alone. He cited one example: In exchange for the rights to Central Asian rail projects, the Chinese government mandated that a certain portion of imported cotton come from these Central Asian countries. “I’m not sure if it was ever in print, but we knew it in the market,” said Lambert. “They [Chinese officials] are looking to override the market with political incentives.” China’s political incentives include pushing for greater links between developing nations, building connections under its “One Belt, One Road” initiative to foster greater connection through Eurasia, and leading a Regional Comprehensive Economic Partnership (RCEP) Asian trade agreement that leaves out the U.S. China has also used aid as a way to further economic and political goals — blurring the line between aid, trade, and investment.

“Aid and capacity building can significantly affect the standards-setting process,” said Eric Trachtenberg, who manages the food and agriculture practice at the Washington, D.C., advisory firm McLarty Associates. For example, China’s corn imports from Ukraine spiked after a loan-for-grain deal that left U.S. corn producers out in the cold. In Africa, China’s infrastructure investments have frequently come in exchange for the resource-rich continent’s commodities, strategically paving the way for future market access while promoting diplomatic relationship-building.

At the same time that China is pushing for greater international integration, President Trump’s proposed budget eliminates aid and foreign diplomacy funding by 28 percent. Domestically, America’s agriculture industry is already taking a hit. At a U.S. Senate Agriculture Committee hearing discussing the upcoming Farm Bill, Kansas farmers from corn to dairy expressed anxiety over a shortage of immigrant labor, declining net farm incomes in the past four years, and urgent need for trade deals.

Both the U.S. and China must figure out how to satisfy consumer demand while supporting farmers who face volatile weather and market conditions. These challenges can also be an opportunity for the two nations to work together. Moving away from an “America first” trade policy and prioritizing the development of a mutually beneficial relationship may be the best way forward for American farmers, U.S.-China agricultural trade, and bilateral foreign policy relations. The tone of tomorrow’s talks, the first summit meeting between Trump and Xi, will have tremendous effects on harvests to come.