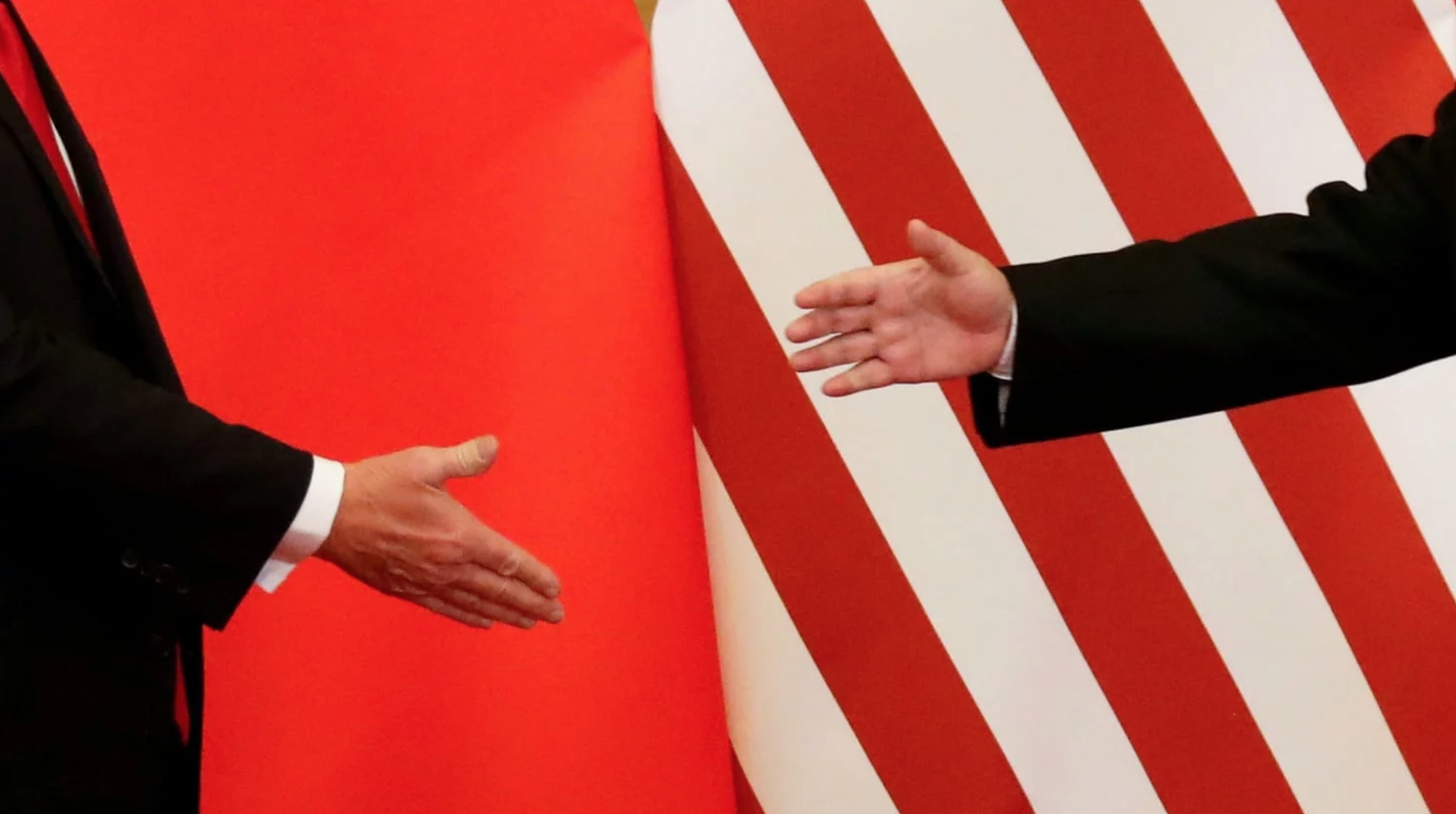

Trade war, day 54: Trump says ‘not the right time to talk’ with China, as trade conflict looks to extend to at least November

The trenches are deeper and the off-ramps looking more distant than ever in the U.S.-China trade war as it approaches the end of its second month. A roundup of signs in the past several days:

- The first bundle of billions of dollars in subsidies for American farmers to offset the pain of tariffs in a protracted conflict were announced yesterday (The China Project Access paywall).

- Lower-level trade negotiations went nowhere last week (Access paywall).

- “It’s just not the right time to talk right now, to be honest with China,” President Donald Trump said yesterday, adding, “It’s too one-sided for too many years…eventually I’m sure that we’ll be able to work out a deal with China,” the SCMP reports.

- China may have given up hope of reaching a deal before November: Bloomberg reports (paywall) that after the negotiations last week, “Chinese officials had raised the prospect of suspending talks until after U.S. congressional elections in November.”

Why is neither side eager to reach a deal on trade in the near future?

On the American side, top officials are convinced that the Chinese economy is in bad shape, so tariffs will pressure China to give in to demands, given enough time.

- Larry Kudlow, chief economic advisor for Donald Trump, sees “problems with the Chinese economy,” he told CNBC in a lively interview.

- “We’ve seen a big slump in China investment, China retails sales, China industrial production. I think money has been flowing out of China, I think capital has been flowing out of China, because of economic weakness. Because their so-called state capitalist model doesn’t work,” Kudlow continued, implying that the trade war is taking a toll on China.

- Many economists disagree. Here are some of the sources the White House is apparently ignoring:

- Nicholas Lardy, a senior fellow at the Peterson Institute for International Economics, writes that the investment argument is based on faulty data, and that the retail sales argument is probably the total opposite of the truth.

- Industrial production for export, meanwhile, is actually a very small part of China’s overall economy these days, economists like Andy Rothman of Matthews Asia pointed out before the trade war officially started.

- Tariffs will have only a “limited direct impact” on China’s economy, the International Monetary Fund said in a report last month.

- The stock market — which Trump and his advisors are obsessed with, whether in the U.S. or in China — has little to do with the real economy in China. Even as the Shanghai Composite has declined by 16 percent, the “Nanhua rebar steel futures index is up 22 percent this year,” CNBC reports, indicating strength in the real economy, according to Larry Hu, head of greater China economics at Macquarie.

- There are real economic problems in China, Trivium economist Andrew Polk writes in Bloomberg (paywall), but they have little to do with Trump’s tariffs. Instead, “China’s growth woes are homegrown… Two factors are largely to blame: the government’s concerted effort over the last five quarters to tighten credit and stabilize China’s debt levels, and, relatedly, a dramatic drop-off in investment spending by local governments.”

On the Chinese side, officials are convinced that the U.S. seeks to contain China’s economic growth, and that there is no appetite for compromise in Washington, so focusing on domestic issues is more important.

- “Once we realised that all you intend is to contain China … it’s clear we’ll never bow to you,” Chen Wenling, a former director of the State Council Research Office and now the chief economist at the China Centre for International Economic Exchanges in Beijing said, according to the SCMP.

- “We are not optimistic because we don’t think Trump is willing to compromise,” one Chinese official admitted last week in advance of the fruitless negotiations.

- Therefore, China seems to have focused on a strategy that includes propaganda and policies to limit criticism about Chinese rise, and counter the image of China as a closed-off market by further opening the country’s financial sector (Access paywall), for instance.

- China has also supported its currency, preventing it from falling to levels that would have sparked larger accusations of “manipulation” from Washington. Neal Kimberley, a markets commentator for the South China Morning Post, calls recent policies supporting the Chinese yuan “a smart strategy to defuse trade tensions with the US.” U.S. Treasury Secretary Steven Mnuchin told CNBC that he welcomed China’s support of the yuan, and that it was “not currency manipulation.”

Other trade war and related reporting:

- Trade war effects on other countries

China and Japan slowly learn to cooperate in the age of Trump / Bloomberg (paywall)

“Japanese Finance Minister Taro Aso will travel to Beijing later this week for a meeting with Chinese counterpart Liu Kun that is likely to demonstrate the improving relationship between the world’s second- and third-largest economies.”

Europe tries to avoid crisis as US-China trade war grows / Bloomberg (paywall)

“The European Union will host trade ministers from the U.S. and Japan next month in Brussels, according to two officials with knowledge of the meeting. The gathering will be part of an effort to address China’s trade practices in a way that doesn’t marginalize the WTO.” - Tough love for American companies in China

US companies in China learn to live with trade tariffs / FT (paywall)

Tom Mitchell writes that “Most executives hate the idea of levies, but many accept that Trump’s threats can be useful.”

He also reports that American business leaders in China met with Trump administration officials late last year, and were given this message when they raised concern about tariffs: “your companies just got a big tax cut and things are going to get a lot tougher with China — fall in line.” - China’s path to superpower

What does a Chinese superpower look like? Nothing like the US / Bloomberg (paywall)

“China aims to expand its influence from one polar cap to the other. Debt, demographics and a middle income trap stand in the way.”

Beijing’s bid for global power in the age of Trump / ChinaFile

Alfred W. McCoy, a history professor at the University of Wisconsin-Madison, writes that “China’s bid couldn’t have been more fortuitous in its timing. After nearly 70 years as the globe’s hegemon, Washington’s dominance over the world economy had begun to wither and its once-superior work force to lose its competitive edge,” and that “humanity seems to be entering a rare historical moment when national leadership and global circumstances have coincided to create an opening for a major shift in the nature of the world order.” - Trade war — industry effects in China

Will the trade war harm China’s fintech industry? / China-US Focus

China in struggle to curb reliance on US market, suppliers / AP via News-Press Now

“From medical products to smartphone chips to soybeans, Beijing is responding to President Donald Trump’s tariff hikes by pushing companies to trade more with other countries. But there are few substitutes for the United States as an export market and source of technology for industries including telecom equipment makers Chinese leaders are eager to develop.”

Previously in The China Project’s trade war coverage: