After Ant IPO suspension, Beijing eyes antitrust regulation for tech sector

A week after the surprise suspension of the Ant Group’s gargantuan IPO, Chinese regulators are taking the country’s entire tech sector to task. Newly drafted antitrust regulations would bring scrutiny to Alibaba, Tencent, Meituan, JD.com, and others.

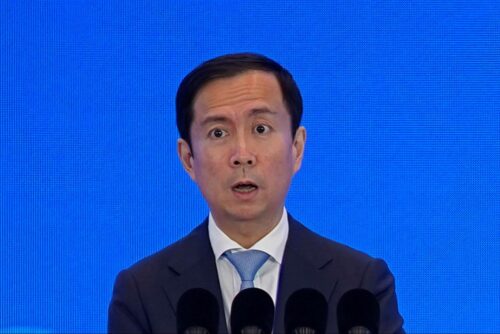

When the Shanghai Stock Exchange announced a week ago that regulators were halting the gargantuan IPO of Ant Group, the exact reasons for the surprise move were unclear.

- We suggested four possible motives: Retaliation against Ant’s majority controller, Jack Ma (马云 Mǎ Yún), after he criticized China’s state-dominated banking system; worries about overheated investor enthusiasm and risks to the Shanghai STAR market; the need to have Ant comply with new microlending restrictions; or genuine regulator discomfort with Ant’s size and sway over China’s financial system.

- It seems likely that the decision was at least partly retaliation, as Reuters reported that the “general office of the State Council compiled a report on public sentiment about Ma’s speech and submitted it to senior leaders, including President Xí Jìnpíng 习近平.”

- But if genuine regulator discomfort was a large motive, we warned that internet giant “Tencent can expect scrutiny, too.”

Now, new draft antitrust regulations target Tencent, along with ecommerce leaders Alibaba and JD.com, and food delivery giant Meituan, among others, the Financial Times reports (paywall). The draft rules are here, in Chinese.

- The move from the State Administration for Market Regulation “will see China attempt to define for the first time what constitutes anti-competitive behavior in the tech sector.”

- “The practices that regulators are taking aim at include using exclusivity clauses to hinder competition, treating customers differently based on their spending behavior and data, and forcing customers to buy a bundle of products to access the ones they want.”

- “Meituan’s shares fell more than 11 percent following the news, while Alibaba’s and Tencent’s fell more than 5 and 4 percent respectively…JD.com was also down more than 8 percent in Hong Kong.”

- A public comment period for the draft regulations will extend until November 30.

Regulators “met recently with 27 Chinese internet companies to discuss ways to ensure the healthy growth of the digital economy,” the Wall Street Journal notes, and the latest announcement “follows guidelines published by China’s main market regulator on Friday targeting its livestreaming sector.”

All this comes during Singles’ Day, the Alibaba-invented November shopping festival that has already racked up $56.3 billion in sales on Alibaba’s Taobao and Tmall, and $30.2 billion in sales on JD.com, since November 1, per the AP.