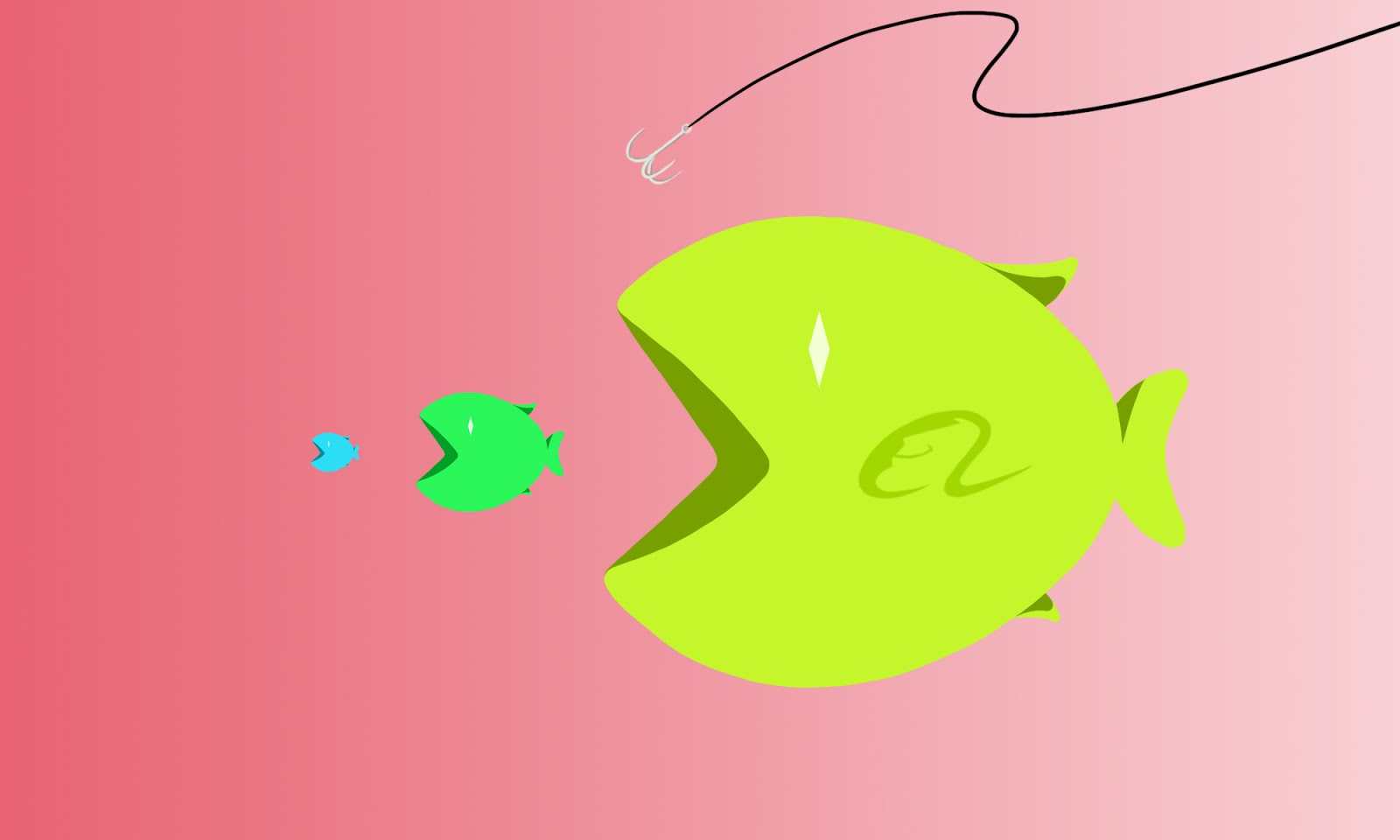

China fines three large internet companies for Anti-Monopoly Law violations

Beijing is beginning to enforce antitrust regulations on large internet companies. Three — Alibaba, China Literature, and Hive Box — received small fines today, and more firms are reportedly under investigation.

Chinese regulators are putting teeth behind promises of tighter supervision of monopolistic practices in China’s tech sector.

- Last month, shortly after the surprise suspension of the Ant Group IPO, the State Administration of Market Regulation (SAMR) announced new draft antitrust regulations. Companies including Alibaba, Tencent, Meituan, and JD.com were suspected to be in the crosshairs.

- Then, a readout of a Politburo meeting on December 11 (English, Chinese) emphasized that China should “reinforce anti-monopoly and prevent capital from expanding in a disorderly fashion” (反垄断和防止资本无序扩张 fǎn lǒngduàn hé fángzhǐ zīběn wúxù kuòzhāng).

Now three companies have been fined: Alibaba, China Literature (a business spun off from Tencent), and Hive Box, an ecommerce company owned by SF Express. SAMR released a short statement (in Chinese) announcing the fines, and a long Q&A (in Chinese) explaining its broader scrutiny of internet businesses.

- The companies were cited for “not reporting past deals properly for anti-trust reviews,” including two Alibaba investments in 2014 and 2017, China Literature’s 2018 acquisition of New Classics Media, and Hive Box’s recent purchase of China Post Smart Logistics, per Reuters.

- All three penalties were for the small amount of 500,000 yuan ($76,500), which is the maximum under China’s 2008 Anti-Monopoly Law.

- But the fines “mark the first time Chinese internet companies have been penalized” under that law, Caixin points out. Markets got the message, Reuters reports, as “Hong Kong-listed shares of Alibaba and Tencent fell after the news, with Alibaba closing down 2.6% and Tencent’s shares ending 2.9% lower in their worst day since Nov. 30.”

Today’s penalties also close “a regulatory gray area that China’s foreign-listed tech companies have enjoyed for more than a decade,” the Financial Times reports. Companies with a “variable interest entity” (VIE) legal structure, popular among listed tech companies, had avoided enforcement of the 2008 deal filing requirements until now.

This is only the start

SAMR “said it would also look into a merger between game livestreaming firms Huya Inc and DouYu International announced in October,” a $6 billion deal that Tencent has a major stake in, Reuters reported.

“While the light fine can be easily mistaken as a slap on the wrist, the penalty, in reality, carries much bigger weight, especially for those who are flirting with the rules, and more importantly, the principle laid out by the Politburo meeting,” writes commentator Zichen Wang.

- Wang points to the longer Q&A with an unnamed SAMR official, who indicated that “similar investigations have also been launched and the cases made public today are just three of them.”

The upper limit for fines could be increased “from 500,000 yuan to 10% of the operators’ sales in the previous year,” according to a draft amendment of the law published in January, Caixin points out.