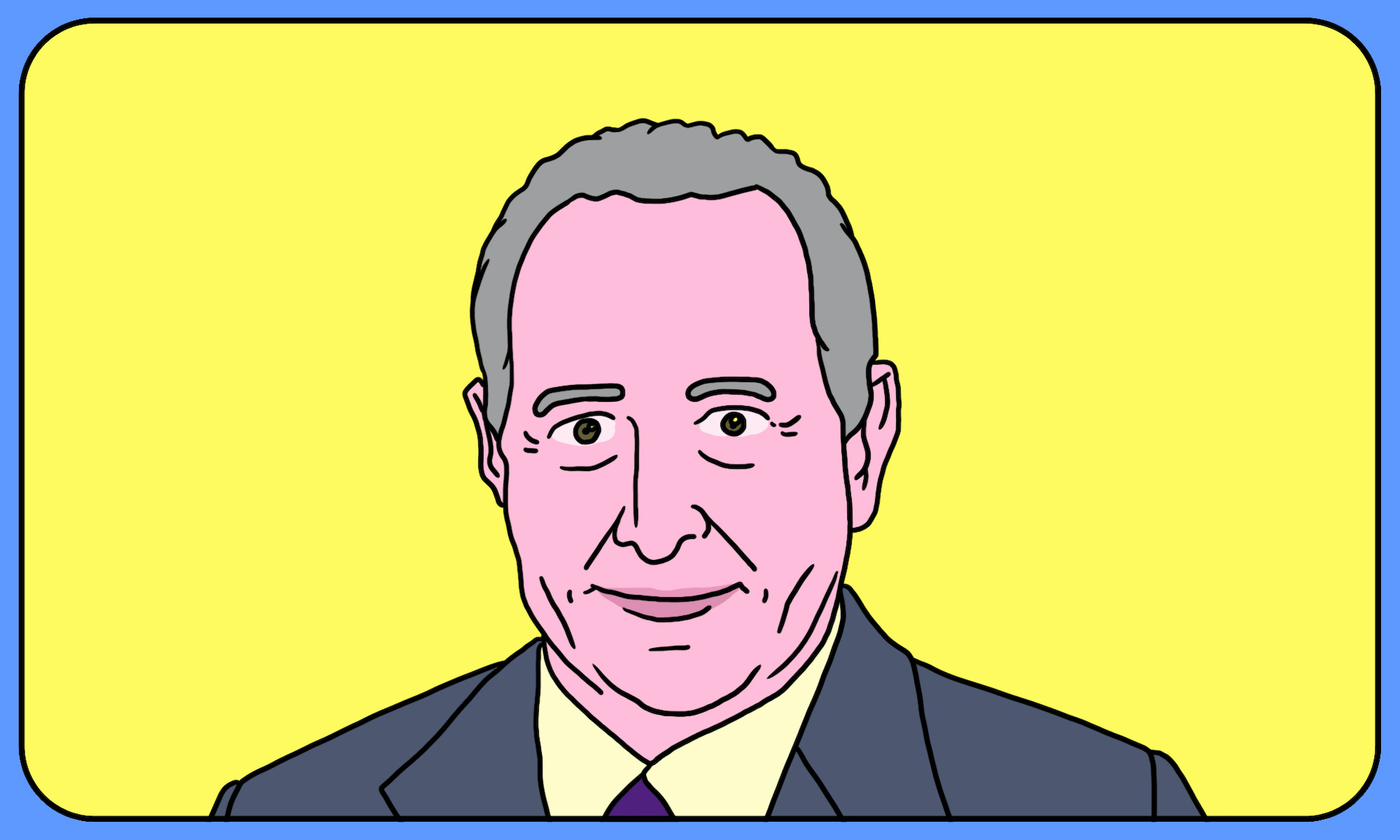

‘The mandate of heaven, ain’t falling yet, but there’s a lot of shit on people’s shoes’ — Q&A with Howard Snyder

Howard Snyder has decades of experience in risk and crisis management in Asia for companies like Coca Cola at events like the Shanghai Expo and the 2008 Beijing Olympic Games. We talked to him about Shanghai under lockdown and what it means for China’s future.

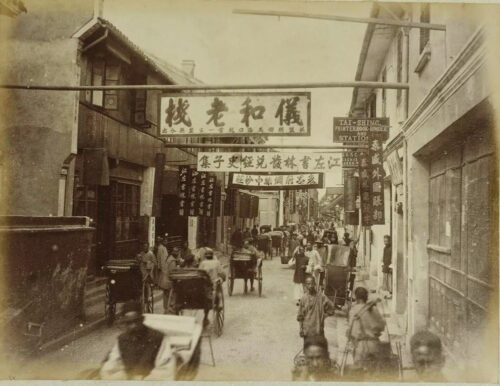

Howard Snyder first went to China to study in 1981. He learned fluent Chinese and then Japanese, and can now get by in half a dozen other languages. He has worked in risk and crisis management for companies like Kroll and Coca Cola, and as a debt collector for Morgan Stanley.

He made a documentary film, My Beijing Birthday, which takes a heart-felt and humorous look at the changing lives of a group of young Beijingers in 1996 and then again in 2008. He now leads Asia projects for risk management firm TorchStone Global.

I spoke to Howard by video call about the COVID lockdowns in Shanghai. This is an abridged and edited transcript of our conversation, part of my Invited to Tea interview series.

—Jeremy Goldkorn

You’ve done a lot of work involving moving lots of people around Chinese cities and making plans for companies and people to handle major crises. You know Shanghai very well. You’ve lived there, worked on the Shanghai Expo, as well as the 2008 and 2022 Olympic Games in Beijing, and the Tokyo Olympics.

You are very familiar with the Communist Party’s usually excellent track record at organizing large-scale activities. So I’m trying to understand, why are they getting it so wrong in Shanghai?

Well, I think they were taken by surprise and unprepared for this Omicron variant that spread through. And they have no ability to calibrate their response given the current doctrinaire mood where officials will always err on the side of overzealousness as opposed to any sort of discretion or personal decision-making which could lead to them taking responsibility. So they just weren’t prepared for this variant. There’s no ability to say, “Oh, this is contagious but it’s not very fatal.”

And so, I think their rigidness really hurt them this time. And then also the massive logistics of shutting down the whole city, right? Feeding 25 million people when delivery trucks are afraid to come into town because they’re afraid of getting locked down. The suddenness of the shutdown just literally shut everything down. The logistics were just frozen.

We all know they look at these things as kind of either a military campaign or some type of political movement.

And there’s also a thousand-year tradition of false reporting in China. You can compare it those floods in Henan last year, where officials said 10 or so people died and later it came out that more than three hundred had died. The same thing is probably happening in Shanghai.

What are they saying? They’ve had 150,000 cases and just a handful of deaths. And no one knows what’s going on in those nursing homes.

Here in America it’s the Bizarro world version of that. Some conspiracy theorist types are saying that deaths in the U.S. are being attributed to COVID when in fact they were just people who happened to have COVID but actually died of something else. Whereas in China, it seems to be the reverse? They’re saying, “Oh, well. He died of X disease,” but they’re not attributing it to COVID.

Yeah. So I just think their rigidness really got them. Xi… Right? Officials these days…I mean, right before Xí Jìnpíng 习近平 took over, maybe they were looking for ways to skim money off the top. But in the last 10 years, Xi’s done a pretty good job of cleaning up corruption. So instead of local officials putting their energy into how they can skim money off the top, now they’re putting energy to show how loyal they are to the leader. And as we see that maybe with Ukraine too, that their intelligence was probably very bad because…No one wants to deliver bad news.

In your work for clients, are you looking at all or can you comment at all on the fragility of supply chains in China and what this tells us about how easily they could be disrupted?

What does this mean for Joe Schmoe and Jeremy Goldkorn in Nashville, Tennessee? Is my Amazon going to stop coming?

Yeah, the logistics bottleneck…In Shanghai, supposedly there’s 500 container ships or so. The numbers I’m hearing vary, but there are literally hundreds of container ships sitting outside of Shanghai that can’t deliver goods, which also means that they can’t get goods out. So the long and short of this is, this is going to be inflationary around the world also, be it getting your iPhone or the world’s pharmaceutical supply chain…China exports all these raw materials.

People can’t make drugs. People’s Christmas presents may be delayed this year because those orders are usually put in July or something. And these supply chains are just going to be more and more stressed, and prices are going to go up all around.

I’ve heard that other major ports like Ningbo and Qingdao are getting stressed too because there aren’t any delivery drivers or things like that. So the long and short of it is, for consumers around the world, this will definitely have further inflationary impact.

What’s your sense of the risk of social instability in China at this point?

I don’t remember seeing this level of anger on the Chinese internet since the Wenzhou high speed train crash of 2011. But this is actually much more serious because the Wenzhou train crash was a discrete event. It happened, people died, citizens were pissed off about the way the government handled it, and they expressed themselves online, but the crash was over.

If you were just sitting at home, it wasn’t going to affect you. Whereas now, if you’re sitting at home, whether you’re in Beijing or Bengbu, you must be thinking, at least I know my friends are thinking, “I better buy rice.”

Yeah, people in Shanghai…This is not an abstraction to anyone. This is real, be it if you’re in Shanghai scrambling for food or if you’re in another city just waiting for the other shoe to drop and be suddenly locked down. So this type of panic buying and things like that is definitely happening. This type of stuff scares the shit out of the Party.

I don’t see things toppling at the central level, but at the local level,…People are going to lose their jobs. I think they’re going to try and blame it on local leadership. The central government is going to try and push it down to that extent.

And we’ll have to see. Will they turn on some sort of fiscal spigot to try and make people whole, be it in Jilin or Shanghai, who have literally been locked in their homes for a month and aren’t making any money?

Xi was in Hainan recently, basically saying, “We cannot waver from this COVID-zero policy.” They’re saying things about consequences if you post things on social media and things like that. So I just see more brutality ahead.

I’ve always been kind of…I don’t want to say optimistic, but confident in the government to be able to meet the material needs of the people. And so, they will do whatever they can to mobilize and get people fed and things like that. But trust which Xi Jinping has been building these past 10 years…

When he came to power, it was in some ways one of the lowest points in the last 20, 30 years with all the corruption. He spent the last eight, 10 years kind of cleaning up the government, and people had a lot more trust and pride in the government. This is going to, I think, set back a lot of that trust in the government.

This time, their rigidity has really hurt them. But Gordon Chang [author of the 2001 book, The Coming Collapse of China] is not right yet.

Not yet. He will be one day. He’ll probably be dead by then, but he’ll probably be right one day.

Yeah. The mandate of heaven ain’t falling yet, but there’s a lot of shit on people’s shoes.

Are your clients starting to freak out and worry about China? How do you see this playing out in terms of people’s risk assessments about dealing with China?

It’s definitely causing [foreign managers to leave China]. There was an expat exodus to begin with that is definitely growing.

Companies too. Yes, move to Singapore if you’re in Hong Kong. All this stuff in China is having people try to move their supply chain even faster to India or to Vietnam or somewhere else.

Except for Elon Musk, of course, because Elon just loves China. Tim Cook loves China too, but this is causing people to see that the vulnerabilities and the political risks of China are just really big. I mean, I’ve never been a successful investor in China, but in one way, investing in China, you should get double or triple returns compared to other places because the risk of some sort of administrative fiat just messing with your business is so great.

So I think it’s going to hasten relocation of facilities, of people, trying to be less reliant on China.

But some of the more savvy companies have been building for the domestic market. Coca-Cola and KFC aren’t going anywhere.

Invited to Tea with Jeremy Goldkorn is a weekly interview series. Previously:

Should global investors own Chinese assets? Q&A with Sofia Horta e Costa