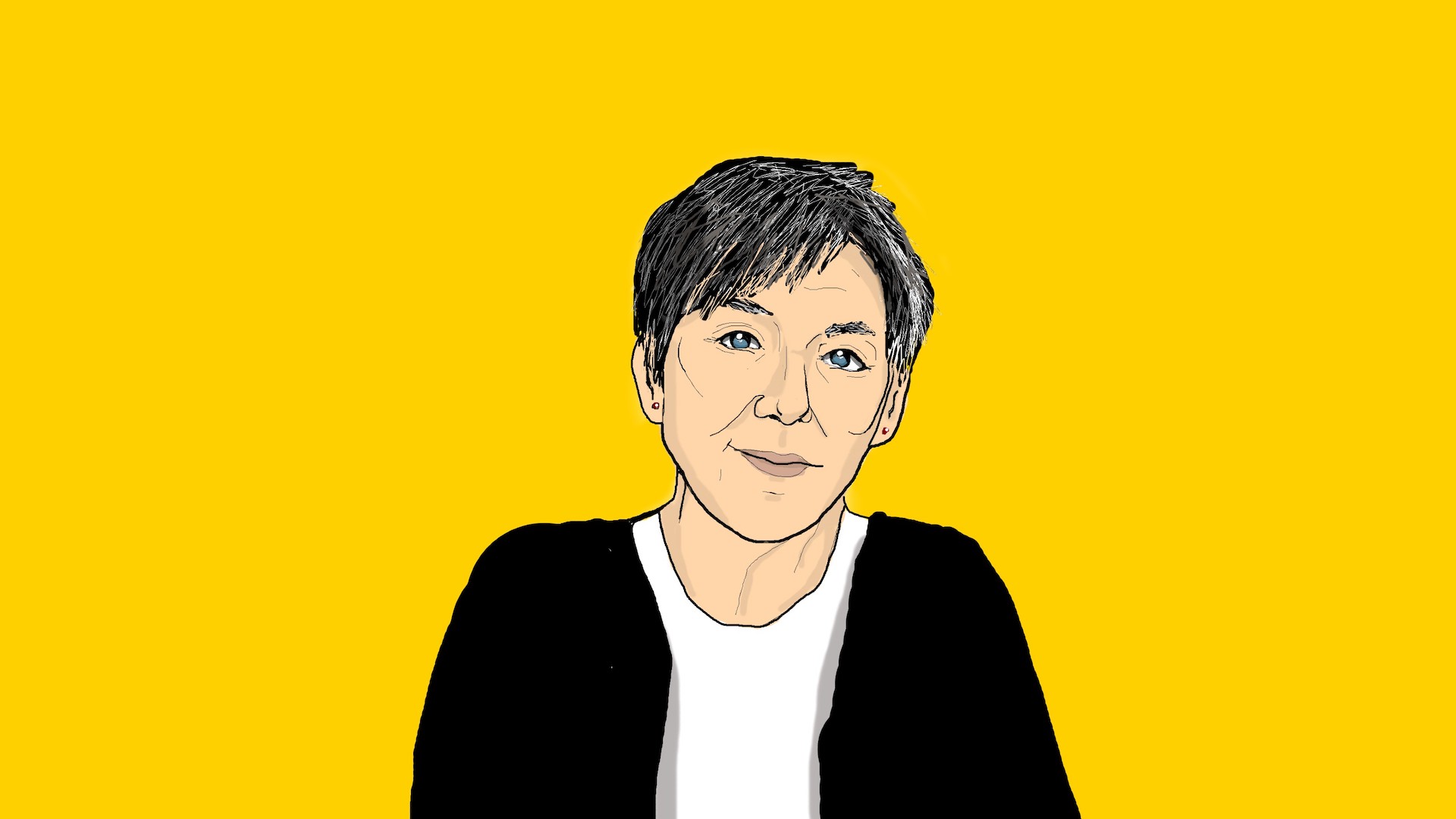

Exactly how pessimistic are you about the Chinese economy? — Q&A with Anne Stevenson-Yang

Veteran China entrepreneur and financial analyst Anne Stevenson-Yang was in China for the roaring 1990s and 2000s. Things have gotten less fun since then, and she told us all about it.

I first met Anne Stevenson-Yang in Beijing in the late 1990s when she ran the big, scary competitor to the failing startup print magazine that I was editing.

She is the co-founder of J Capital Research, which does financial and economic research in Asia. For 25 years, she lived in China, where she started and sold media and technology companies, headed up the U.S. Information Technology Office, and raised a family.

But she’s not going back anytime soon.

I spoke to her by video call on May 12. This is an abridged, edited transcript of our conversation, part of my Invited to Tea interview series.

—Jeremy Goldkorn

You recently wrote an email to a group of which we are both members about China’s new exit controls that will make it very difficult for citizens to leave the country, ostensibly as part of stopping COVID-19 transmission.

It made me think of a piece that you’d written at the beginning of this year about keeping the foreign flies out of China, and how China is isolating itself under Xí Jìnpíng 习近平.

It seems to me that the restrictions on Chinese people going abroad, as you put it in your email earlier, are not just about controlling the disease anymore. This is just micromanagement of people’s lives.

So what’s going on? Why are there essentially exit bans on Chinese citizens?

This is the classic means of control in imperial China: motion control, control of where people are and where they can go.

And I always thought they were going to reimpose that, and that we were going to head back toward 1978. The COVID policy is clearly an excuse. It doesn’t have anything to do with health metrics.

Xi Jinping seems to have a bit of a Churchill complex. He thinks to himself, I’m leading the nation in a war against this disease, and I was very successful last time. So I’m just going to keep doing it this time. And then there’s this authoritarian feedback loop where the worse it goes, the more angry he gets and the more he pushes against COVID, and so the more miserable people get.

But I also think it’s just plain about control.

The Churchill feedback loop. Yeah. So, you’ve been kind of a permabear on China, maybe since about 2008?

Well I became rather negative about China in 2008, in the lead up to the Olympics because there were so many controls imposed and imposed in this way, which was to issue quotas nationwide to achieve this or that metric, without any regard for whether the quotas actually had something to do with reality. So for example, I knew a couple of people around me who were detained for three months in one case, a year in another case, basically, not to go into too much detail but basically because the police had quotas…

This was 2008?

This was 2008. Yeah. So the police had quotas and seemed to be using agents to help them pick people up and make the quotas. And so they would pay the agents and after they paid the agents, then they’d need to produce somebody in order to fill that quota. I knew people who were caught up in that with really no reason other than to make a police quota. And it felt very Green Gang to me. And it made me feel very bitter about the whole thing.

In 2008. I personally would date my bad attitude to 2009, but that’s when my own website was blocked.

It’s part of the same thing. I do think that there’s this kind of magic 30 year cycle in China. So we had 1919, 1949, 1979, and then 2009. That wasn’t an obvious governmental change as in 1949 and 1979 were, but it was a real shift in emphasis and in style of governance. And it was a shift back to command control. And I think those of us, like you, who were there at the time, watched it happening, in a rather uncomfortable manner. And yet there was so much cash still going into the economy that foreign companies and investors were still rah, rah, rah, and it made people like you and me into Cassandras for quite a long time.

Do you think that now suddenly the Cassandras are going to actually be proven right?

It feels to me like in the last few weeks suddenly, the reality has hit a lot of the investment community, the people who are the most willing to believe in all kinds of wonderful stories about China.

People who are concerned about politics have been negative on China for quite some time, but American investors and economic types…I feel as though there’s been a bit of a shift in the last month or two? Many of them now seem to agree with some of the more negative things that you’ve been saying for years.

CFOs of foreign companies in China and asset managers are some of the most conservative people in the world. Or let’s say CFOs are some of the most conservative people in the world and asset managers are some of the most ethics-free people in the world. They look at the world in terms of profit and loss and that’s it. And China has been fairly profitable for them, for a while, because it’s been a growth story.

That story has changed along two dimensions. The first dimension is that the international world became politically much more skeptical of China. I think that had to do with the fact that money was leaving China. So there was less at stake, and there were fewer people to lobby for China, but certainly the U.S. government and other governments internationally also became more negative about China.

That’s been going on for about two years now. Then on the heels of that, the foreign analysts and investors who are left in China have become much more pessimistic about their own prospects for growth. So they have mandates to look elsewhere for their supply chains, and for…

So, is China, er…

So is the China story over? Yeah, kind of.

I mean, look, [China] was always a very typical investment story, à la Indonesia, right. It was always an economy that was driven by capital investment, and that was always going to end. It’s just that it’s [actually ending] right now. I think the politics doesn’t help and it certainly makes everybody uncomfortable and we could have very surprising events this year.

But the fact is that the debt limit was always coming, and now it appears to have come.

What’s your sense of regular people in China? This kind of negative attitude you’re displaying, Ms. Stevenson-Yang, how common is it in China, amongst your friends and business contacts and people you speak to for research?

I suppose I feel as though something has really changed in the last few months, particularly in Shanghai and because of Shanghai. It feels as though people who just even six months ago were not negative on China in any way are suddenly really pessimistic?

In 2010, I noticed, the first time I went to Russia, how the average standard of living and education was reasonably high. It was higher than the average in China, but people were, to a man and woman, just completely bleak and cynical in their outlook. They just had no hope for the future.

But in China, on the other hand, you found people with a much worse standard of living, but who were all optimistic. I find that that’s changed very significantly.

Now, you know, it’s hard to know whether you’re talking to a representative sample of people, but the same people who were positive and supportive of the country’s direction a couple of years ago now are very bleak. I think they have been traumatized by the lockdowns, but they’re just bleak about their economic prospects as well.

You run a firm that produces research on companies. You don’t advise people how to invest, right? You put out research and then you make your own positions?

Where are your bets going at the moment? Are you thinking that China is completely fucked and there’s no opportunity? And the only way is to short China generally? Or are you thinking that there are things going on in China that are still going to make a profit for companies, and…?

Our work is very, very narrow and very focused on particular companies. I will work on one company for three months at a time. So I really don’t have a very broad view of the Chinese economy or the macro economy generally.

Certainly the profit growth of asset managers in China has been 85% from growth rather than from profitability. In other words, it’s been from the imagination and the aspiration that China has a growing middle class, and that the growing middle class is getting stronger and spending more and la la la la la la, and there are all of these companies that are growing like 40% a year. And that’s what you should invest in because you’re not getting growth elsewhere in the world.

That dream is fading.

Does that answer your question? I don’t know. I mean, there’s a lot that’s good about the Chinese economy. It’s big. A lot of people have a lot of money to spend. There are a lot of companies in China.

In the U.S., you can, not to mention any names, but let’s say have a best-selling electric car, and basically be somebody who doesn’t have any idea about how to do business. But in China, you can’t run a cigarette stand without being a genius, because everything is so hard. So the companies that have developed distribution channels and good brand equity, you really have to think those are solid companies that should be invested in and rewarded.

Nonetheless, there’s a lot of crap out there that should not be rewarded?

There is.

When do you think you might ever go back to China?

I wish I could go. I miss China. I have a lot of nostalgia about China and it’s, you know, it’s a fairly big part of my identity. I lived there for 25 years, but at this point I wouldn’t risk it, even if the chance of being detained is only one in, you know, 25 or something. Is that worth the risk of two years of your life? No. So I’m waiting for regime change, which perhaps will not come in my lifetime.

Invited to Tea with Jeremy Goldkorn is a weekly interview series. Previously:

How scared are people in Beijing of a COVID lockdown? — Q&A with Anthony Tao