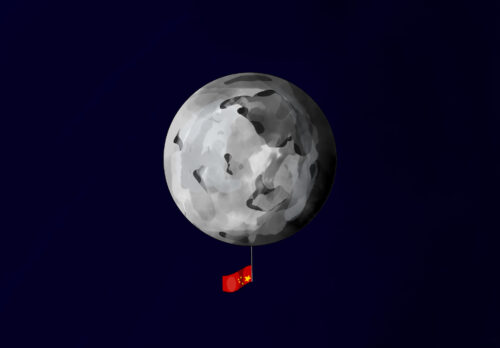

Has the U.S. added a chip on China’s shoulder, or a leg up?

Beijing has hit back at U.S. efforts to restrict global chipmaking technology to China, but it might only boost its growing industry.

Chinese Foreign Ministry spokesman Zhào Lìjiān 赵立坚 accused the United States of “technological terrorism,” after Bloomberg reported that Washington is lobbying its allies to stop selling essential chipmaking technology to China to curb the country’s rise.

According to the report, the U.S. is ramping up pressure on the Netherlands to bar Dutch firm ASML from selling older deep ultraviolet lithography (DUV) systems to China, a move that would expand an existing moratorium: Since 2019, the Dutch government has not permitted ASML to sell its most advanced machines, which use extreme ultraviolet (EUV) light waves, to Chinese chipmakers.

- ASML has a near monopoly on the manufacturing of lithography systems, very expensive machines that are vital for the production of chips. Previous EUV models held a hefty price tag of up to $200 million, with its next model set to cost upward of $300 million.

- Though ASML only sells machines to five chipmakers, China does not make its top three: TSMC, Samsung, and Intel made up nearly 84% of its business in 2021.

- The U.S. is exerting similar pressure on Japan to ban Tokyo-based Nikon, ASML’s smaller rival in the same chip-manufacturing sphere.

Semiconductor chips — critical pieces of technology used in everything from smartphones and cars to medical devices and refrigerators — are at the center of global competition and national security concerns.

Though both the U.S. and China have benefited from interconnected supply chains in such critical technologies, a recent uptick in geopolitical tensions, COVID-choked supply chains, and extreme weather has spurred the two superpowers — and other major global players — to shore up their domestic production in a bid for technological independence.

- In 2020, Washington unveiled its Creating Helpful Incentives to Produce Semiconductors (CHIPS) for America Act, which pledges to provide more than $50 billion in incentives to advance domestic semiconductor production.

- Beijing also doubled down on its previous efforts to boost its own semiconductor industry in January 2022, when the State Council published the 14th Five-Year Plan on the Digital Economy.

- The European Chips Act was proposed in February 2022 in a bid to bolster Europe’s competitiveness and resilience in chipmaking technology, as shortages caused by the COVID pandemic forced factory closures in key industries.

Beijing has been hell-bent on making more chips at home, despite U.S. efforts to restrict the flow of technology to the country: China’s semiconductor industry, which has lagged behind in the past, is racing to catch up with the U.S. and other global chipmaking powers.

- The United States added Chinese state-owned chipmaking giant SMIC to its Entity List, citing the “risks of China’s leverage of U.S. technology to support its military modernization.”

- But that has only shifted China into high gear: Nineteen of the world’s 20 fastest-growing chip industry firms over the past four quarters, on average, come from China, compared with just eight at the same point last year, per Bloomberg estimates.

Washington’s lobby might have even given it another leg up: Chinese semiconductor stocks surged today.