China’s radically transformed tutoring market, one year after crackdown

A year after Beijing’s sweeping crackdown on China’s for-profit online tutoring companies, New Oriental Education, TAL, and Gaotu Techedu remain the market leaders, but they — and their competitors — are scrambling to adapt in the new environment.

Last July, China’s State Council dropped a bombshell on the country’s education landscape. Regulators required existing tutoring companies specializing in the core K-9 curriculum to register as nonprofits while banning them from raising funds on stock exchanges or through foreign investment. At the time, many observers predicted that the $100 billion sector as we knew it was finished.

Three of China’s largest online education firms, New Oriental Education 新东方, TAL 好未来, and Gaotu Techedu 跟谁学, all of which are listed on U.S. stock exchanges, chose to weather the regulatory storm, but their decision to soldier on came at a cost, as they gutted most of their K-12 after-school tutoring operations.

- The share prices of all three companies were decimated by the July 2021 State Council announcement.

- New Oriental in 2021 reported an 80% drop in revenues compared to the previous year, and had to pay around in severance pay and tuition refunds.

- Gaotu Techedu and TAL also saw significant drops in revenue and year-on-year profits during the autumn of 2021.

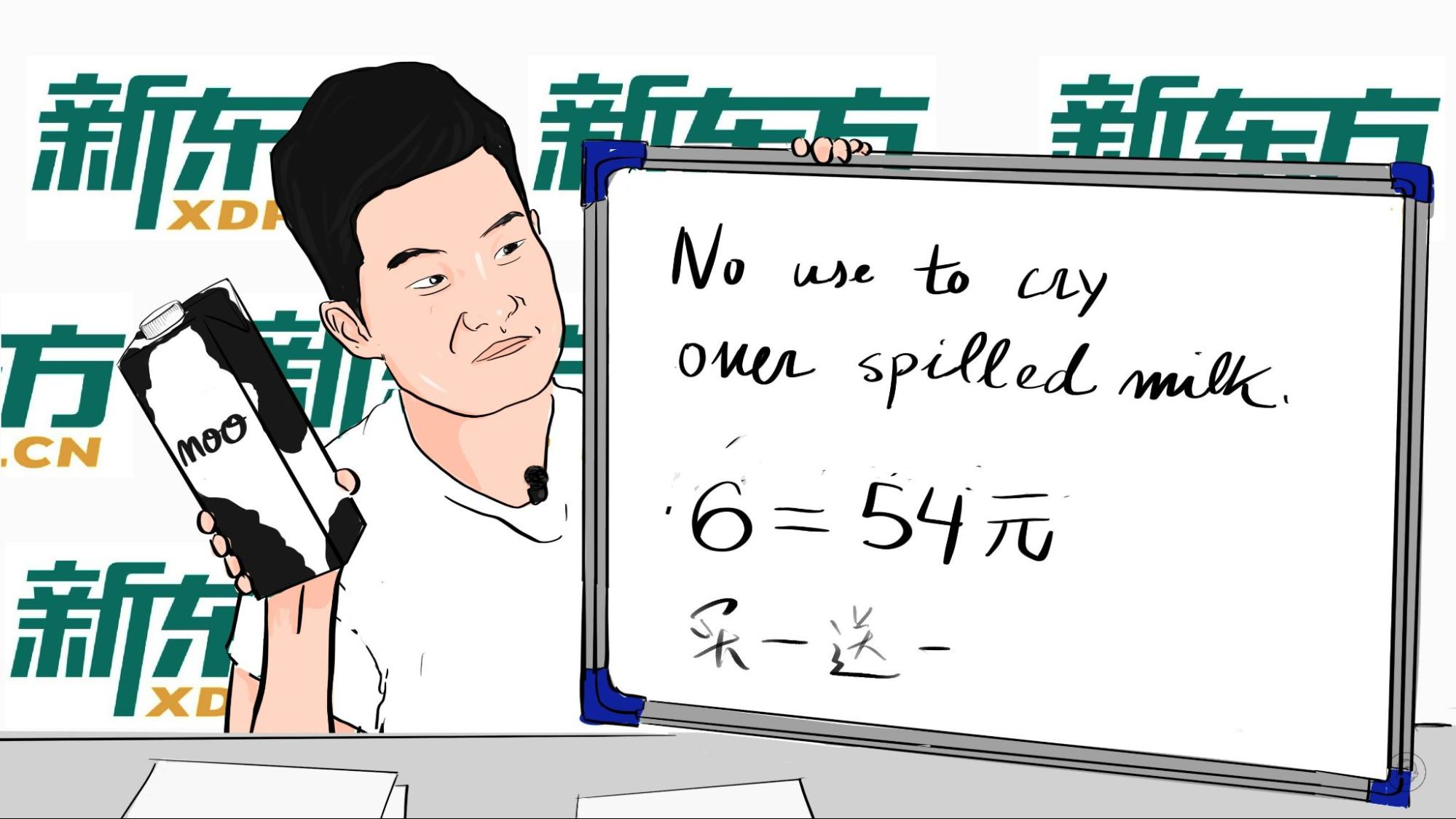

But after months of restructuring, things may be starting to look up for these firms. New Oriental, for one, seems to have found a new revenue stream. Last month, a livestreaming channel run by Koolearn, a subsidiary of New Oriental, went viral thanks to a new innovation: combining teaching with ecommerce.

- Streamers on the channel “Oriental Selection” (东方甄选 dōngfāng zhēnxuǎn) began speaking English and teaching basic phrases as they hawked agricultural products.

- The channel involves livestreamers, many of whom are former tutors at the company, selling agricultural goods, books, and other products.

- Koolearn and New Oriental both saw their share prices rise in the wake of a spike in sales on the livestream channel.

TAL and Gaotu Techedu’s stocks also seemed to benefit from the developments, and TAL subsequently posted job openings for various types of livestream anchors on their website, indicating they may be following New Oriental’s lead.

Still, despite the recent optimism, none of these three major firms have come even close to recovering their pre-July 2021 market capitalizations. Whether or not selling products over livestreams will be able to sustain long-term growth for any of these companies remains to be seen.

“I think this whole livestreaming and selling fruit and teaching English at the same time is a bit of a gimmick, I don’t think that’s a sustainable business,” said Julian Fisher, the founder of Venture Education, an education consulting firm in Beijing. “What was the valuation of New Oriental, $38 billion at its highest? That is not a $38 billion business.” (New Oriental Education’s market capitalization peaked at around $33 billion in February 2021.)

A number of smaller players in the online education industry listed on the Shanghai Stock Exchange, including Only Education 昂立教育, Xueda Education 学大教育, and Offcn Education Tech 中公教育, rode New Oriental and Koolearn’s coattails to higher share prices last month. But from mid-June, their share prices have tapered off and sank closer to their earlier levels, unable to match Koolearn’s momentum.

New Oriental is not relying wholly on livestreaming for its new business model, however. In a recent WeChat post, the company’s founder and president, Yú Mǐnhóng 俞敏洪, explained that education will continue to be an important part of New Oriental’s business. Instead of focusing on the K-12 core subjects, the company will shift towards holistic education for young students (subjects such as arts or computer programming are not regulated under the new policies), services for Chinese students studying abroad, career training for college students, and educational tech development.

Yuwan Hu, Associate Director at Daxue Consulting, a Shanghai-based market research and consulting firm, told The China Project that these newly diversified lines of business will open up opportunities for firms, and that the government has signaled some policy support for them. “If those firms or companies are searching and seeking more opportunities, that [diversification] would be the direction, especially for professional education,” she said. “That is one of the focuses in terms of policy direction, and it was marked in the 14th Five-Year Plan.“

These new opportunities are certainly viable paths forward for these firms, said Hu, though it may take some time. “They still have some sort of adaptation period, or are seeking out how to do it, and how to make it more successful.”

Many other online education tutoring companies have also cited these alternatives to K-12 education as new lines of business, including Gaotu Techedu and TAL. In a statement last month, Gaotu CEO Chén Xiàngdōng 陈向东 explained that his firm would continue investing in “professional education for college students and adults, vocational education, STEAM education, and digital educational products.”

Fisher explained that the policymakers have refrained from laying out comprehensive and specific rules on restricted subjects, making companies wary of pushing boundaries and testing the limits, lest they incur further crackdowns. “You sort of know what you can’t do, but I think the toughest part is you don’t know what you can do,” he said. “The problem is, the Chinese government has not and will not define that. But that has left everyone in this kind of gray area, and no one wants to move aggressively in another direction because if they do, they could easily get closed down in six months time.”

Other private tutoring companies are also getting creative in finding new ways to adapt their business models away from education in core subjects:

- Last October, Yuanfudao, formerly a major player in K-12 education and one of China’s edtech unicorns, invested in a winter clothing firm, but stated that its focus would remain on education.

- Zuoyebang, also a unicorn, has moved into the printer business, and Zhangmen Education and Netease’s Youdao have begun producing smart educational tech, such as smart lamps and smart pens for students.

- China Online Education Group, listed on the New York Stock Exchange and known for its English-language learning brand 51Talk, announced that in the wake of the crackdown it would shift its focus to the overseas tutoring business.

- Many of these companies have also stated their intentions to expand their holistic education and career development tutorial businesses.

While some of the larger private tutoring firms have adapted and survived, many of the smaller ones haven’t fared as well. Last December, China’s Ministry of Education held a press conference on progress on the government’s “double reduction” policy, aimed at reducing time spent on homework and time spent in after-school tutoring classes. The press conference revealed that the policy had been remarkably effective: Over a mere few months, the number of offline and online training companies decreased by 83.8% and 84.1%, respectively.

It wasn’t just small private tutoring firms that were forced to close down. Juren Education 巨人教育 and Wall Street English 华尔街英语, two former private tutoring companies providing services to hundreds of thousands of students, ran out of money to fund their operations, declared bankruptcy, and ultimately shut down.

The firms that have survived until now are by no means out of the woods. Beijing has continued rolling out more regulations as recently as May, when policymakers banned educational apps for preschool-age children. This further restriction of the educational space — and clear signaling from Beijing that it is committed to limiting the role of private for-profit companies in education — will make it difficult if not impossible for companies like New Oriental, TAL, and Gaotu Techedu to reclaim their former glory.

Hu stressed that not all firms would face the same pressures, and that those more focused on English-learning may find it harder to turn their businesses around. “A few years ago, English was supposed to be one of the most important subjects to learn, but today we are focused more on Chinese values,” she said, referring to a recent trend away from English-language learning in China.

“I would say for those firms that are only specialized in English, the market could be a little challenging for them.”