What’s behind China’s surprise interest rate cuts?

Chinese people are not spending money, nor are they trying to start businesses or buy homes. When a whole nation chooses to stop spending and borrowing, it indicates anxiety and fear. The People’s Bank of China had to act.

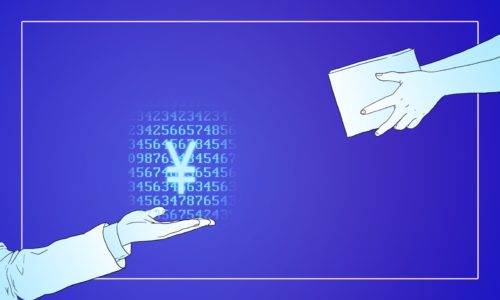

Two Mondays ago, China’s central bank, the People’s Bank of China (PBOC), adjusted interest rates for the second time this year, slashing two key interest rates. Interest rates are a dry topic, most explanations are abstract, and they appear on the surface to primarily affect financiers worried about their portfolios, but this news came as a surprise, and caused concern in many observers.

There is an alarming connection between August 15’s news and nationwide political stability. Economic indicators such as consumption rates and household credit are like a public opinion poll with two questions: How do you and your family feel about your quality of life today and what do you think your quality of life will be like tomorrow?

According to July’s economic indicators, for many citizens the answer to these questions is “bad” and “worse.” Retail sales rose only half as much as predicted, and new property sales dropped almost 30 percent compared to the year before. The message was dire enough that the PBOC stepped in. What’s really frightening, though, is that it may not be enough to keep things from getting worse.

Question of interest

The PBOC’s interest rate cut was directly in response to the unexpected drop in consumption and lending in July. These indicators had been flagging for months, but July’s numbers were a more significant drop than experts had predicted.

In plain English, people are not spending money, nor are they trying to start businesses or buy homes. When a whole nation chooses to stop spending and borrowing (regardless of which nation it is), it means people are worried and scared. They either think tough times are coming, or they are already going through tough times and don’t expect it to get easier soon.

It would be tempting to place the blame on the government’s persistent zero-COVID policy. It is certainly a contributing factor; 2022 has been a rough year, with lockdowns being reinstated in an ever-growing number of cities. To say there is lockdown burnout is putting things lightly.

But COVID lockdowns are just the surface problem. The real culprits are much more mundane: jobs and housing.

Record unemployment and fake real estate

People are not getting jobs, especially young students. In 2019, before lockdowns, recent-graduate unemployment hit an historic low. Back then, it was estimated only 2 out of 3 students were able to secure jobs the summer after graduating. Today, there is a new historic low: 24 percent of urban youth in China are unemployed.

Youth unemployment translates into youth dissatisfaction, but there is spillover beyond young people themselves. Family members who invested in their child’s future may now need to save their incomes to ensure that they can support their unemployed children. Those without children can also be affected by youth unemployment rates. Tighter competition for limited jobs affects anyone changing jobs or otherwise on the job market, and makes it more likely an employee will stay in a low-paying position for fear of no alternative.

Outside of income, household wealth in China depends primarily on property prices. According to Peterson Institute of International Economics Research Fellow Tianlei Huang, in 2019 about 60 percent of household assets were invested in real estate. At that time, approximately 75 percent of consumer loans were mortgages. After years of rising prices and an abundance of construction, property prices appeared to be a safe investment; plus they are a necessity — we all need to live somewhere.

Constant demand and optimism meant real estate companies started relying on apartment and building sales before construction was finished, in addition to creative financing and bank credit. But starting with beleaguered Evergrande, construction started halting on already-purchased projects.

Fears have risen that already-sold prospective apartments will not be completed, leaving buyers with nothing but very expensive broken promises. Capital Economics estimates that this past year, construction stopped on more than 13 million apartments. The Australia and New Zealand Banking Group estimates $220 billion in mortgage loans were taken out for these uncompleted homes.

To those considering purchasing an apartment or taking out a mortgage, these numbers are warning signs to stay clear away.

What the central bank plans to do about it

Citizens are both customers trying to save as well as employees trying to make and sell products. The more people save, the less cash can translate into salaries. Said employees lose their jobs or take a pay cut, making them want to save more and spend less – creating a negative spiral.

Housing and construction face a similar pattern. If customers don’t purchase apartments, real estate and construction companies can’t afford to buy materials and pay workers to build homes. When more construction halts, consumers become more pessimistic about purchasing homes and workers lose their income. The negative spiral deepens.

The central bank’s interest rate cut is supposed to make it easier for businesses to take out loans, making it easier for new businesses to form and for existing businesses to borrow to cover short-term costs, both of which bode well for jobs and salaries.

This is the theory — but it might not work. Since the “cost” of borrowing is the loan’s interest, cutting rates is effective only if interest rates have been too high. However, interest rates are already low. As recently as June, PBOC Governor Yì Gāng 易纲 said so himself when asked what the central bank would do to bolster China’s economy.

When bubbles burst, do they make a sound?

Accounts from Japan in 1990 say that money was still flowing freely. The successful boom of the 1980s had left people with the habit of expecting that no matter how much they spent, more cash would be available just around the corner. This expectation was most exaggerated with investors, but even middle-class households operated with a similar, if less extreme, mindset. It took several years for people to realize the bubble had popped.

Could the same be said about China’s economy today?

The issues facing China’s consumers are coming to a head now, but they have been building for years. Citizens are expressing with their wallets that they don’t feel secure in their futures. They aren’t sure when or if they’ll get a stable job that can support themselves and their families, and they aren’t sure if they’ll be able to afford a place to live. They don’t trust real estate companies to deliver on their promise of a livable home. This is before considering other anxieties, such as power reliability during record heat waves.

There are plenty of stories describing Chinese citizens’ dissatisfaction, with reports of young people “lying flat” (躺平 tǎng píng) or studying “the art of running away” (润学 rùn xué). A growing number of frustrated homeowners are boycotting paying mortgages on unfinished homes. These stories offer telling windows into the opinions of Chinese citizens, but they are difficult to translate into popular opinion.

The July consumer and loan numbers, on the other hand, give a very clear message. People are anxious, and they expect things to get worse. And the central bank can do little to change that.