The sodium battery era is coming soon

Lithium still rules China’s electric vehicle and battery industry, but as prices of the metal skyrocket, sodium battery technology could provide a cheaper alternative.

The lithium boom

The relentless rise of electric vehicles (EVs) and the batteries that power them have created a global lithium boom, and China is at the center of it.

Over the last year, the price of battery-grade lithium carbonate as well as the share prices of lithium mining stocks have both increased more than 10 times.

- Lithium carbonate now costs about 500,000 yuan ($72,179) per ton; just a year ago, the price was only 40,000 yuan ($5,706).

- A lithium-ion battery pack for a single electric car contains about 10 kg (22 lbs) of lithium, which costs about $5,000 at current prices.

- The more EVs China produces, the higher the price of lithium climbs: From January to August this year, China produced and sold 3.97 million and 3.86 million EVs, respectively, compared with 1.36 million and 1.36 million units, respectively, in the whole of 2020.

- During this period, the price of lithium carbonate increased by more than 1,000%.

The lithium boom has transformed parts of China. Yichun 宜春 is a small town in Jiangxi Province with proven lithium oxide reserves of 1.1 million tons, accounting for 31% of China’s total reserves and 12% of global reserves. In the first half of the year, Yichun’s lithium industry was worth 40.33 billion yuan ($5.75 billion), a year-on-year increase of 101%, and is expected to top 800 billion yuan ($114.12 billion) in 2025.

- Earlier this year, EV pioneer BYD 比亚迪 made an investment in a lithium battery project in Yichun of 28.5 billion yuan ($4.06 billion).

- The small city of Xinyu 新余, located 70 kilometers (43.4 miles) from Yichun, while only accounting for 1.9% of the total area of Jiangxi Province, now has the highest per capita GDP in the province, and is home to “Lithium King” Ganfeng Lithium 赣锋锂业.

The rapid increase in EV sales has driven up the price of lithium at lightning speed, but there is in fact no shortage of lithium, and its high cost is a temporary phenomenon. As Robin Zeng (曾毓群 Zēng Yùqún), the chairperson of China’s leading battery manufacturer Contemporary Amperex Technology (CATL), has pointed out, proven global reserves of lithium can produce 160 terawatt hours (TWh) of lithium batteries, about 40 times the entire global demand according to some estimates. Moreover, electric batteries and lithium are increasingly being recycled.

Sodium-ion batteries are cheap, but the tech isn’t ready for prime time

High lithium prices are incentivizing the development of sodium-ion batteries. CATL has on several occasions confirmed that it is working on an industrial chain for sodium-ion batteries and will start producing such batteries on a larger scale in 2023. But the development of sodium-ion batteries is still at an early stage: There is no mass production, and how exactly the technology will fit into EV design is still not clear. Moreover, the energy density of sodium-ion batteries is still far inferior to lithium-ion batteries, and sodium-ion batteries are so far mostly being used for small vehicles operating over short distances, such as two-wheeled scooters.

In principle, however, sodium-ion batteries make a lot of sense: They operate in a similar fashion to lithium-ion batteries (using a positive electrode, negative electrode, current collector, electrolyte, and separator), but sodium-ion batteries are 20-30% cheaper. This is because around 43% of the cost of a lithium-ion battery is accounted for by the cathode materials — cobalt, nickel, and manganese — which sodium-ion batteries do not need.

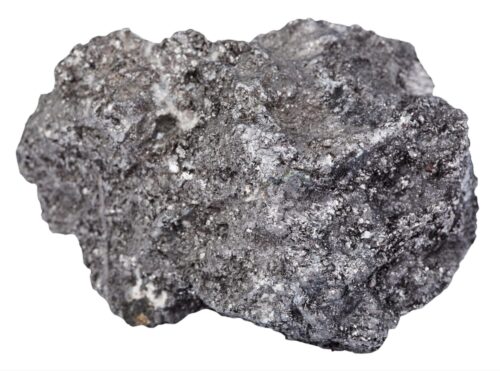

And compared with the lithium price of more than 500,000 yuan per ton, the price of sodium carbonate is a mere 2,000–3,000 yuan ($285–427) per ton.

But in the absence of a developed industrial chain, with unproven performance, and a lack of research and development, sodium-ion batteries are as yet far from being able to replace lithium-ion batteries. Instead, they will develop in tandem with lithium-ion batteries. Hence, the companies developing sodium-ion batteries are still trying to innovate and improvise to find a workable strategy for mass production, and they will not be profitable for at least the next three to five years.

Smart money in sodium

According to a report published in Securities Daily 证券日报 this week, as of September 16, there were 36 A-share listed companies involved in the development of sodium-ion batteries, including Shanxi Hua Yang Group New Energy 华阳股份, Natrium Energy 钠创新能源, Guangzhou Great Power 广州鹏辉能源, and Sunwoda Electronic 欣旺达. Jiangsu Transimage Tech 传艺科技 will in 2023 commence a sodium-ion battery plant of 2 gigawatt hours (GWh) and a pilot production line, with an increase in production to 8 GWh to follow after that, based on market conditions.

There are still multiple technical options for developing the most effective cathode materials for sodium-ion batteries, with the most common being layered transition metal oxides, polyanionic compounds, and Prussian blue analogs. These three options have their own advantages and disadvantages, and there is not yet a clear dominant technical route. For the development of its sodium-ion batteries, CATL, for example, opted for a combination of layered oxide and Prussian blue analogues. Jiangsu Transimage Tech, on the other hand, uses layered oxide and polyanionic compounds.

While the technology is still immature, the foundations for the mass production of sodium-ion batteries are currently being laid in China. As mentioned above, CATL is planning to start large-scale production from 2023, and Ningbo Ronbay New Energy 宁波容百新能源科技 has announced that it will mass-produce cathode materials for sodium-ion batteries starting from next year, while HiNa Battery 中科海钠, whose investors include Huawei 华为, will expand production of positive and negative electrode materials for sodium-ion batteries.

In 2023, sodium-ion batteries will probably start replacing lithium-ion batteries in two-wheelers and microcars, and then in some passenger cars. It is not clear when the technology will be adapted for passenger cars, but the smart money seems to be betting that the sodium revolution is coming.