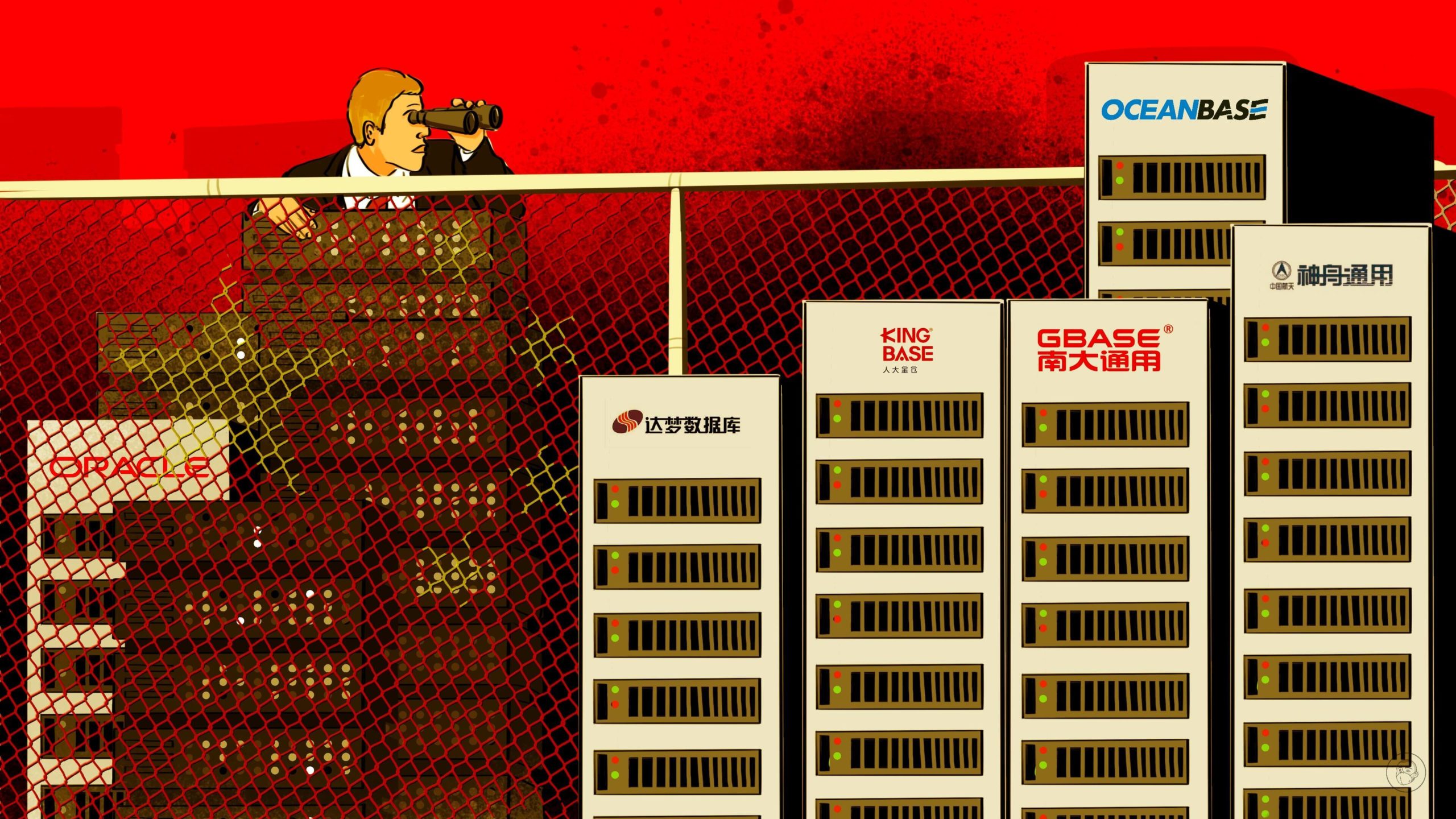

Made in China 2025 is back, with a new name and a focus on database companies

The Chinese government has yet another plan to domesticate the country’s IT infrastructure and to take back control of its data from foreign companies. Chinese investors have taken note.

The Chinese government released its Strategic Plan for Expanding Domestic Demand 2022–2035 on December 14. Investors are taking note.

Respected financial news outlet the Securities Times published an analysis that concludes that a big new wave of “information innovation” (信创 xìnchuàng) is coming, and that the new plan for boosting domestic demand will result in the creation of a xinchuang industry worth hundreds of billions of yuan.

Business and economics magazine Caixin, also considered a highly reliable source, published an article on four of China’s rising database companies, which it said were “riding the xinchuang wave” on the capital markets. All four of the database companies originated at universities and are now set to become hot property on the stock markets:

- On November 7, Shentong Data 神舟通用, which launched at Zhejiang University with investment and talent from the company Beijing Shenzhou Aerospace Software Technology 北京神舟航天软件, passed the final review of the Shanghai Stock Exchange Science and Technology Innovation Board (STAR market), and is set to be officially listed soon.

- In June 2022, Dameng 达梦数据库, which originated at the Huazhong University of Science and Technology in Wuhan, Hubei Province, submitted an application to the STAR market. Its application is still under review.

- Kingbase 人大金仓 originated at Renmin University of China in Beijing. In 2021, the company became a subsidiary of the listed company Taiji 太极股份, which provides IT and cloud services for government departments, and public security and national defense companies.

- In October 2022, GBase 南大通用, which originated at Nankai University in Tianjin, completed a D round of financing with hundreds of millions of yuan.

Made in China 2025 redux

The companies mentioned above are all implementing xinchuang, an abbreviation of “information technology application innovation” (信息技术应用创新). The concept of xinchuang was first mentioned in a long-term government plan, released in 2006, for managing science and technology development up to 2020. Back in 2006, China’s IT infrastructure and databases were mostly managed by foreign companies, notably IBM, Oracle, and Dell EMC. These companies had entered China in the 1990s, and captured up to 80% of the market. There was always some discomfort with that situation, yet it was the increasing scrutiny and opposition toward Huawei 华为 in the U.S. and Western countries from 2018 onward that really inspired clear xinchuang policy formulation, especially at the Ministry of Industry and Information Technology.

Xinchuang is a different formulation than Made in China 2025, which was announced in 2015, but the two phrases have the same goal: The government wants China to make and control its own advanced technology, become self-reliant, and terminate dependence on foreign companies.

In essence, xinchuang requires the full domestication of China’s IT infrastructure and ecology, and domestic substitution of core chips, basic hardware, software and operating systems, and databases and servers. Xinchuang has four main focus areas:

- IT infrastructure, e.g., CPUs, chips, servers, switches, routers, cloud computing

- Basic software, notably operating systems

- Application software

- Information security

Starting from July 2020, when the first xinchuang projects were announced, the project will be implemented in three stages:

- First, it will be installed and tested in closed markets, notably Party and government IT;

- Then, it will be extended to key industries; and

- Finally, it will be applied in consumer industries.

As of October 2022, the central government and local governments have issued a total of 166 xinchuang policies, 67 of which were released in 2022. According to an industry report, from 2011 to 2018, the scale of government contracts for xinchuang projects amounted to 199 million yuan ($28.52 million). From 2019, however, the scale picked up drastically: In 2020, it jumped to 27.92 billion yuan ($4 billion), and for the start of 2021 to November 2022, the amount was 18.45 billion yuan ($2.64 billion). According to the report, some of the key focus areas of these projects were:

- Hardware development, e.g., Infrastructure as a Service (IaaS), including computing, storage, and networking resources, and Central Processing Units (CPUs), i.e., the computer system that controls the interpretation and execution of instructions.

- Software development, e.g., operating systems, enterprise application software; middleware (software beyond the operating system); low-code applications (i.e., drag-and-drop interfaces); and databases.

Databases are a key focus of the xinchuang plan

Databases are central to xinchuang, as the entire project depends on keeping all of China’s data in Chinese hands, which requires the mastering of basic database technology, establishing independent tools and products as well as a full system ecology. According to a report by the consultancy iResearch 艾瑞咨询, the size of China’s database market in 2021 was 28.68 billion yuan ($4.11 billion), which was a year-on-year increase of 16.1%. The xinchuang policy is a major driver of the growth of database companies in China, and the homegrown development of a database management system (DBMS) that includes hardware operating systems and software management tools. The key challenge inherent in databases is the development of source code for managing distributed databases (as opposed to centralized databases) where data is stored across multiple physical locations and that have higher requirements for IT infrastructure.

OceanBase is one of the leading database companies in China, and it operates an open-source DBMS. The company was launched in 2014 by the Alibaba 阿里巴巴集团 affiliate Ant Group 蚂蚁集团 after Alipay 支付宝, the latter’s online payment system, was experiencing problems with its DBMS run by U.S. company Oracle. The company now claims to have 100 clients in the financial industry and 300 in non-financial industries, and its open-source database has more than 3 million lines of source code. In August 2022, OceanBase released its fourth-generation stand-alone distributed integrated database.

OceanBase has touted its success in providing database solutions to the financial industry. The DBMS of such databases have high requirements for concurrent use, data volume, and reliability, cost, and security — all of which can be provided for, according to OceanBase, by the company’s distributed databases.

So far, however, only a small number of self-developed DBMS products have been launched in China like that of OceanBase. TiDB is another open-source DBMS that was launched by the Beijing-based company PingCAP 北京平凯星辰科技发展, and other examples are Polar DB by Alibaba and Mog DB that was launched by the company Enmotech 云和恩墨. Around 80% of China’s databases are still centralized databases, and distributed databases account for less than 20% of the total.

The takeaway

The xinchuang policy will be good for Chinese IT companies, and especially database companies. But it’s yet another sign that the days in China are numbered for Oracle, Microsoft, IBM, and any foreign IT companies that still have a presence in the country.