Ecuador and China sign a free-trade agreement

Ecuador has become the fourth Latin American country to ink a lucrative free-trade agreement with China. But not everybody is happy about Beijing’s growing engagement in the region.

Ecuador President Guillermo Lasso said on Tuesday that his government has completed negotiations on a free-trade agreement (FTA) with China, adding to a growing list of Latin American countries that are inking lucrative economic deals with Beijing.

- “Good news to start 2023. The negotiation between China and Ecuador has been successfully concluded,” Lasso said on Twitter.

- “Ecuadorian exports will have preferential access to the largest market in the world, and our industries will be able to acquire machinery and inputs at lower costs,” he added.

- Bilateral negotiations had started in February 2022, with an aim to seal the deal by the end of last year.

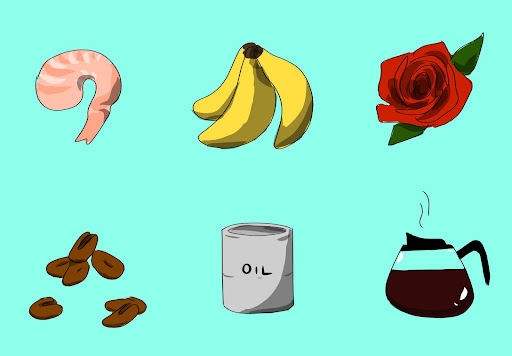

The deal “will allow preferential access for 99% of Ecuador’s current exports to China, particularly agricultural and agro-industrial products such as shrimp, bananas, roses and flowers, cocoa, coffee,” Ecuador’s production ministry said in a statement.

- China has become a major trade partner with Ecuador: Trade between the two nations amounted to $10.95 billion in 2021, a 44.5% growth from the previous year. Much of that comes from crude oil exports, and recently, China’s hunger for shrimp.

- Ecuador, on the other hand, is of significant interest to Beijing because of strategic minerals such as its extractable reserves of copper, iron ore, and oil.

- Earlier this year, China also surpassed the U.S. as Ecuador’s main trading partner in non-petroleum goods, totaling $4.9 billion between January and October 2022.

- Lasso previously said the deal would secure an additional $1 billion in Ecuadorian exports to China, though did not offer further details on Tuesday.

Including Ecuador, China has now signed FTAs with four Latin American countries, with Uruguay in line to be next. China previously signed free-trade agreements with Chile (October 2006), Costa Rica (March 2010), and Peru (August 2011) — all within the past two decades.

“Chile, Peru, and Costa Rica have had mixed results,” Parsifal D’Sola Alvarado, founder and executive director of Fundación Andrés Bello, told The China Project. “Except for a small boost right after signing the FTAs, if you compare the trade growth rate between China and these three countries with the rest of the region, there’s little difference.”

“Furthermore, Chile’s copper industry and Peru’s oil industry have become increasingly dependent on China. No diversification of exports took place in all three countries. It’s hard to say whether we would’ve seen the same trends without the FTAs, especially given China’s energy and raw materials needs,” he added. “Odds are that something similar will happen in Ecuador, the country’s oil and copper sales to China will see a boost, while other exports will continue to grow at their historical pace.”

Uruguay’s “go-it-alone” negotiations with Beijing, which were formally announced last July, have rattled fellow members in Mercosur, South America’s major trade bloc.

- The unilateral trade deal would allow Uruguay greater economic benefits compared with its options within Mercosur, but has drawn stern rebukes from bloc powerhouses Brazil and Argentina.

“China seems to have a general strategy on how to engage and further its interests in the region. The same cannot be said the other way around, and this works to China’s advantage. Latin America and its subregions have historically struggled to work together. Attempts at building trade blocs have either failed or had subpar results,” D’Sola told The China Project.

“The increase in FTAs is a manifestation of this, as countries seek to act individually instead of coordinating with their neighbors,” he added. “For example, Uruguay’s FTA negotiations with China have generated strong opposition from Argentina and Paraguay because it would undermine the Mercosur trade bloc. Until countries in the region do not prioritize a diversification of their economies and take regional trade coordination seriously, the demand for natural resources, be it from China or any other country, will inevitably lead to dependency.”

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Ecuador’s FTA deal with China has also put pressure on the U.S. to counter China’s growing influence in Ecuador and more broadly in Latin America, a region that has typically landed within the U.S.’s sphere of influence.

- Lasso met with U.S. President Joe Biden in Washington in December — with, at the time, a nearly done Chinese free-trade agreement in his back pocket.

- However, talk on ramping up bilateral trade was minimal, despite both sides announcing in November that they would “explore expanding” their trade rules.

- Lasso has sought to join Colombia and Chile as the only South American nations granted a FTA with the U.S.

“With maybe the exception of Mexico — because of its proximity to the U.S. and the USMCA — there’s not much that the United States can do if it wishes to counter or slow down China’s ever-growing participation in the region,” D’Sola told The China Project. “While the Biden administration has had a more conciliatory foreign policy towards Latin America, the damage done during the previous administration still lingers, especially when it comes to China.”

“Pressure and calls to limit engagement with China end up having the opposite effect. This is not to say that Latin American countries wish to distance themselves from the US, on the contrary, generally speaking, even authoritarian states like Venezuela, want a prosperous relationship with the US, they just don’t want to be put in a position where they have to choose sides,” he added.

Meanwhile, last year, Ecuador reached an agreement with China to restructure its debt, providing relief worth some $1.4 billion until 2025.

Note: This story was updated after publishing to include quotes from Parsifal D’Sola, founder and executive director of Fundación Andrés Bello.