Big box stores are dying and Carrefour China is on its last legs

Shelves are empty, staff are leaving, and Carrefour’s China operations — sold in 2019 by the French retail giant to Chinese white goods conglomerate Suning.com — is ready to breathe its last in China after 28 years. Blame ecommerce and COVID.

Consumer goods retailer Carrefour — with its large supermarkets and even larger hypermarkets — is slowly imploding in China. The French retail giant opened its first store in the country in Beijing in 1995. In 2019, the French owners sold 80% of the company to Suning.com, a Chinese white goods retail chain with ecommerce aspirations.

But now Carrefour China seems to be in a death spiral:

- On January 9, shoppers started reporting empty shelves at Carrefour supermarkets and problems with using the company’s prepaid cards.

- During the succeeding week, Carrefour restricted use of the prepaid cards to selected items. Amid speculation that the company will be closing several stores, there was a rush of people trying to spend the remaining funds on their cards.

- On January 18, Carrefour announced that its Changsha hypermarket — the company’s last remaining location in Hunan Province — would be closing on January 30. The next day, long lines started forming outside the store.

- On February 4, the company issued a damage control statement saying that it was actively replenishing merchandise, and that the supply situation would be restored to normal within a month. The company attributed the problems with the prepaid cards to an ongoing internal upgrading process, and also blamed scalpers.

- On February 8, however, news broke that COO Zhāng Qízhé 张其喆, who had been with the company for many years, had resigned for personal reasons, along with several other senior staff.

Following the resignations, Carrefour and its parent Suning.com both stated that there are no plans for Carrefour’s remaining 131 outlets in China to be shut down.

But in the first three quarters of 2022, a total of 54 stores were closed, bringing the total down from 205 at the end of 2021 to 151 at the end of 2022, and so far this year, 20 more have disappeared.

By early February, among the 131 remaining stores, 88 (or two-thirds) had recently received reviews on restaurant and accommodation ratings app DianPing 大众点评 and ecommerce app Xiaohongshu that described empty shelves and a lack of staff. Journalists visited Carrefour supermarkets in Beijing and Shanghai, and found empty shelves at 80% of the stores, including cold sections entirely devoid of produce.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

The context: An idea whose time came and went

Carrefour is a veteran of China’s retail industry. When the first Carrefour hypermarket opened in Beijing in 1995, the big store with the huge variety of produce was a highly attractive novelty. Carrefour then expanded rapidly in China, opening hypermarkets in Shanghai as well as in Jiangsu, Guangdong, Sichuan, Yunnan, and other provinces.

By 2010, Carrefour was the largest foreign retailer in China with a total of 249 stores in 23 provinces (eventually reaching a peak of 259 in 2017). Carrefour’s sales in China steadily climbed up to 2015, when it reached a peak of 5 billion euros ($4.55 billion). But from here onwards sales began to drop inexorably, falling to 3.6 billion euros ($3.19 billion) in 2018.

What changed? In one word: ecommerce. In 2008, Alibaba founded its Tmall ecommerce platform TMall and JD.com started selling general merchandise. China’s ecommerce revolution was underway, and consumption habits began steadily shifting from in-store to online: In 2015, the total online retail Gross Merchandise Value (GMV) in China was 3.87 trillion yuan ($571.23 billion) — by 2018 this had almost tripled to over 9 trillion yuan ($1.32 trillion).

With its huge hypermarkets with huge overheads, Carrefour was left high and dry. It made some halfhearted attempts to launch an ecommerce app and smaller convenience stores, but these did not amount to much. By 2012, Carrefour Group wanted to sell its business in China, and by 2014, Carrefour was starting to close some of its stores there.

Carrefour then became a loss-making enterprise of epic proportions with vast annual net losses:

- 2017: -1.09 billion yuan ($160.93 million)

- 2018: -578 million yuan ($90.15 million)

- 2019: -304 million yuan ($44.26 million)

- 2020: -795 million yuan ($112.42 million)

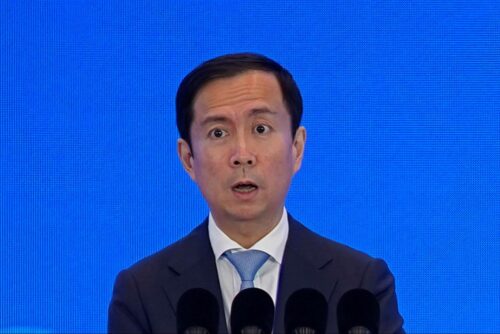

Finally in June 2019, big box retailer Suning.com acquired 80% of Carrefour’s China business for 4.8 billion yuan ($695.03 million). But the new majority owners failed to turn the business around.

In 2021, when the COVID pandemic was playing havoc with retail enterprises in China, Carrefour reported a net loss of a whopping 3.33 billion yuan ($516.49 million), while Suning.com lost a humongous sum of 43.26 billion yuan ($6.37 billion). For the first half of 2022, Carrefour reported a further net loss of 471 million yuan ($74.23 million), and at the end of January, Suning.com released a 2022 performance forecast of up to -11.5 billion yuan ($1.69 billion).

The takeaway

The demise of Carrefour will mark the end of the days of the big hypermarket, which has been superseded by a range of new retail formats, including community group buying, fresh food supermarkets, convenience stores, “instant retail,” and warehouse stores.

Related companies:

- Carrefour China

- Carrefour Group

- Suning.com

- Alibaba

- JD.com

- DianPing

- Xiaohongshu

Sources and additional data:

- 家乐福回应部分货架空置:正积极协调,多举措优化商品供应链效率 / 36Kr

- 视线|家乐福限制购物卡使用 北京顾客抢购“清卡” / Caixin

- 长沙市民排队办理退卡 家乐福正式退出湖南市场 / Caixin

- 家乐福回应购物卡消费受限 / 36Kr

- 家乐福中国COO离职,多数门店经营异常 / 36Kr

- “缺货”风波再起,零售“老兵”家乐福何以至此?/ Jiemian

- 苏宁易购2022年预计亏损95亿至115亿元,同比减亏73.42%至78.04% | 看财报 / TMTpost

- 家乐福中国COO离职,多数门店经营异常 / 36Kr

- A Timeline of China’s E-Commerce Sector and the Evolution of Alibaba, JD, and Pinduoduo / Investor Insights Asia

- Carrefour in China: 25 years of success ends with slow market exit / Daxue Consulting

- With ‘instant retail,’ brick-and-mortar stores are making a comeback / The China Project

- Pinduoduo, the ecommerce platform for Chinese farmers, had a profitable quarter despite the slowing economy / The China Project