Costco entered China at the right time but can its success last?

Members club warehouse retail is suddenly very big in China, and Costco may have struck gold by offering bulk quantities of high value products that Chinese consumers want to buy.

In Shanghai on March 10, U.S. wholesale retailer Costco (开市客 kāishìkè) opened its third warehouse store in China (and 849th global store).

The company was the world’s fifth-largest retailer in 2022 with total revenue of $219.2 billion, and has big hopes for its China operations. Its first Shanghai store opened in 2019, nearly causing a riot. In 2021, the company opened another location in nearby Suzhou.

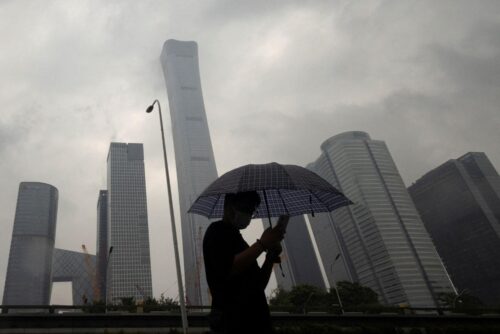

The new store is located in the middle of the vast urban sprawl of Pudong, about 15 miles from the famous skyscrapers opposite Shanghai’s Bund, and about 10 miles away from Shanghai Disneyland. The building has an enormous parking lot and more than 160,000 square feet of space (the average size of a Costco warehouse is 146,000 square feet).

This time, opening day entry was by appointment only and capped at 20,000 shoppers — customers had to already have purchased their membership cards, and needed to register beforehand. Nonetheless, before the official opening, the Pudong warehouse had accumulated 80,000 new members, and by 8 a.m. on opening day, large queues had formed outside. As soon as the doors opened, the warehouse was crowded with people.

Branded products that could be purchased at discounted prices included Moutai liquor, Burberry windbreakers, and North Face jackets. Shoppers could even purchase BMW i3 and iX3 electric vehicles at discount prices. What really drew the crowds, however, was the fresh food. Alongside parmesan cheese from Italy, macarons from France, ham from Spain, and beef from Australia, Chinese shoppers could purchase fresh Korean noodle meals, durian puff pastries, croissants, and big strawberries.

People in China are prepared to buy bulkier formats for what they think is a better deal, as Mark Tanner, Managing Director of China Skinny, a China-based marketing research firm, told The China Project. He thinks Costco has been smart in choosing their locations, “which are in outer areas with less competition, [where there are] large concentrations of villas with larger kitchens and more storage.”

There are other factors that make such locations similar to Costco’s home market in the U.S.: “They are also affluent areas with higher car ownership, allowing customers to purchase larger quantities to take home, because their delivery options aren’t up to scratch against most grocery retailers in China, which was one of the issues which led to Carrefour’s downfall.” Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.China news, weekly.

Discount memberships lure new customers to the Costco cult

Costco’s business model is the members-only warehouse club, a concept that was first popularized by Price Club, which opened its first store in San Diego in 1976 and merged with Costco in 1993.

The concept is that the shopper must pay an annual membership fee to even enter the store. It is these fees that make Costco profitable and allow its stores to offer deep discounts. The membership card also provides a feeling of exclusivity, and inspires customers to make more purchases, ranging from groceries to impulse buys. The products themselves also come in wholesale quantities and outsize packages that are often not available in regular supermarkets.

Other offerings that make shopping at Costco’s huge warehouses an addictive experience for many families are the large range of free food samples, and the fast food stalls. In the U.S., Costco famously sells a soft drink and hot dog combo for $1.50, a price that has remained unchanged since 1985. In China, Costco hotdogs sell for 11.50 yuan ($1.67), along with crumbed, fried chicken and other American fast food staples. Judging from Chinese social media, the cheap junk food formula is working.

According to Richard Chang (张嗣汉 Zhāng Sìhàn), president of Costco Asia, Costco entered China at exactly the right time. As he explained recently at the opening of the new Shanghai store, “Previously, many customers did not know about membership stores, but now customers are able to recognize and understand the membership store because the market is more mature. The more mature consumers are, the more they understand what value is, and the more advantage we have, because consumers can appreciate and recognize the high standards of products and services in our stores.”

Chang points to another key aspect of Costco’s model: Although the prices are famously low, quality control is the real secret ingredient that inspires cult-like loyalty among customers. One supplier to Costco told The China Project that Costco is not interested in selling new brands and products, but rather focuses on established brands. The company does thorough due diligence on the quality control and supply chains of all the products it sells, investigates the financial health of its suppliers, and will only sell products that are set up for long term success.

This value proposition seems to be already well known among Chinese customers. As one shopper explained to a Chinese journalist, membership stores like Costco and Sam’s Club are “definitely not the cheapest. But if you look at the quality and price collectively, you can see the advantages of the membership store…Although the prices of membership stores are higher [than normal supermarkets], the quality is better.” According to Mark Tanner, Costco has “created an experience that a certain segment of consumers like. While younger consumers often prefer quick, convenient offerings, many still enjoy losing a couple of hours in a store, eating along the way, helped by the feeling of getting a host of deals on products they believe are premium. They do create a large buzz for every new opening, which illustrates that there is some latent demand for what they offer.”

But Costco did focus on price when it opened its new Shanghai store: Before the opening day, customers could purchase memberships for 199 yuan (just under $30), below the usual price of 299 yuan ($43). Before the store even opened, 80,000 people had signed up, earning the company 15.92 million yuan ($2.31 million) before the doors even opened. Costco is planning to open a new warehouse in Ningbo in June 2023, and then several more warehouses after that, including in Hangzhou, Shenzhen, and Nanjing.

The context: the rise of members-only warehouse retail

According to the National Bureau of Statistics, in 2022, online sales in China accounted for 27.2% of total retail sales of consumer goods. With the prevalence of ecommerce in China’s current retail landscape, a physical store has to be highly differentiated and attractive to consumers. Both Carrefour and Walmart have found to their cost that large supermarkets and hypermarkets have for years not been any of these things. But while Carrefour and Walmart basically stopped being profitable in China around 2015-2016, Sam’s Club, Walmart’s wholesale chain, has become very profitable. Costco only entered China in 2019, but it is already very popular.

Aside from Costco and Sam’s Club, Metro AG (known as 麦德龙 Màidélóng in China) from Germany is another foreign wholesale retailer in China. Metro opened its first outlet in 1996 and currently has around 100 stores around the country. It opened its first membership warehouse in 2022.

Notable local competitors include Hema Xiansheng 盒马鲜生, Alibaba’s supermarket chain known as Freshippo in English. Freshippo includes a membership store called Hema X. In November 2022, the eighth Hema X members-only warehouse in China opened in Shanghai. With a building of more than 170,000 square feet, the warehouse sells a range of imported goods like bluefin tuna from Japan and oysters from France. In 2022, Freshippo stated that it had broken even after online sales of its fresh produce were boosted during the COVID lockdowns and quarantines. The expansion of the Hema X stores probably played a key role in Freshippo’s profitability. And COVID was good for Costco too in China for a number of reasons: According to Mark Tanner, “people concerned about lockdowns were buying in bulk, in addition to upgrading their homes to make them more liveable, in many cases creating nicer kitchen spaces with more storage.”

Several Chinese supermarket chains have now also started to establish membership warehouses, including Yonghui Superstores 永辉超市, Beijing Hualian Group 北京华联, Jiajiayue Group 家家悦, and Taiwan’s RT-Mart 大润发. And in October 2021, even Carrefour China belatedly accelerated development of a membership-only warehouse retail model. As Tanner told The China Project, “Membership warehouses are performing better than other grocery formats at present, with Sam’s Club being the best performer in the Walmart group and helping them gain back some market share, and the always-interesting Yonghui with its membership stores. Obviously Alibaba with its swathes of data believes it is worth investing in too through Hema X. Chinese consumers love a deal, and also a feeling of exclusivity, which the membership model offers, so it does feel like there are still some legs for memberships particularly with the buzz at openings.”

The challenge: Can China be like the U.S. for Costco?

The membership card is fundamental to Costco’s business model. In 2020, for example, Costco reported annual profit of about $4 billion, of which $3.5 billion (87.5%) came from membership fees. In the U.S., Costco’s card renewal rate is in excess of 90%, but so far in China, according to Richard Chang, the card renewal rate is lower than in other markets.

Specifically at the Costco warehouse in Suzhou, there may be something akin to a wave of membership card returns going on. In early March 2023, a journalist found a long queue of people wanting to refund their cards, and many of these people reported that they were doing so because of infrequent use and poor shopping experiences, while some complained that shopping at Costco is just not convenient if you don’t have a car.

All this could just be because the paid membership retail model in China is still under development and has not yet formed a clear value proposition in the consumers’ minds. But it could also be that China can never quite be like the U.S. for Costco, and there is a limit to the company’s growth prospects. Costco is already targeting higher end Chinese consumers, and while its membership numbers have expanded rapidly since 2019, it may run out of well-heeled consumers after expanding beyond China’s largest first tier cities. And with several other brands now also developing membership retail models, the bigger cities may soon become saturated with large retail warehouses.

According to Tanner, while there are some positive indicators for the membership model, Costco’s retention of members in China is actually really poor — 60% versus over 90% in the U.S. and Canada. “This will prove to be challenging,” he said, “and also reflects that some consumers don’t want to lose a couple of hours shopping there or buy the large volumes. Obviously their plans to open more stores will help them get more economies of scale and efficiencies which are core to their success in offering discounted prices. But with just a few stores they will struggle to get any real efficiencies in the market just yet.”

Companies:

- Costco

- Walmart / Sam’s Club

- Carrefour China

- Freshippo / Hema Xiansheng 盒马生鲜 / Hema X

- Alibaba

- Yonghui Superstores 永辉超市

- Beijing Hualian Group 北京华联

- Jiajiayue Group 家家悦

- RT-Mart 大润发

- Metro AG

Sources and additional data:

- 上海第二家开市客试营业:买出全球第一,真的是因为便宜? / Jiefang Daily

- 现场直击|会员店内卷升级,上海浦东开市客开业首日限流2万人 / Yicai

- 1亿中产买单,没开业就赚了近1600万,这个零售巨头加速开店 / 36kr

- Costco上海开新店,苏州店却排队退卡 / 36Kr

- 疯狂的Costco:以“封建忠诚”之名,行“精神控制”之实 / 36Kr

- 镇做题家,Costco的中国难题 / 36Kr

- 上海第二家开市客试营业:买出全球第一,真的是因为便宜? / China News

- 重磅数据公布!2022年经济全景图来了 / Securities Times

- Metro Shoots Down Rumor That German Retailer Will Exit China Soon / Yicai

- Carrefour to Accelerate Membership-Only Model in China / Yicai

- Costco to open its third store in China — can it challenge Walmart’s Sam’s Club? / Yahoo! News

- A look at the 2023 top 50 global retailers / National Retail Federation

- A Costco opens in China, draws such massive crowds it has to close early / NBC

- Costco’s first China store was so popular it shut down traffic. But can it keep the buzz going? / CNN

- How Costco uses $5 rotisserie chickens and free samples to turn customers into fanatics / CNBC

- Members-only supermarkets becoming popular in China amid consumption slowdown / Global Times

- Costco by the numbers / Cheapism

- 2023 McKinsey China Consumer Report / McKinsey & Company

- Costco Wholesale (COST) Q2 2023 Earnings Call Transcript / The Motley Fool

- Alibaba’s grocery brand Hema Xiansheng breaks even as China’s Covid lockdowns boost need for online groceries shopping and deliveries / SCMP

- Find a warehouse, New locations, Company profile / Costco

- The Elegance of the Costco Supply Chain! / Supply Chain Game Changer

- Big box stores are dying and Carrefour China is on its last legs / The China Project

- Walmart is a China survivor thanks to its wholesale chain Sam’s Club / The China Project