Will China’s EV price war kill some of its car companies?

After Tesla dropped its prices in China, local electric vehicle companies began slashing theirs, too, responding to both market dynamics and government policies. This could spell disaster for some of the smaller firms.

On March 10, a Toyota dealership in Shenzhen posted a new promotion that stunned internet users: The dealership was offering a buy-one-get-one-free deal for certain Toyota models.

Reporters called the dealership and learned that the promotion had ended almost as soon as it had begun. Just two lucky customers managed to cash in on the deal and receive a Toyota Vios free of charge.

The deal was short-lived, but epitomized the current frenzy of price cuts in China’s car market, set off by a potent combination of policy developments and market dynamics. “I don’t think you ever see that anywhere,” Lei Xing (邢磊 Xíng Lěi), a veteran analyst of China’s car market, told The China Project. “You buy a car and throw in another car.”

The origins of the pandemic of price cuts

What is causing the current price wars among auto manufacturers, and how important will this war be for companies to navigate the next few months in China?

As 2022 drew to a close, two major car purchase incentives ended: Government subsidies of 12,600 yuan ($1,831) and 4,800 yuan ($698) for electric vehicles (EVs) and plug-in hybrids, respectively, ended in December. A policy that reduced the purchase tax for traditional internal combustion engine (ICE) cars from 10% to 5% also concluded at the end of last year.

Meanwhile, a new set of stringent emission standards, which have been in the works since 2016, are set to go into effect in July 2023. The new standards will ban vehicles that emit too much carbon monoxide, hydrocarbons, particulate matter, and other pollutants. Some automakers are moving to aggressively cut prices on older inventory that doesn’t meet the standards, as they will be unable to sell the cars come July.

China’s auto industry had a tough start to the year: Overall passenger vehicle sales were down nearly 20% in January and February compared with in 2022. The unusually early Spring Festival also adversely affected auto sales for the year’s first two months.

As the above developments combined to create an environment in which car companies are incentivized to cut prices, Tesla did just that, in January slashing the prices of its popular Model 3 and Model Y cars by about 6% and 13%, respectively.

At the same time that Tesla cut prices, several firms, including Volvo and SAIC’s Roewe and MG brands, effectively extended the ICE purchase tax incentive through January by taking on the tax burden themselves and keeping to their previous prices. In February, Tesla’s steep price cuts forced the hand of Chinese EV makers: BYD, XPeng, and NIO all proceeded to offer discounts on their vehicles.

From price cuts to price massacre

Then in March, state-owned automaker Dongfeng Motor took the major step of cutting prices across all of its models in its home province of Hubei, in the case of some models reducing prices by 90,000 yuan ($13,084). Another state-owned outfit, FAW Group, took a similar tack, announcing total promotions valued at 150 million yuan ($21.8 million) for customers in its home province of Jilin. FAW’s promotions specifically targeted many of its joint ventures with other automakers. The Jilin and Hubei provincial governments also said they would chip in to help subsidize the vehicles. One by one, foreign and domestic firms began to follow suit, starting an all-out price war that Lei Xing believes could turn into a “price massacre.”

Many of the firms are offering the steepest price cuts on their less popular products, making only modest discounts on better-selling models, or not discounting them at all.

Executives from several firms, including NIO and Li Auto, told the media that they would not partake further in the price cuts, but there are subtle ways the companies could still effectively slash prices. Firms could rebrand certain models as entirely new product launches at lower prices, for example.

As competitors cut prices, automakers are incentivized to keep up in order to avoid losing market share, even if it means that profit margins — which are already low to negative in the EV industry — suffer. As more firms announce promotions, those that haven’t yet done so are likely to follow suit in a bid to keep sales from falling, which could affect share prices and worry investors.

Some have predicted that China’s central government will step in and offer similar subsidies as they did in 2022, maintaining demand while offering firms a respite from the recent cutthroat tactics. Lei Xing told The China Project that he wouldn’t be surprised if the government moved to implement similar measures as last year’s purchase tax reduction of 5%. “I think China is looking at this current price war situation, and also the demand in automobiles, and I think it’s very possible that a similar type of incentive could be announced at least before midyear.”

China’s central government has yet to announce any nationwide measures, but provincial governments have in many cases taken the initiative. In addition to Jilin and Hubei’s promotions mentioned above, Sichuan Province’s Chengdu, Heilongjiang Province’s Harbin, and Tianjin, among others, have moved to offer car buyers incentives in order to stimulate demand, aligning themselves with Beijing’s priority of boosting domestic consumption.

Trouble brewing for smaller brands and foreign firms

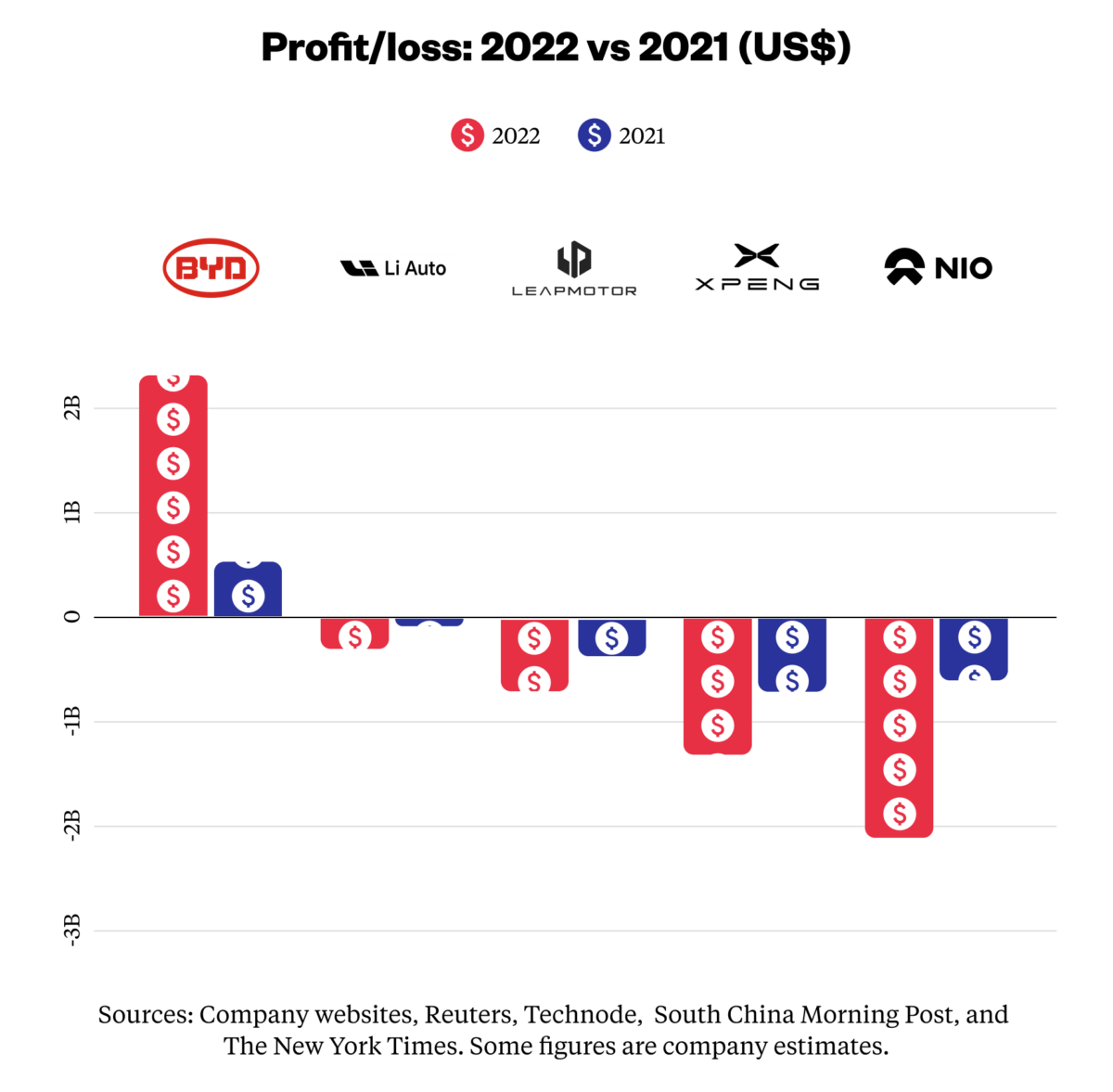

As Chinese auto companies work to attract consumers and offload inventory that will be below standard come July, smaller firms will likely struggle to keep up. China’s three U.S.-listed EV firms, NIO, XPeng, and Li Auto, still have low market share when it comes to EV sales, compared with competitors BYD and Tesla. The price war could only exacerbate this problem, especially for XPeng and NIO, which reported significantly higher net losses than Li Auto last year.

Sino-foreign EV joint ventures (which have struggled to find success in China) and other loss-making smaller EV brands like Leapmotor 零跑 and WM Motor’s 威马 Weltmeister could also struggle to compete with better-performing, profitable firms in the ongoing price war — and could end up following other small EV firms like the once-promising China-German JV Byton 拜腾 into the dustbin of history.

By contrast, a couple of Chinese EV startups may be welcoming the price wars. Baidu and Geely-backed Jidu 集度汽车 and an internal EV unit from phone-maker firm Xiaomi have yet to launch any products, meaning they do not have to expend resources to compete in the current market. As the likes of WM Motor fight to simply stay afloat, Xiaomi and Jidu can look forward to weakened competitors when they eventually enter the market, counterbalancing their latecomer status to some extent.

Foreign firms, which have struggled to keep up with homegrown Chinese brands when it comes to EV sales in China, could also see their problems exacerbated by the price war. Already, Chinese firms make up more than 80% of the market share of EVs in China, where American, Japanese, and European firms have struggled to pivot to new energy vehicles. EVs are only set to grow, with some predicting that half of the cars on China’s roads will be EVs by 2025. Premium brands such as Mercedes and Audi, which have long seen China as a major source of revenue, stand to lose business if they do not become more nimble when responding to Chinese consumers.

“These premium brands are losing people who used to own volume brands that would then trade up to these foreign premium brands, especially the German premium brands,” Lei Xing told The China Project. “They’re losing these potential customers to the NIOs, to the Li Autos, because now Chinese consumers seek more advanced technology, avant-garde features, connectivity, service, and community, where these Chinese brands are much quicker to respond.”

The takeaway

Multiple factors have combined in recent months to weaken demand for cars in China, setting off one of the most intense price wars in the history of the local auto market, with domestic and foreign firms alike offering discounts. Smaller EV startups, as well as foreign players who have struggled to break into China’s EV market, will have a difficult time weathering the storm.

Companies:

Sources and additional data:

- All the electric car companies in China — a guide to the 46 top players in the Chinese EV industry / The China Project

- VW’s electric cars have software problems, and Chinese customers are angry / The China Project

- Troubles deepen for electric vehicle brand XPeng / The China Project

- 真的假的?深圳一4S店购车买一送一!店家回应:两辆赠品车已送出! / Sohu

- China’s carmakers outstrip foreign brands in its electric vehicle boom / Financial Times

- Chinese EV makers rush to boost year-end sales as subsidies expire / TechNode

- 购置税减半2022年结束,这些车企准备继续延! / 懂车帝

- China’s Stage 6 Emission Standard for New Light-Duty Vehicles (Final Rule) / International Council on Clean Transportation

- 【月度分析】2023年2月份全国乘用车市场分析 / 乘联会

- Tesla slashes prices in China after deliveries slump / Wall Street Journal

- Li Auto and NIO opt out of Chinese auto price war / Pandaily

- 东风旗下七大品牌大幅降价被抢购,合资燃油车降价潮将至? / 36Kr

- 成都给出补贴,长城开始官降,第二波降价潮却没有购买欲? / 维科网

- 最高补贴5000元 哈尔滨开展春天驰骋行购车优惠补贴活动 / 北极星电池网

- 天津市支持科研院所创新发展实施意见 / 中国南车

- EV startup Leapmotor is listing in Hong Kong, but its prospects are precarious / The China Project

- Weltmeister: A cautionary tale of China’s electric vehicle industry / The China Project