GAC Aion claims to be better than Tesla, but how good is it really?

Chinese electric car company GAC Aion has high sales and investment numbers, and says it has world-leading tech. Its IPO is in sight, but not all is exactly as it seems.

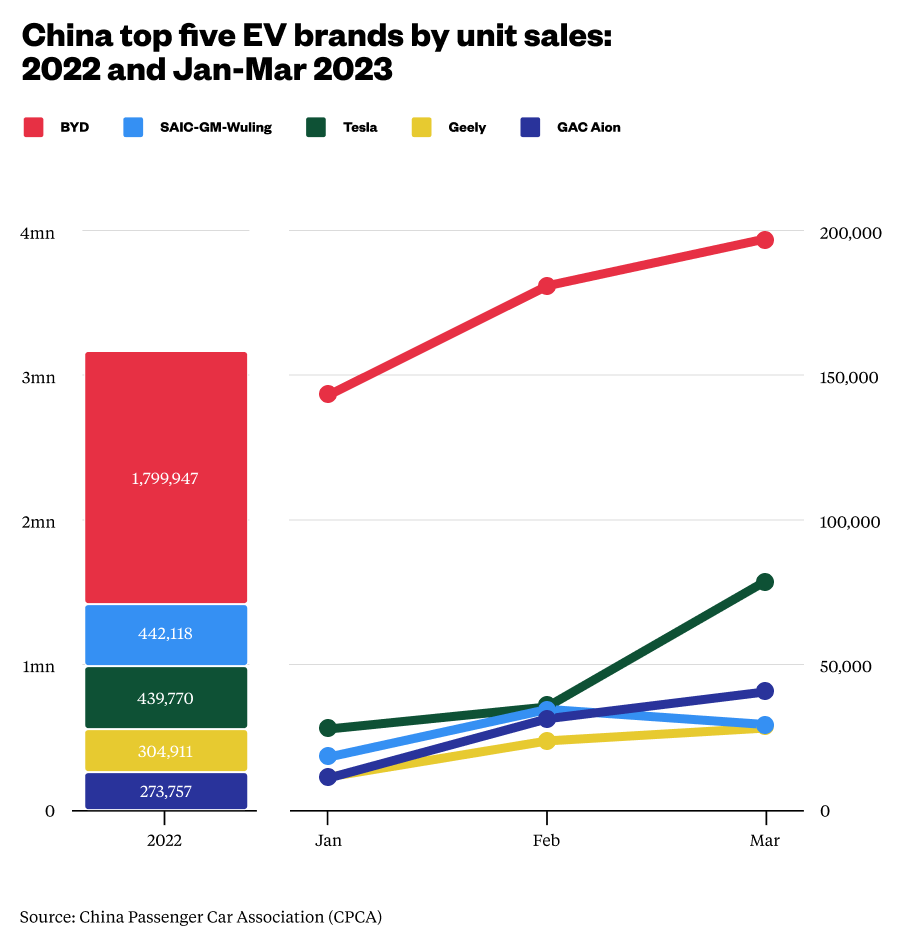

In March, retail sales of new energy passenger vehicles (NEVs), mostly full electric vehicles (EVs), in China amounted to 549,000 units, an increase of 5% year-on-year. The top of the NEV sales table has what is by now a very familiar look with BYD and Tesla far in the lead:

- In March, BYD was way out in front with 207,080 units, an increase of 97.45% year-on-year, and 552,076 units in the first quarter, an increase of 92.81% year-on-year.

- Tesla followed in second place with 76,663 units in March and 229,322 units in the first quarter, an increase of 25.88% year-on-year.

Behind the two frontrunners was a less familiar brand, not Li Auto, XPeng, or NIO (the much hyped Wei Xiao Li triumvirate, named after the first characters of their Chinese names), but GAC Aion 广汽埃安, the EV unit of Guangzhou Automobile (GAC) Group. GAC Group, which is majority-owned by the Guangzhou municipal government, was only founded in 1997 and is not one of China’s Big Four auto manufacturers (SAIC, Changan, FAW, and Dongfeng).

In March, GAC Aion sold 40,016 units, an increase of 96.96% year-on-year and 33.01% month-on-month, and more than Li Auto, XPeng, and NIO put together (38,203 units). In the first quarter, sales amounted to 80,308 units, an increase of 78.96% year-on-year. Although it is not well known (at least outside China), GAC Aion is not exactly a newcomer to the upper reaches of the EV sales table: In 2022, the brand sold 273,757 units, accounting for 4.8% of total EV sales in China that year and placing it fifth behind BYD (1.79 million units), SAIC-GM-Wuling with its mini EVs (442,118 units), Tesla (439,770 units), and Geely (304,911 units).

A stellar trajectory

This is clearly a company to watch — on April 12 2023, Xi Jinping himself visited GAC Aion’s research and development center in Guangzhou during which he called for Guangdong Province to “lead the nation in comprehensively deepening reform.” Lei Xing (邢磊 Xíng Lěi), a veteran analyst of China’s car market, told The China Project, “One word that comes to mind is consistency. GAC Aion is so far one of the more successful mass market EV brands that came out of a second tier traditional local state-owned automaker, and maybe one of the best out of all the major state-owned automakers from a growth trajectory perspective.”

GAC Group first started working on NEVs in 2011. In July 2017, GAC New Energy 广汽新能源汽车 was officially launched. The brand’s first model appeared in November 2018, the Aion S compact electric sedan, which had a price range of 149,800-165,800 yuan ($21,777-24,103). With a battery capacity of 58.8 kWh and an admirable maximum range of 316 miles on one battery charge, the Aion S sold well from the outset, shipping 30,000 units in 2019, 45,000 units in 2020, and almost 75,000 units in 2021. The Aion S was China’s first vehicle to use solar power with panels situated on the sunroof.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

In May 2019, the company launched the Aion LX, a mid-size SUV. The Aion V, a compact SUV, followed in 2020. In November of that year, GAC New Energy changed its name to GAC Aion when the latter became a marque brand under GAC Group. Neither the LX nor the V models would make any significant impact in the market, however, but the Aion Y, a compact hatchback launched in April 2021, shipped 34,108 units in 2021.

The Y model was similarly priced at 119,800-153,800 yuan ($17,416-22,358), but the largest version had a battery capacity of 135 kWh and a maximum range of 372 miles. Of GAC Aion’s total 2022 sales of 273,757 units, the Y hatchback accounted for 119,687 units and the S sedan for 115,655 units, and the two models collectively accounted for 85.9% of total sales.

Could GAC be the first traditional Chinese auto manufacturer to get EVs right? Lei Xing thinks they might be. “I think one reason is GAC started developing Extended Range Electric Vehicle (EREV) and Plug-In Hybrid Electric Vehicle (PHEV) technology back in 2011, and in the early days of the NEV game they launched mostly PHEV models. They put these vehicles into taxi/ride-hailing fleets to grow volume, and iterated quickly from GAC to GAC New Energy and again to GAC Aion. GAC also had relatively better designed EVs that were quite avant garde compared to others.”

In October 2022, GAC Aion completed Series A financing of a whopping 18.29 billion yuan ($2.62 billion), setting a new record for the largest single private equity financing in China’s EV industry. After this investment, GAC Aion had an estimated valuation of 103.23 billion yuan ($15 billion), which is higher than the actual market capitalization of its parent company (as of April 13 2023, GAC Group’s market capitalization is $13.47 billion).

The next big step for GAC Aion is a public listing on the Sci-Tech Innovation Board (STAR Market) on the Shanghai Stock Exchange. With the IPO expected to take place at the end of 2023 or early 2024, this would indeed be a stellar achievement, because no Chinese auto company has ever been able to list on the STAR Market.

Better than Tesla?

With impressive sales and investment numbers, GAC Aion executives are talking big. Like the Wei Xiao Li brands, GAC Aion has its sights firmly set on Tesla, the benchmark for Chinese EV brands, whose executives regularly make claims that one of their new models is better than Tesla. So it was something of a rite of passage at January’s Guangzhou Auto Show when two GAC Aion executives made a “better than Tesla” proclamation. Their confidence was based not on past achievements but on what the company is about to unleash in the market.

In September 2022, GAC Aion launched a new high-end sports car brand called Hyper (Hàobó 昊铂 in Chinese), the first model of which is the Hyper SSR pure electric “supercar,” which will be mass produced from October 2023 and carry a price tag of 1.28 million yuan ($186,920). At the Guangzhou Auto Show, GAC Aion officially launched the second Hyper model, the pure electric coupe Hyper GT.

The GT will also be mass produced in 2023. Pre-sales will commence in April and deliveries in June, with the price expected to exceed 300,000 yuan ($43,605). According to GAC Aion, the GT will be able to accelerate from zero to 100 km/h (62 miles/h) in just four seconds.

At the Guangzhou Auto Show, Xiào Yǒng 肖勇, GAC Aion deputy general manager, made his Tesla claim about the Hyper GT:

In terms of performance, smart driving technology, appearance, and luxury craftsmanship, we have already comprehensively surpassed Tesla…We believe that we can win the favor of young and aspiring Chinese consumers. We have the confidence to say that we are more expensive than Tesla, but we believe they will choose us.

(In January 2023, the Tesla Model 3 was about 229,900 yuan / $33,400 in China, so the GT will be at least 70,000 yuan / $10,000 more expensive).

Talk is cheap, but how good is the tech?

Speaking at Guangzhou Auto Show, Gǔ Huìnán 古惠南, GAC Aion general manager, also oozed confidence, saying: “The key advantage is to have the best, most original, and exclusive technology.” GAC Aion has it, Gu declared, and he mentioned some specific examples: “We have the three-in-one electric drive, the magazine battery, autonomous driving, the Xingling electronics architecture, and more, and all of this technology is world class.”

But how good is GAC Aion’s tech really? As Lei Xing put it, “GAC likes to talk the talk more than others. I think they do have some unique technology but it’s just that they are sometimes too provocative in their marketing messages.”

Batteries

On March 29, a video was posted online of what was reported to be a Hyper GT that had caught fire and spontaneously combusted at a charging station in Guangzhou. The next day, GAC Aion held a press conference to announce the release of its Magazine Battery 2.0 (so called because it has the appearance of an ammunition storage magazine, 弹匣 dànxiá). GAC Aion announced the results of a live gunfire safety test (to simulate a serious accident) in which a rifle bullet was fired into the Magazine Battery 2.0 as well as a mainstream lithium-ion battery (i.e. non-GAC Aion) from a distance of 15 meters (49 feet). The GAC Aion battery emitted smoke for 6 minutes and 36 seconds, but there was no fire or explosion; the mainstream battery, on the other hand, caught fire and combusted. According to GAC Aion, the Magazine Battery 2.0 has an ultra-stable electrode interface, heat resistant materials, and a battery fire extinguishing system that it calls a “miniature fire brigade.”

In October 2022, the company established Yinpai Battery Technology 因湃电池科技 with an investment of 10.9 billion yuan ($1.58 billion). Construction of a factory commenced in late 2022, and the site is expected to be in full operation by the end of 2025 with production of 36 GWh annually, which will be enough batteries for 600,000 EVs every year.

Electric drives

The “three-in-one electric drive” (encompassing “electric drive, electric control, and differential reduction”) mentioned by Gu refers to technology released by GAC Aion in 2018 and fitted to all its previous models. In 2020, GAC Aion released a “four-in-one” electric drive consisting of an integrated two-speed dual-motor, controller, and reducer. The Hyper SSR will be equipped with the four-in-one drive and will be able to generate horsepower (hp) of 1,225, exceeding the 1,020 hp of the Tesla Model S.

In March 2023, GAC Aion released the Quark Drive 夸克电驱, a “palm-sized” electric motor that it claims is able to generate more horsepower than a V8 engine. GAC Aion has established Ruipai Power Technology 锐湃动力科技 to build electric drive systems with an investment of 2.16 billion yuan ($320 million), and the plant is expected to be fully operational by 2025 with production of 400,000 electric drive systems and 100,000 electric motors annually.

Electronics and software

In November 2022, GAC Aion released the Xingling Electronics Architecture 星灵架构 navigation system that includes infrared remote sensing technology, second generation intelligent zoom lidar, aerospace-grade satellite-based positioning, and other smart driving technologies. The system has a range of 200 meters (218 yards) and coverage of 360 degrees, and can distinguish obstacles at night and in all weather scenarios.

The Xingling system includes three core computing unit modules and four regional controllers, and the system can reportedly reach a maximum computing power of 2,000 Tera Operations Per Second (TOPS). If it can indeed reach a level of 2,000 TOPS, this would be very impressive: In September 2022, Nvidia announced its new groundbreaking Thor system-on-chip (SoC) integrated circuit (integrating most or all components of an electronic system) that is expected to deliver 2,000 TOPS — but Thor is only going to start appearing in applications by 2025. GAC Aion has established a research laboratory with the China National Space Administration, and the company now has 2,000 software engineers, accounting for more than 50% of the whole research and development team.

Obstacles ahead

As GAC Aion now gears up for what it hopes will be a blockbuster IPO, all the while talking up its technology, there are a few potential speed bumps ahead.

Lack of profitability

GAC Aion’s revenue increased from 5.23 billion yuan ($759.84 million) in 2019 to 7.61 billion yuan ($1.10 billion) in 2020 and 17.26 billion yuan ($2.50 billion) in 2021.

But like all of China’s EV brands (apart from BYD), GAC Aion has never seen any profit — Tesla, after all, needed 17 years to achieve its first profitable year in 2020. From 2019 to May 31 2022, GAC Aion had a cumulative net loss of over 3.7 billion yuan ($537.14 million). As the company’s cars have so far all retailed below 200,000 yuan ($29,034), the company is making a loss of at least 10,000 yuan ($1,451) for every unit sold.

Yet as a marque brand of a traditional auto manufacturer that is very profitable, a lack of profitability is likely less of a concern for GAC Aion than for the independent Wei Xiao Li brands. And unlike those brands, whose buyers from January 1 no longer enjoy government purchase subsidies, the Guangzhou provincial government still provides subsidies for GAC Aion customers.

Dubious sales numbers

GAC Aion’s impressive sales numbers are not quite all they’re cracked up to be, because the brand has a similar problem than that faced by Hozon Auto: high sales but few customers.

A large proportion of GAC Aion’s sales have not been to individual customers but to car businesses like rental and car-hailing companies, especially Ontime 如祺出行, GAC Aion’s own car-hailing business, which has 18 million registered users and is also gearing up for an IPO. In 2021, for example, as much as 43% of GAC Aion’s total sales came from these businesses; for the Aion S sedan, the proportion was as high as 63%. Sales to car and rental companies can be a short-term solution to buck up sales, but will not contribute much to expanding brand recognition among customers.

A lackluster IPO

GAC Aion seems well placed for its IPO, even if it doesn’t make it to the STAR Market. But with the Hyper models hitting the market this year, the stakes are about to get very high for GAC Aion, and a sudden drop in sales could put the brakes on the brand’s IPO momentum, and a less than exuberant IPO could deal a blow to the company’s development as a whole. The capital markets have lost some enthusiasm for EV companies, as was illustrated by Leapmotor’s flopped IPO in September 2022.

The takeaway

GAC Aion might not be China’s Tesla, but it could be the first successful attempt by a traditional Chinese auto manufacturer to get EVs right.

Companies:

- GAC Group

- GAC Aion 广汽埃安

- Ontime 如祺出行

- BYD

- Li Auto

- XPeng

- NIO

- SAIC

- Changan

- FAW

- Dongfeng

- SAIC-GM-Wuling 上汽通用五菱

- CATL

- Ganfeng Lithium

Links and sources:

- China’s Mar NEV retail sales at 549,000 units, preliminary CPCA data show / CnEVPost

- BYD sells 207,080 NEVs in Mar, up 6.9% from Feb / CnEVPost

- Tesla sells 88,869 China-made vehicles in Mar, CPCA data show / CnEVPost

- Tesla delivers 76,663 vehicles in China in Mar, exports 12,206 from Shanghai plant / CnEVPost

- 官宣!3月汽车销量榜,25家新能源厂商销量排名,特斯拉88869辆 / Dongchedi

- 33% Plugin Vehicle Market Share In China — February 2023 Sales Report / CleanTechnica

- China EV deliveries: Aion, Leapmotor, Shenlan and more / CnEVPost

- Troubles deepen for electric vehicle brand XPeng / The China Project

- 乘联会发布 2022 年中国市场汽车销量榜 / Sina

- Mini electric cars are big in China — will the rest of the world catch on? / The China Project

- Key role seen for Guangdong / People’s Daily Online

- 全年销量突破27万辆,广汽埃安能否突破“网约车”枷锁? / 36Kr

- 3月造车新势力排行榜 多家销量同比大涨 / Sina

- 22% Of New Car Sales In China Were 100% Electric In 2022! / CleanTechnica

- China’s traditional car companies are getting electric vehicles right / The China Project

- 拳打特斯拉、脚踢蔚小理? 广告法管不了广汽埃安了 / 36Kr

- Carmaker Nio is ‘well positioned’ to capture a lot of China’s electric vehicle market, analyst says / CNBC

- Xpeng is finally shipping the P7, China’s Tesla Model 3 rival / SCMP

- 对话广汽埃安:闯入高端局 叫板特斯拉 / Auto Home

- The Futuristic Aion Hyper GT Is Part Sports Car And Part Family Car / Hot Cars

- GAC Aion Hyper GT Debuts As The Most Aerodynamic Production EV / Car Scoops

- 光靠销量,广汽埃安超越不了特斯拉 / 36Kr

- 疑似广汽埃安Hyper GT充电站自燃 车辆还未正式亮相发布 / Sina

- 针刺试验成弟弟!广汽埃安发布弹匣电池2.0:枪击后不起火不爆炸 / Mydrivers

- 广汽埃安发布弹匣电池2.0:将逐步搭载昊铂品牌 / Sina

- GAC breaks ground on battery plant in China / Electrive

- GAC Aion Holdings’ RuiPai Power officially started construction: self-developed IDU electric drive system and electronic control / Techgoing

- GAC New Energy Announces Pre-Sale Price for the Aion S / PR Newswire

- GAC New Energy unveils new drive unit that allows cars to accelerate from 0-100 km in less than 2 seconds / CN Tech Post

- GAC Group’s Aion Announced First Super Sports Car Hyper SSR in China with 0 to 100 Acceleration in Less than 2 Seconds / Energy Trend

- GAC AION introduces ‘Quark Drive’ electric drive tech comparable to V8 engine / Gasgoo

- 广汽埃安发布“夸克电驱” 突破电机世界级难题 / China News Service

- GAC AION launches new premium BEV-dedicated platform AEP 3.0 / Gasgoo

- 星灵架构+AEP 3.0 平台,智能电动下半场竞赛,埃安稳了 / Dongchedi

- Nvidia Cancels Atlan Chip For AVs, Launches Thor With Double Performance / Forbes

- 广汽埃安发布星灵架构 智驾系统引入红外遥感和星基融合定位 / Chedongxi

- 星灵架构背后的故事 / Sohu

- 广汽联合赣锋锂业意欲何为 / Sina

- GAC Group’s net profit in 2022 was 8.068 billion yuan, a year-on-year increase of about 10% / Tech Going

- 新造车排位赛3月再生变:理想再破2万辆,埃安首破4万辆 / 21st Century Business Herald

- 欧洲外商“组团上门”广汽埃安,广州新能源汽车如何借势出海? / 21st Century Business Herald