China’s semiconductor industry can’t quit German optics

Optical systems are crucial to the high-tech machines China needs to manufacture advanced semiconductors. But Chinese optics firms are reliant on foreign supply chains that are coming under growing scrutiny.

The supply chains for the production of semiconductors are notoriously complex; manufacturing advanced photolithography machines, the devices that “print” chips out, for example, requires thousands of parts from a host of different companies.

The optical systems involved in lithography are some of the machines’ most important components, and some of the most difficult to engineer. Chinese firms are stepping up to the task of making these systems as part of broad-based efforts to make China’s high-tech industries more self-reliant and less exposed to foreign supply chain bottlenecks. But recent documents from Chinese companies show that they often still rely on German, American, and Japanese companies for inputs.

Last week, Bloomberg reported that Germany was considering restrictions on exports of key chemicals required for the production of semiconductors. The move highlights a growing trend of U.S. allies cutting off pieces of the semiconductor supply chain from China. While major companies have long restricted the export of top tech like ASML’s extreme ultraviolet (EUV) lithography machines, the restriction of more basic components like chemicals or optics from non-U.S. companies is just now ramping up.

These kinds of measures likely worry policymakers in Beijing, but they won’t come as a shock. China has long complained of U.S.-led Western efforts to contain its rise, and has invested in industrial policy to achieve higher levels of tech independence.

While Beijing hasn’t always supported smaller Chinese firms further up the supply chain, it has begun doing so in recent years. “What’s interesting is for the 2014 policy, the first tranche basically ignored a lot of the upstream suppliers into fabrication, so I didn’t see much successful activity,” said Copenhagen Business School Professor Douglas Fuller, speaking of the 2014 establishment of the China National Integrated Circuit Industry Investment Fund, often called the “Big Fund”, which saw a second tranche of funding in 2019. “But given the ever-increasing moves towards decoupling, in the second tranche China responded to that and focused more on capital equipment and various other inputs into fabrication.”

China’s steps to support smaller firms include its “little giant” program meant to improve the performance of small innovative firms working to plug gaps in key supply chains, including in the semiconductor sector. But these efforts have not borne the fruits policymakers hoped for, partly because the technologies in question are so advanced and complex. “I would have to say at this juncture I don’t see great success stories, and in some supplies there already seem to be very high technical barriers to entry,” said Fuller.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Getting the optics right

Smaller optics companies are a major part of these efforts. Optics play an important role in semiconductor fabrication, with precisely engineered lenses and mirrors key for focusing the light rays that carve circuitry patterns onto silicon wafers. Optical systems play a role in other parts of the production process as well, such as inspection of the chips after they’ve been etched.

“The role of what the optics are doing, it’s very important…You have a mask, a photomask, which includes the chip design, so that would be very complicated, right?” said Jon Y., who writes the semiconductor-focused Asianometry newsletter. “And what you’re using then is the optics to shrink down that image view in a way that helps to make it much more economical.”

China’s flagship chip fabrication equipment manufacturer, Shanghai Microelectronics Equipment (SMEE), produces photolithography machines used to manufacture semiconductors, but lags way behind the Netherlands-based industry leader ASML, as well as Japanese lithography companies Nikon and Canon. Chinese chip producers continue to use imported lithography machines to make their most advanced chips, but SMEE’s role is only likely to grow as China relies more on homegrown firms.

Currently SMEE produces lithography machines capable of making chips at the 90 nanometer (nm) node, putting the firm decades behind foreign competitors. Previous predictions from the company said they would release machines at the 28 nm node by 2021, but this has not yet occurred. One Taiwanese chip engineer told the Asia Times that it was unlikely SMEE would be able to put 28 nm lithography tools to use within six years.

Catching up will be difficult for SMEE. The U.S. and its allies are tightening the access that Chinese firms get to equipment, and in December the U.S. Department of Commerce placed SMEE on the Entity List, putting roadblocks in place for any U.S. companies that aim to export to SMEE.

Roadblocks to self-reliance

While Chinese policymakers often speak about technological self-reliance, it’s unlikely China will be ever able to have a completely domestic semiconductor supply chain. The complexity of semiconductor design, fabrication, testing, and assembly makes it difficult for any single country to have all the pieces.

“Even though most of its semiconductors are produced by other countries and regions like Taiwan, the reason the U.S. doesn’t feel that pressure of not being self-sufficient is because the U.S. controls some of the key elements of the supply chain, like the chip design, like the semiconductor manufacturing equipment,” said Jeffrey Ding, Assistant Professor of Political Science at George Washington University. “So, if another country even tried to cut the U.S. off, the U.S. would have an easy countermeasure.”

This is partly what China’s little giant enterprises are for, said Ding. “Attempting to try to carve out a specific niche is essential, and that’s what China is trying to do with all these little giant projects, to sort of capture these niche elements of key supply chains.”

China’s government may also be playing fast and loose with how they define indigenous innovation, given the complexity of supply chains. While one component of a lithography machine may be sourced from a Chinese company, the sub-components that went into that piece might come from overseas firms.

During its own economic rise in the 1980s, Japan touted its indigenous innovation in satellites, but in reality sourced crucial subcomponents from abroad, Ding explained to The China Project. “Japan had this domestic production ratio where they would say, we have 100% domestic production in satellites now, but that was only with the first tier manufacturers,” he said. “If you looked deeper into where are you sourcing all these different components and subcomponents from, they were overstating the indigenous aspect of innovation.”

China’s optics companies are running into similar issues today.

China’s optics firms continue to use foreign suppliers

When it comes to the optical systems in its lithography machines, SMEE does not tend to source from foreign firms, according to its website. Instead it uses systems from Chinese optics companies like UP Optotech, Focuslight Technologies, and MLOptic Corp. However, recent documents from these firms in turn showed heavy procurements from German and American suppliers.

Registered as a little giant, Changchun-based UP Optotech is a major supplier for SMEE, and was founded in 2001 with backing from the Chinese Academy of Sciences-affiliated Changchun Institute of Optics, Fine Mechanics and Physics, a leader in China’s optics tech ecosystem.

UP Optotech’s 2021 annual report revealed that the firm’s top supplier wasn’t Chinese, but in fact the German application-specific integrated circuit company iC-Haus. That year, 11.49% of the company’s procurements came from iC-Haus.

A year later, in its 2022 annual report, UP Optotech directly mentioned the issue of foreign supply chain exposure, writing that independent control and import substitution would be key to solving the “chokehold” (卡脖子) problem. But the same report showed that iC-Haus was the second-biggest supplier for UP Optotech for 2022. UP Optotech’s purchases from the German firm made up 8.5% of its more than $13 million in procurements in 2022.

Another document from 2019 related to an issuance of UP Optotech shares showed that in 2018 and the first half of 2019, California-based Newport Corporation was the Chinese firm’s top supplier. Company annual reports for 2020 and 2021 showed that Newport didn’t crack the top five suppliers, perhaps reflecting the firm’s efforts to diversify away from U.S.-reliant supply chains.

Focuslight Technologies is another key supplier for SMEE whose supply chain as recently as 2021 was quite exposed to U.S. and German firms. A document issued in the lead-up to the firm’s December 2021 IPO in Shanghai showed German firms Trumpf, Jenoptik, and Rogers Germany, as well as U.S.-based Coherent, as the firm’s top four suppliers for the first half of 2021, making up over 30% of Focuslight’s procurements.

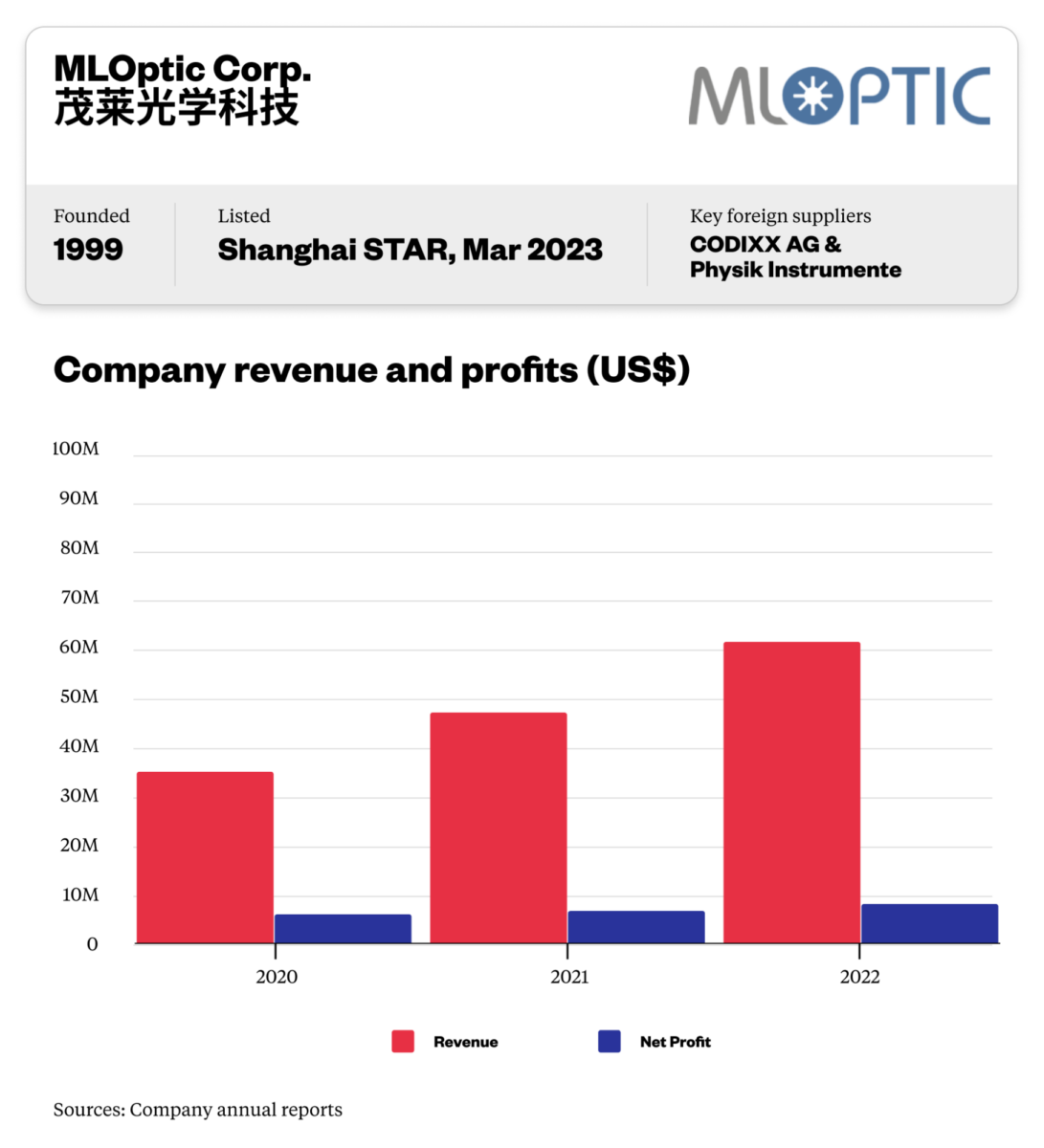

Documents from Chinese optics firm MLOptic, another supplier for SMEE’s lithography machines, also showed a reliance on German suppliers. MLOptic’s 2022 annual report showed German optics companies CODIXX AG and Physik Instrumente as its first and third biggest suppliers, together accounting for nearly 8% of procurements. The same document showed that in 2020 and 2021, Japan-based Ohara Corporation was a major supplier.

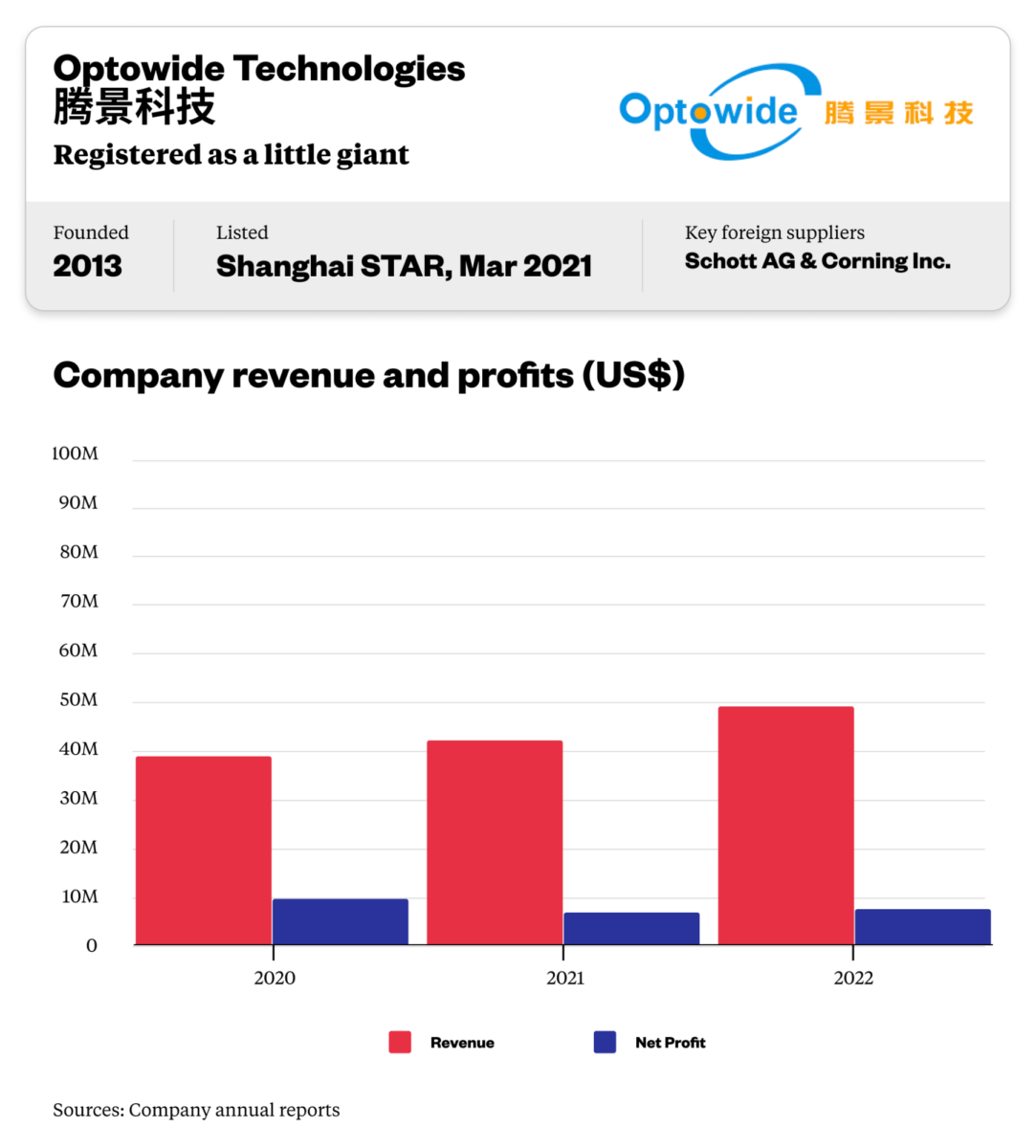

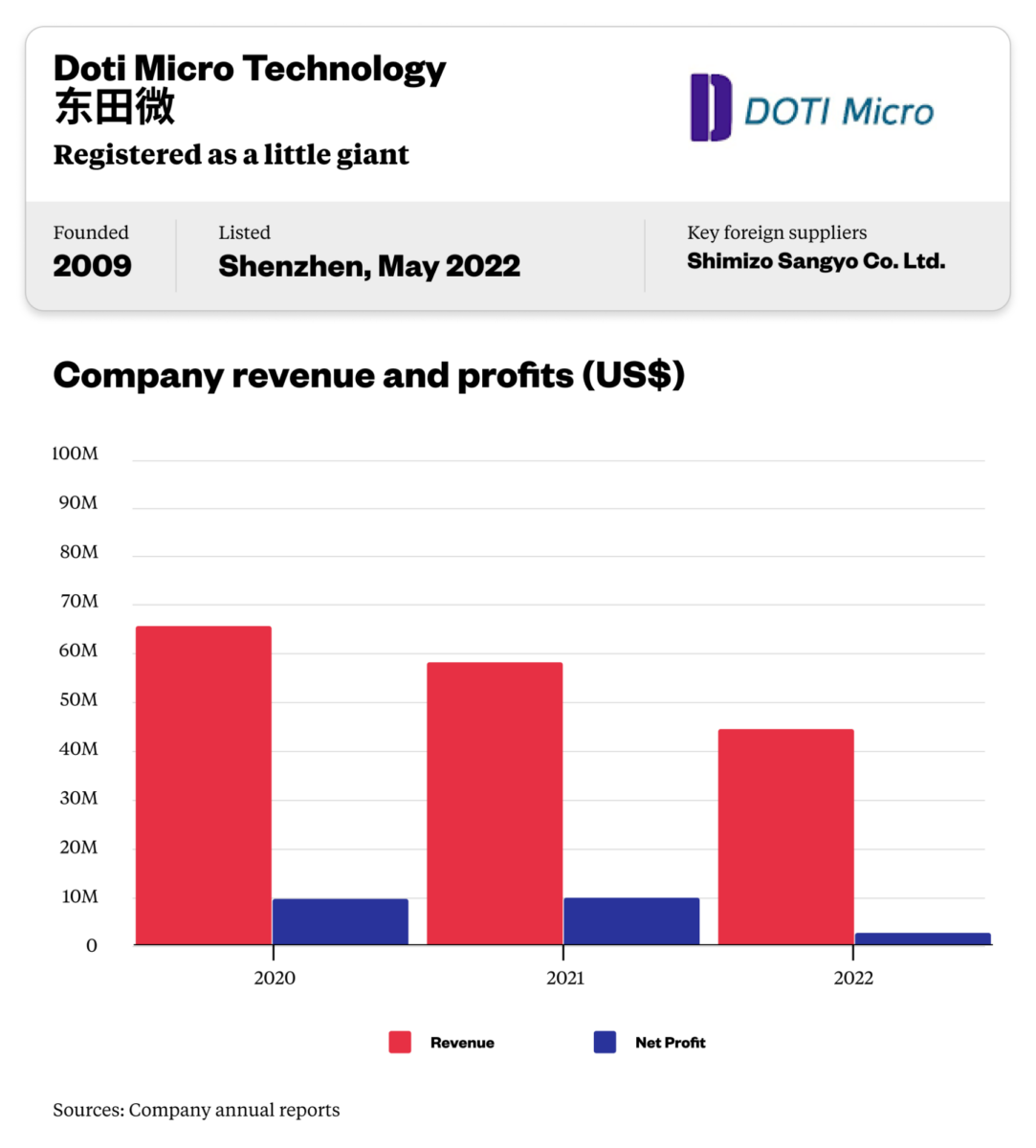

Optics companies Doti Micro Technology and Optowide Technologies, both little giants, also relied on foreign firms for some sourcing. From 2019 to 2021, Doti Micro spent millions on resin products from Japanese firm Shimizo Sangyo Co. Ltd. Optowide in 2019 bought optical glass components from German firm Schott AG and fiber optics equipment from U.S.-based Corning Inc. (More recent annual reports from these two companies give information on the value of goods procured from top five suppliers, but do not specify which companies they are.)

The takeaway

Germany looks increasingly willing to cut Chinese companies in the semiconductor supply chain off from important materials and components. For China’s optics industry, and by extension its efforts at developing advanced photolithography, this could present a major roadblock going forward.

Companies:

- Shanghai Microelectronics Equipment 上海微电子

- UP Optotech 奥普光电

- Focuslight Technologies 炬光科技

- MLOptic Corp 茂莱光学科技

- Doti Micro Technology 东田微

- Optowide Technologies 腾景科技

Sources and additional data:

- 「科普」国产光刻机的真实差距 / 一水遮夏

- 老树开新花,蔡司不再依赖镜头业务,最让人眼馋的竟是半导体业务 / New公司观察

- The Semiconductor Supply Chain: Assessing National Competitiveness / Center for Security and Emerging Technology

- China’s Progress in Semiconductor Manufacturing Equipment / Center for Security and Emerging Technology

- 从仿制到自研:百年镜片钻研史 / Jiemian

- Deep Dive: SMEE and China’s Attempt to Replace ASML Tools / Equal Ocean

- Factbox: Chinese chipmaking equipment manufacturers filling void left by U.S. export restrictions / Reuters

- EUV’s Underdog Light Source Will Have Its Day / IEEE Spectrum

- 国产光刻机全产业链协同发展,A股零部件公司初具关注价值 / ijiwei.com

- TH Capital portfolio company Focuslight successfully completes their IPO, confirming once again our hard-tech investment strategy / TH Capital

- 上海微电子光刻机产业链- 张江高科 / Xueqiu

- 重新认识炬光科技—三年三倍潜质的小巨人 / Xueqiu

- 茂莱光学:目前主营业务暂不涉及光通信业务 / ijiwei.com

- 茂莱光学科创板上市:年营收4.4亿募资9亿 市值110亿 / Sohu

- 精密光学综合解决方案提供商茂莱光学拟首次公开发行1320万股 / OFWeek

- 2022年亏损幅度或扩大 欧菲光的失速引擎何时重启? / The Paper