Qing Dynasty bonds and the trade war as toddler tantrum

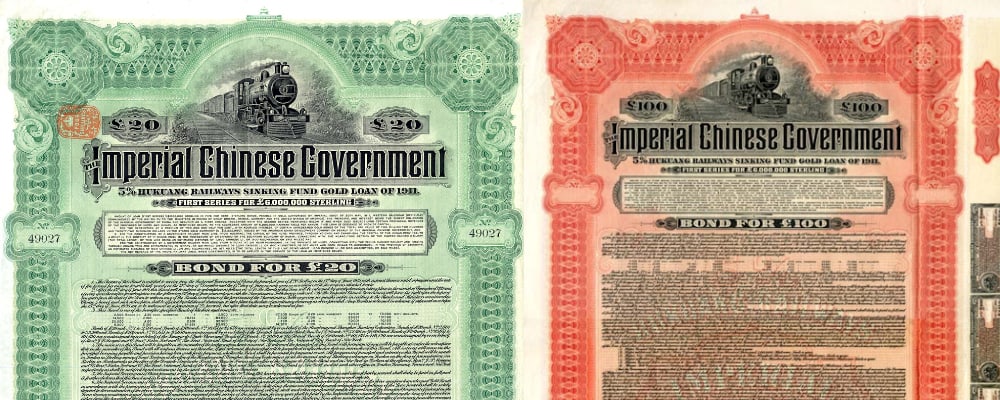

Here’s a possible toddler move from Donald Trump that the Chinese government is sure to ignore. A group of Americans own Hukuang Railway bonds, which were sold in 1911 to help fund construction of a rail line stretching from Hangzhou to Sichuan. The government of the Qing Dynasty (1644-1911) issued the bonds, just before it collapsed, rendering the bonds worthless. Bloomberg reports:

Now, with Trump ratcheting up the trade rhetoric with China, holders of the antiquarian bonds are hoping he’ll press their case, even as other parts of the U.S. government are accusing people of fraudulently selling the same paper.

“With President Trump, it’s a whole new ballgame,” says Jonna Bianco, a Tennessee cattle rancher who leads a group representing pre-revolutionary China bondholders and who has met with the president. “He’s an ‘America First’ person. God bless him.”

Parents with toddlers may recognize the moment: when there is nothing to be done about a temper tantrum or a fit of crying, except to wait it out while making the occasional reassuring noise. At this phase of a toddler’s emotional outburst, neither the threat of punishment, nor loud screaming, nor even being nice and offering hugs and ice cream, will work. You just got to wait. Eventually the little beast will become human again.

The Chinese government seems to have resigned itself to a similar situation with regards to Trump’s trade war, on day 420. Here’s the latest:

“China indicated that it wouldn’t immediately retaliate against the latest U.S. tariff increase announced by President Donald Trump last week, emphasizing the need to discuss ways to deescalate the trade war between the world’s two largest economies,” reports Bloomberg (porous paywall).

“China has ample means for retaliation, but thinks the question that should be discussed now is about removing the new tariffs to prevent escalation of the trade war,” Ministry of Commerce spokesman Gāo Fēng 高峰 told reporters in Beijing on Thursday.

“The most important thing at the moment is to create necessary conditions for both sides to continue negotiations,” said Gao, “adding that China was lodging ‘solemn representation’ with the United States” about the latest round of tariffs, according to Reuters.

A voice of moderation in the Wall Street Journal: Has America’s China backlash gone too far? (paywall) asks economy columnist Greg Ip:

Yet if the pendulum swung too far toward accommodating China in the past, it may be rebounding too far toward confrontation now. That’s what I gleaned from speaking with several establishment figures with decades of combined experience on China.

“We have a China attitude, not a China policy,” says Henry Paulson who, as Treasury secretary under Mr. Bush, dealt with China intensively and has recently become more critical. “You have Homeland Security, the FBI, CIA, the Defense Department, treating China as the enemy and members of Congress competing to see who can be the most belligerent China hawk. No one is leaning against the wind, providing balance, asking what can we realistically do that has some chance of getting results that won’t be harmful to our economic and national-security interests in the long term?”

American companies ♥️ Chinese consumers: Bloomberg reports (porous paywall):

With fewer Chinese tourists visiting the U.S., Tiffany & Co. moved some of its most expensive jewelry to its Beijing and Shanghai stores last quarter, selling limited quantities of special Tiffany Keys diamond pendants and Tiffany Love Bugs. The New York-based retailer is also upgrading all three greater China flagships, including Hong Kong.

Ford Motor Co., which expects China to become the biggest market for its Lincolns in the next few years, has said it eventually plans to build locally most of the vehicles it sells in the country under that brand, avoiding tariffs. Tesla Inc. is focused on getting its plant in Shanghai running by the end of the year.

“China is studying technology companies’ reliance on American suppliers,” says the Wall Street Journal(paywall), and “plans to release ‘in the near future’ an ‘unreliable-entity list’ of foreign businesses and individuals that would face restrictions in their dealings with Chinese counterparts.”