China’s top economic policy priorities for 2021 — according to the Two Sessions

China pledges to invest more on technology innovation, put stronger hands on Big Tech, and get started on its climate goals.

Economics is at the center of the ongoing Two Sessions’s policymaking agenda.

The Government Work Report and 14th Five Year Plan (in Chinese), both delivered by Premier Lǐ Kèqiáng 李克强 last week at the opening of the Two Sessions, are expected to be passed this week and become the official guidelines for all levels of government.

Last week, we reported that the goal of 6% GDP growth, environmental protection, and crushing dissent in Hong Kong were the main stories from the Two Sessions. The Work Report and Five Year Plan offer more specifics, especially as it pertains to the economy. Technological innovation, regulations on internet and fintech companies, and energy reform have been the top priorities.

1. Lots of money coming for science and technology

For the first time in history, China has a whole chapter in the five year plan dedicated to technology. “Science and technology innovation” are frequently mentioned on both documents. The 14th Five Year Plan also contains the Vision 2035 development strategy, a road map for China’s ambition to become a “leading innovation nation” (进入创新型国家前列) by 2035.

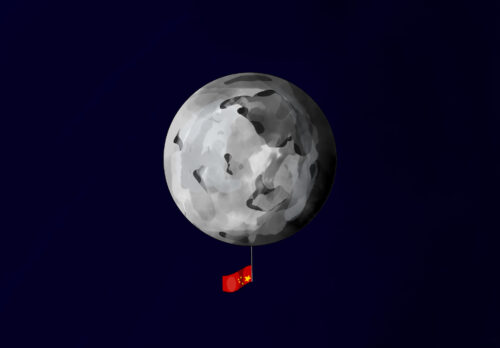

Under the five year plan and Vision 2035, China will invest resources and introduce policies to build the state’s technology power and promote innovation in fields like artificial intelligence, quantum computing, integrated circuits, brain science, as well as space and deep sea exploration.

Boosting the country’s research and development (R&D) capability and quality is the key: The 14th Five Year Plan promises a 7% annual increase in the country’s total R&D spending. China spent 2.4% of the country’s GDP on R&D in 2020, short of the U.S.’s 2.7%. As part of this effort, the authorities will offer further tax cut benefits for companies that invest in R&D.

But the central government is also concerned about the “development quality” of government incentivized innovation. The head of China’s Ministry of Industry and Information Technology, Xiāo Yǎqìng 肖亚庆, warned against (in Chinese) “blind and repetitive” capacity building for new strategic industries such as chip manufacturing and 5G, which has led to company bankruptcies and waste of state resources.

2. Bad news for Jack Ma: harsher regulations on tech giants and fintech firms

Chinese internet giants had a tough year in 2020 facing the government’s increasing scrutiny. 2021 won’t be any easier.

The Government Report for the first time included goals for strengthening anti-monopoly efforts and preventing “unregulated expansion of capital.” The report comes after a series of government actions against internet companies’ over-competitive behaviors, including issuing maximum fines over the price war among group buying platforms backed by tech giants including Alibaba, Tencent, ByteDance, and Meituan earlier this month.

Fintech companies have especially been at the forefront of Beijing’s crackdown on Big Tech. The authorities halted the mega IPO of Alibaba’s fintech arm Ant Group last November, and JD.com’s fintech unit JD Technology is also reportedly planning to withdraw its public offering application amid tightening regulatory environment.

Financial technology companies are expected to face more regulatory scrutiny in 2021, according to the Government Work Report. “We will strengthen regulation over financial holding companies and financial technology to ensure that financial innovations are made under prudent regulation,” the report said, noting that China is determined to control financial risks.

Financial stability is also a priority for the 14th Five Year Plan, and China pledged to explore and improve the regulatory framework for fintech firms in the next five years.

Big Tech will also encounter more government oversight in content moderation, i.e. censorship. The Government Report said the authorities will impose more efforts to “ensure the quality of online content” and “cultivate a positive and healthy online culture.”

3. First energy plan after Xi Jinping’s 2060 carbon neutral promise

China is now the world’s largest greenhouse gas emitter. Xí Jìnpíng 习近平 last year pledged that China would be reaching carbon neutrality by 2060, and China promised to hit peak carbon emissions by 2030. The five year plan is supposed to serve as a step-by-step driving force for the country’s climate goals. But the latest energy strategy shows that China’s is still at an early stage on its way to cutting the use of coal, currently its major power source, and other fossil fuels.

In fact, the 14th Five Year Plan has put more focus on energy security and ensuring the country’s power supply, aiming to reduce China’s reliance on foreign sources for coal, crude oil, and natural gas. As part of these efforts, China will increase domestic production of oil and gas.

But there are clear plans for clean power: China has set the target of having 20% of its energy come from non-fossil fuel sources by 2025, up from 15.3 percent in 2020. To achieve this goal, China will largely count on hydro and nuclear power.

The 14th Five Year Plan outlined targets of building hydropower stations in the southwestern area, and building more nuclear power plants in coastal regions. The plan has set the target of building nuclear power capacities that can produce 70 gigawatts (GW) of power by 2025, up from its 58 GW target for the previous five years. China failed to meet the goal with about 5GW short in 2020.