Mayhem in China’s semiconductor industry as ‘chips madmen’ are arrested

Years of government spending on semiconductors seem to have only led to massively expensive failed projects and chief executives in jail.

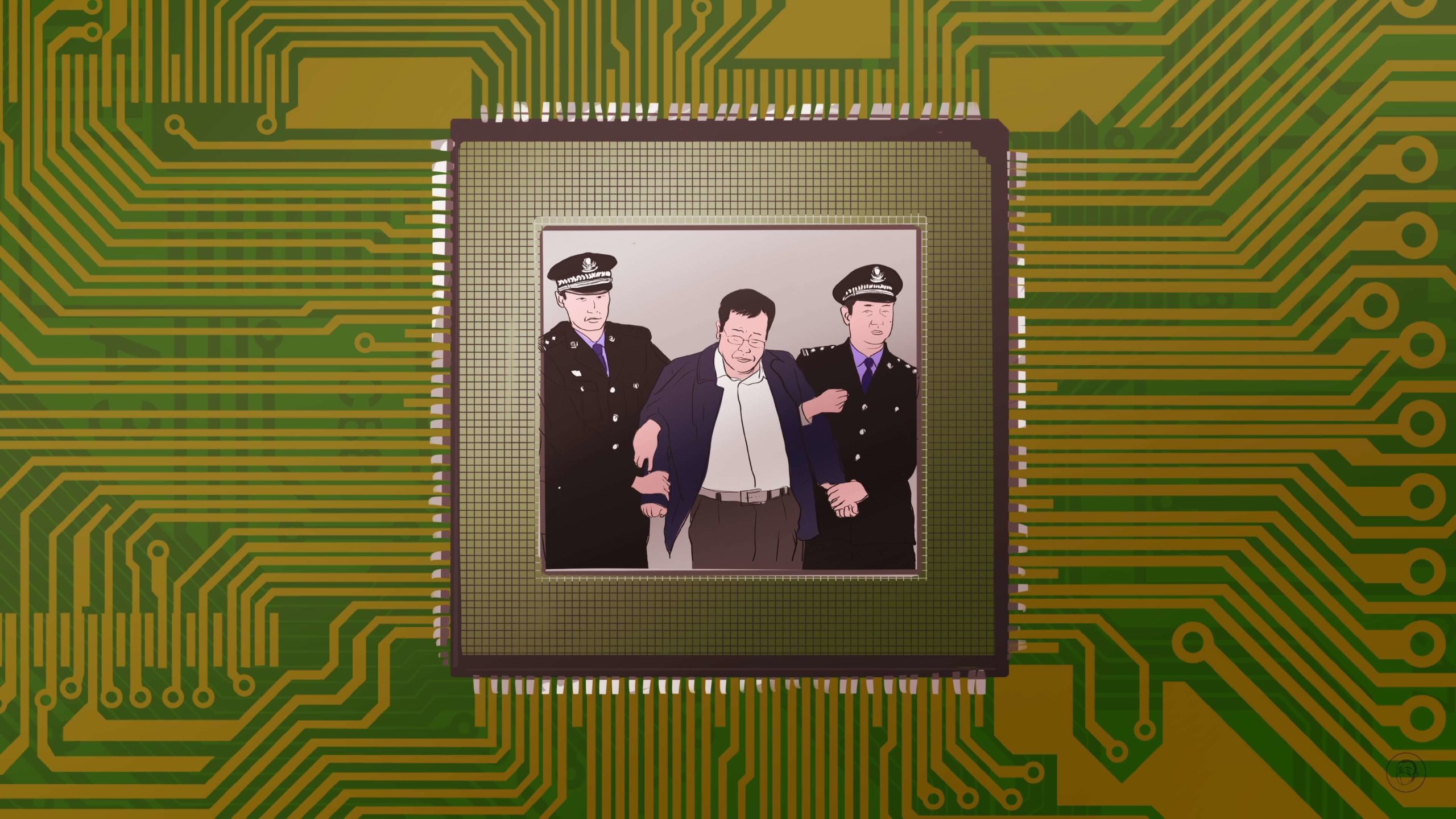

In mid-July, Zhào Wěiguó 赵伟国 (who had previously made a fortune in the real estate industry in Xinjiang), the former chairperson of Tsinghua Unigroup 紫光集团, once the largest supplier of mobile phone SIM card chips in China, was taken away by police from his home in Beijing, and has been incommunicado since then. Tsinghua Unigroup, known as China’s “microchip aircraft carrier,” has been publicly in trouble since July 2021 when it announced that it could not repay some of its large debts.

During his 13 years in charge from 2009 to July 2022, Zhao built Tsinghua Unigroup into a giant microchip enterprise by means of mergers and acquisitions, increasing the company’s assets from 1.3 billion yuan ($192.73 million) to a peak of 297.8 billion ($44.15 billion) in 2019, becoming China’s largest integrated microchip company. From 2013 to 2019, Tsinghua Unigroup spent vast sums of money to acquire more than 20 companies, giving Zhao Weiguo the reputation of “chip madman” in the industry, but this aggressive expansion was also in line with government policies to minimize China’s dependence on imported chips. However, the rapid expansion was made possible by massive borrowing, and Tsinghua Unigroup finally declared itself bankrupt in July 2021, when a reorganization of the company commenced.

Tsinghua Unigroup’s reorganization was completed a few days before Zhao was arrested, and his arrest may have been related to his very public dissatisfaction with the reorganization, which he believed vastly undervalued the company. Zhao made public statements to the effect that officials involved with the reorganization of Tsinghua Unigroup had embezzled state-owned assets.

Several arrests at the “national chip fund”

Many of Tsinghua Unigroup’s mergers and acquisitions were supported by the National Integrated Circuit Industry Investment Fund 国家集成电路产业投资基金股份, known as the “national chip fund,” which has seen several of its officials join the recent series of microchip arrests.

The 100 billion yuan ($14.82 billion) national chip fund was established in 2014, with Tsinghua Unigroup as one of the main beneficiaries: From 2018 to 2021, the fund invested more than 54.5 billion ($8.07 billion) in the company. Already in November last year, Gāo Sōngtāo 高松涛, the former vice president of Sino-Ic Capital 华芯投资管理, a subsidiary of China Development Bank 国家开发银行, which managed the national chip fund, was arrested. A new series of arrests kicked off on July 17 this year when an investigation was announced into Lù Jūn 路军, the former president of Sino-Ic Capital. No official explanation has been provided for the arrests of Gao and Lu, but as both held leading positions in the national chip fund, the media has speculated about their links with Zhao Weiguo and Tsinghua Unigroup.

On July 28, there was another high-profile arrest related to the chip fund when the fund’s former president, Dīng Wénwǔ 丁文武, was detained by police. During his tenure, Ding once remarked in a speech that the situation in the microchip industry is so good that “anyone not making money is a fool.” Then, on Friday last week, Wáng Wénzhōng 王文忠, a partner of the national chip fund based in Shenzhen, was also arrested.

The context

The context of the fall of the “microchip madmen” is a period of breakneck expansion in China’s microchip industry, and a global shortage of microchips that has made this industry a geopolitical battleground. In 2014, around the time when the national chip fund was launched, the State Council issued a chip industry promotion plan, dubbed by the media as the microchip “Great Leap Forward,” along with a total planned investment of 9.5 trillion yuan ($1.40 trillion) in microchip research and development over five years.

A headlong stampede of companies into the microchip industry followed. According to a survey by state media, over the period of January 1 to October 27, 2020, no fewer than 58,000 microchip companies were established in China, equivalent to about 200 new companies every day, some even without any microchip experience or technology. Large-scale microchip projects were launched at a cost of billions of yuan, but many of these projects were never completed:

- From 2019 to 2020, for example, seven large semiconductor silicon wafer manufacturing companies were launched, but these companies never got off the ground and did not produce a single wafer.

- A typical example was the Hongxin Semiconductor Industrial Park that was launched in Wuhan, Hubei Province, in 2018. In 2020, it was announced that the project was on the brink of collapse due to a lack of funding, and in 2021 — after an investment of 128 billion yuan ($18.97 billion) — the site was derelict.

The national chip fund operated at the center of these shady dealings. According to one insider source, in the early years of the fund’s large microchip investments, the construction cost of a microchip factory amounted to no more than 200 million yuan ($29.65 million), but later, this amount had ballooned to nearly 2 billion yuan ($296.50 million), with little indication as to where the vast sums ended up.

The takeaway

China’s microchip Great Leap Forward to increase China’s self-sufficiency of this vital component took on a parallel of the original Great Leap Forward, with a mad rush ending in an uncoordinated failure.

The question now is how much of a setback the years of chaos have been for an industry that the government sees as a top priority.