This is the state of play at Huawei under sanctions

The giant telecommunications equipment maker is counting on China’s growing indigenous microchip industry to support an ambitious attempt at diversification into new lines of business shielded from U.S. export controls.

Founded in 1987, Huawei, the telecommunications equipment maker based in Shenzhen, China, leads the global market in infrastructure for fifth-generation (5G) wireless technology and was also, until recently, the largest maker of mobile phones on the planet. But now U.S. government sanctions make it tough to even use a Huawei phone in America.

The U.S. sanctions squeezed Huawei’s nearly 20% share of the world’s mobile phone handset market in 2020 — surpassing both Apple and Samsung — down to a mere 4% in 2022. The sanctions effectively cut Huawei off from computer chips made using U.S. software and tools, which account for the bulk of the world’s supply. This has meant that Huawei’s most recent phones are not able to connect to 5G networks, nor are they able to use Google’s Android operating system or access any of its suite of popular applications such as Maps.

These are some of the many roadblocks to which Huawei, which declined to comment for this story, is currently engineering solutions, chiefly by pivoting to new lines of business to get the company growing again.

Reasons for the restrictions leveled against Huawei ranged from evidence that the company was dealing with Iran (counter to U.S. sanctions on that country) to fears that the Chinese Communist Party was able to conduct espionage through Huawei’s networks. The company denied all allegations.

Huawei’s advances in 5G — it is still the market leader in 5G base stations globally — undeniably played a part in raising U.S. concerns about Chinese involvement in developing global critical infrastructure.

Huawei’s embattled position shows up in the numbers. In 2022, its working capital was around $50 billion, but revenue of around $92 billion was well below the 2020 peak of around $140 billion. Moreover, the 2022 net profit of just over $5 billion was way below the nearly $18 billion netted in 2021.

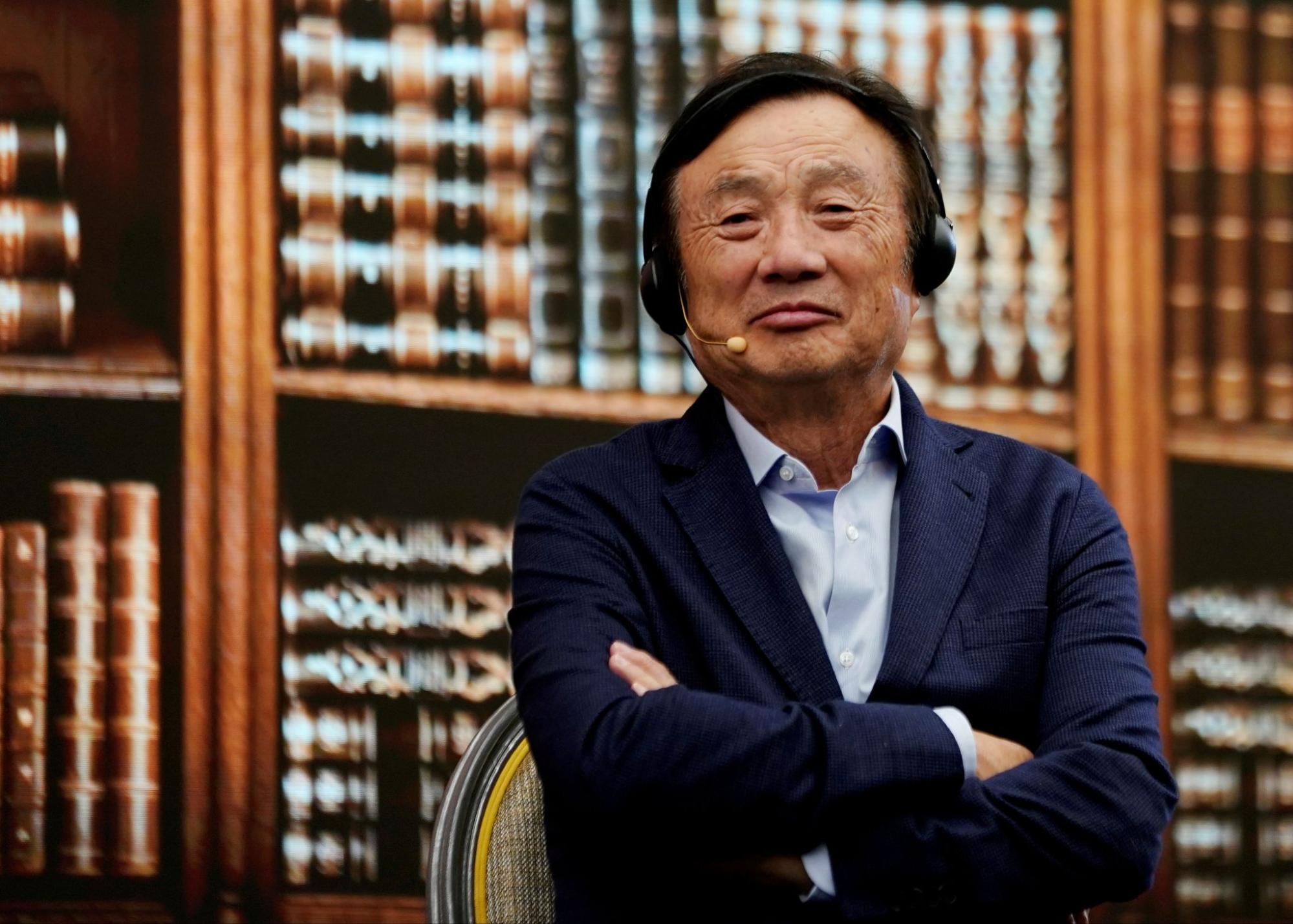

Huawei founder Rén Zhèngfēi 任正非 warned in August 2022 that everyone in the firm would feel the sanctions’ chill. Huawei’s current rotating chairman, Eric Xu (徐直军 Xú Zhíjūn), acknowledged that the sanctions presented a “challenging external environment,” filled with “non-market factors” affecting Huawei’s business.

But in the company’s annual report of March 31, 2023, Xu also said that Huawei is “like a plum blossom” that “grows sweeter from a harsh winter’s freeze.”

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

R&D is key

Florid rhetoric aside, Huawei is undergoing an enormous transition that puts research and development at the center. In 2022, the firm invested a quarter of its $92 billion revenue in R&D, more than Apple, and more than the Chinese tech giants Alibaba, Tencent, and Baidu combined. Microsoft, Meta, and Alphabet/Google both spent more than Huawei in R&D in 2022.

While other Chinese companies have decided to focus only on older-generation tech not subject to the effects of the U.S. export controls, Huawei’s R&D is trying to develop cutting-edge tech that will skirt the sanctions by stamping out a long-standing dependence on U.S. chips.

Huawei “believes that they’re going to crack the code sometime down the road,” tech analyst Lu Xiaomeng told The China Project.

“Doubling down on R&D is in line with the effort to find a new core business model to focus on,” said Lu, the director of geo-technology in the New York office of Eurasia Group, a political risk consultancy.

Huawei is more likely to succeed in business-to-business markets, and in the servicing of Chinese government contracts for automobiles or cloud infrastructure for IT systems, Lu said. As for consumer markets around the world, these days, “it’s harder for them to compete,” she explained.

Huawei already services contracts with the European Union, from which it receives funding to research next-generation (6G) technologies and cloud computing, despite having been barred from accessing the telecom networks of several governments in the bloc.

However, an EU Commission announcement on June 15 indicated that the bloc wants to further restrict Huawei’s network infrastructure across its 27 member states.

On October 7, 2022, the U.S. Department of Commerce barred the export to China of high-end semiconductor technology over concerns that it could end up in military applications. Being effectively cut off from access to the world’s tiniest and most advanced technology caused a push by China to bring the entire semiconductor supply chain inside its borders.

Can Huawei diversify?

Some believe that sanctions will drive Chinese innovation. But an industry-wide process of indigenization will take years. When it comes to developing electronic design automation tools used to make microchips, Huawei is “trying to reinvent the wheel by themselves,” Lu said. “I think that’s very difficult to crack. It’s a market that is very capital intensive, and with a high failure rate.”

For Huawei, there aren’t that many lines of business beyond handsets that are quickly scalable and can maintain high profit margins. Consider HarmonyOS, Huawei’s in-house operating system, for instance.

“It’s a sunk cost,” analyst Paul Triolo, the senior VP for China and the tech policy lead for Albright Stonebridge Group, told The China Project. “They still haven’t figured out how to monetize it.”

Nevertheless, the company has already made some breakthroughs as it attempts to engineer U.S.-reliant technology out of its products.

On the software side, Huawei has made some gains. In April, the company launched an integrated software called Enterprise Resource Planning to manage its business processes across all segments of the giant firm.

On the hardware side, in February 2023, founder Ren told students gathered at the prestigious Shanghai Jiaotong University that Huawei had completed the development of over 13,000 components and 4,000 circuit board parts, all without reliance upon American technology.

Huawei is also diversifying its portfolio, focusing on 20 industries such as transportation infrastructure, autonomous vehicles, ports, mining, finance, education, and healthcare. For most of these, Huawei is largely reliant on partners in each sector, to whom it supplies its technology. By its own count, Huawei’s global partners comprise over half of the Fortune 500.

Most of these ventures are under the umbrella of the industrial internet of things. Huawei’s expertise in 5G and its forays into cloud services position the firm to capitalize on the transition to an increasingly digitally integrated world.

But Triolo was skeptical about the transition. The new, diversified business model, he said, “is a little more challenging for [Huawei] to figure out how to make money on all of these things sustainably over time.”

Locked out

Huawei makes and maintains critical telecommunications infrastructure around the world. U.S. industry sees it as a threat, and the American government treats Huawei and China with suspicion.

The sanctions by the U.S. have come in waves, but it was the May 2019 U.S. Department of Commerce placing of Huawei and 68 affiliates on its Entity List that stung the most. The move barred the Chinese firm from buying critical U.S. goods and technology. American tech firms lost one of their largest customers. The willingness of the administration of former president Donald Trump to accept these costs was a “turning point in the relationship,” according to Susan Shirk in her book Overreach: How China Derailed Its Peaceful Rise.

Triolo said the DOC’s blacklisting of Huawei was a significant moment: “You remember where you were that day.”

In spite of the sanctions, 113 applications by U.S. suppliers to ship tech to Huawei were approved from November 2020 to April 2021, accounting for $61 billion in potential business.

“There are folks on [Capitol Hill] who have been very annoyed that export licenses were still being granted,” Emily Kilcrease, a senior fellow at the Washington, D.C., think tank Center for New American Security, told The China Project.

Financial historian Niall Ferguson has argued that the “net effect of American economic sanctions, dating back as far as 1979, has been to drive China, Russia, and Iran together.”

Indeed, only one in three sanctions has achieved “even moderate success,” according to a historical survey from the Peterson Institute think tank.

America’s fearful fail?

American fears that the Chinese government spies on the U.S. through Huawei’s products and that the company is an arm of the Chinese Communist Party don’t stand up to scrutiny, Triolo said: “The concern is more a future one, about what might happen further down the line.”

Leaning into that fear and “abusing U.S. financial power by wielding sanctions too often will only hasten China’s independence from Western financial leverage,” wrote Rush Doshi — U.S. President Joe Biden’s China director on the National Security Council — in a paper comparing Huawei’s predicament with the telecommunications rivalry between Imperial Germany and Great Britain.

Sure enough, in March, striking a note of indigenization, Huawei’s Chairman Eric Xu pledged to “render our support to all self-saving, self-strengthening, and self-reliance efforts of the Chinese semiconductor industry.”

Even if Huawei asserts its independence from the Chinese state, it will be eyed with suspicion by some U.S. lawmakers.

“I don’t think it matters much whether Huawei is state-owned,” Donald Clarke, a specialist in Chinese law at the George Washington University Law School, told The China Project. “The important question is whether it can be independent of the state. China’s political system is Leninist and does not admit, in principle, of institutions being independent of the state.”

Solutions to Huawei’s problems “can only come from changes to [China’s] broader political ecosystem,” wrote Colin Hawes, an associate professor of law at the University of Technology, Sydney, in his detailed research on the company’s ownership structure. “Fears of China (and Huawei) amongst the U.S. and its allies will only subside if the Chinese government introduces some fundamental political changes itself.”

As Clarke sees it, the key questions for U.S. policymakers are: “First, is what [Huawei is] supplying to my country critical infrastructure? Second, if they were given an order from their government to compromise the equipment in a way that’s dangerous to national security, would they? And third, is there a non-trivial chance their government would give them such an order?

“I believe that the answer to all of those questions is yes,” Clarke said.

Down, not out

Huawei is keen to stress its resilience. In May 2023, speaking at a Huawei factory in Dongguan in front of an array of banners referencing the Long March, Tao Jingwen, a member of Huawei’s board of directors, enthused, “We have broken through the blockade and survived!”

The company has reached a critical juncture, and its future is unclear. Chairman Eric Xu hopes that Huawei’s bets on R&D around new lines of business in the industrial internet of things will prove prescient. If China is able to make more of its own semiconductors, then Huawei’s strategy just might produce the sweet plums Xu hopes will ripen after the chill of U.S. sanctions fades.

Companies:

Sources and additional data:

- Corporate Information / Huawei

- Huawei 2022 Annual Report / Huawei

- Washington wants to completely cut Huawei off from U.S. suppliers / The China Project

- Winter is coming for Huawei’s car business / The China Project

- The U.S.-China tech battle from inside ZTE / The China Project

- 彻底断供?美国或再打击华为,影响几何?_业务_制裁 / Sohu

- 美国政府考虑彻底断供华为,影响几何?-虎嗅网 / Huxiu

- 美对华为新一轮制裁政策跟踪及应对策略建议 / CWW

- 深瞳丨对华为制裁再度加码 美国霸权“绊”不倒中国科技企业 / STDaily

- “我们活了下来!” 华为面对美国制裁,走向本土化 / FT

- 美国的严厉制裁下,在5G的年代,华为推出4G手机 / VOA

- Gallagher, Colleagues Introduce Bipartisan Bill to Freeze Huawei from U.S. Financial System / U.S. Congress

- Beijing’s Bismarckian Ghosts: How Great Powers Compete Economically / Washington Quarterly

- Colin Hawes (2020). Why is Huawei’s ownership so strange? A case study of the Chinese corporate and socio-political ecosystem / Journal of Corporate Law Studies

- Tim Ruhlig (2020) Who Controls Huawei? / Swedish Institute for International Affairs

- Who Owns Huawei? by Christopher Balding, Donald C. Clarke

- Sanctions by the Numbers: SDN, CMIC, and Entity List Designations on China / CNAS

- Is China’s Huawei a Threat to U.S. National Security? / CFR

- 23-1 Industrial policy for electric – vehicle supply chains and the US-EU fight over the Inflation Reduction Act / PIIE

- Running on Ice: China’s Chipmakers in a Post-October 7 World / Rhodium Group

- China’s New Strategy for Waging the Microchip Tech War / CSIS

- An Overview of Global Cloud Competition / CSIS

- China’s Huawei looks to ports, factories to rebuild sales / Asahi Shimbun

- New rules curbing US investment in China will be tricky to implement / PIIE

- Export controls against Russia are working—with the help of China / PIIE

- All countries spy, says ex-Huawei director Sir Ken Olisa / The Times

- Seagate to pay $300 million for violating export restrictions on China’s Huawei / WSJ

- The Huawei Moment / CSET

- FCC faces long road in stripping Chinese tech from US telecom networks – Center for Security and Emerging Technology / CSET

- China has equipment that can spy on us in our telecommunications networks. We must remove it now / The Hill

- Congress called Huawei a national security risk — it’s still in US networks / The Verge

- Huawei declares return to normal operations in 2023 despite ongoing restrictions / TechNode

- Christopher Marquis on Mao’s Influence Over China’s Economy / The Wire China

- The Economic Costs of America’s Conflict with China / The Wire China

- What Huawei’s CEO Thinks of America – by Irene Zhang / Chinatalk

- Would You Pay $1,000 for a Smartphone Without 5G? Huawei Thinks So / WSJ

- Bipartisanship Is Dead. Except on China / Bloomberg