China bulls lose a boatload of money on Alibaba, on paper

Some investors remain sanguine as Alibaba and other Chinese internet stocks continue to tank.

The ongoing crackdown on Chinese internet companies has hit their share prices hard. One of the worst affected has been ecommerce giant Alibaba, whose slapdown — the suspension of the IPO of its fintech arm, Ant Group — began the government’s season of scrutiny against Chinese Big Tech.

Alibaba’s New York–listed shares have fallen by more than 25% since June, which has caused huge paper losses for a number of prominent investors, per MarketWatch:

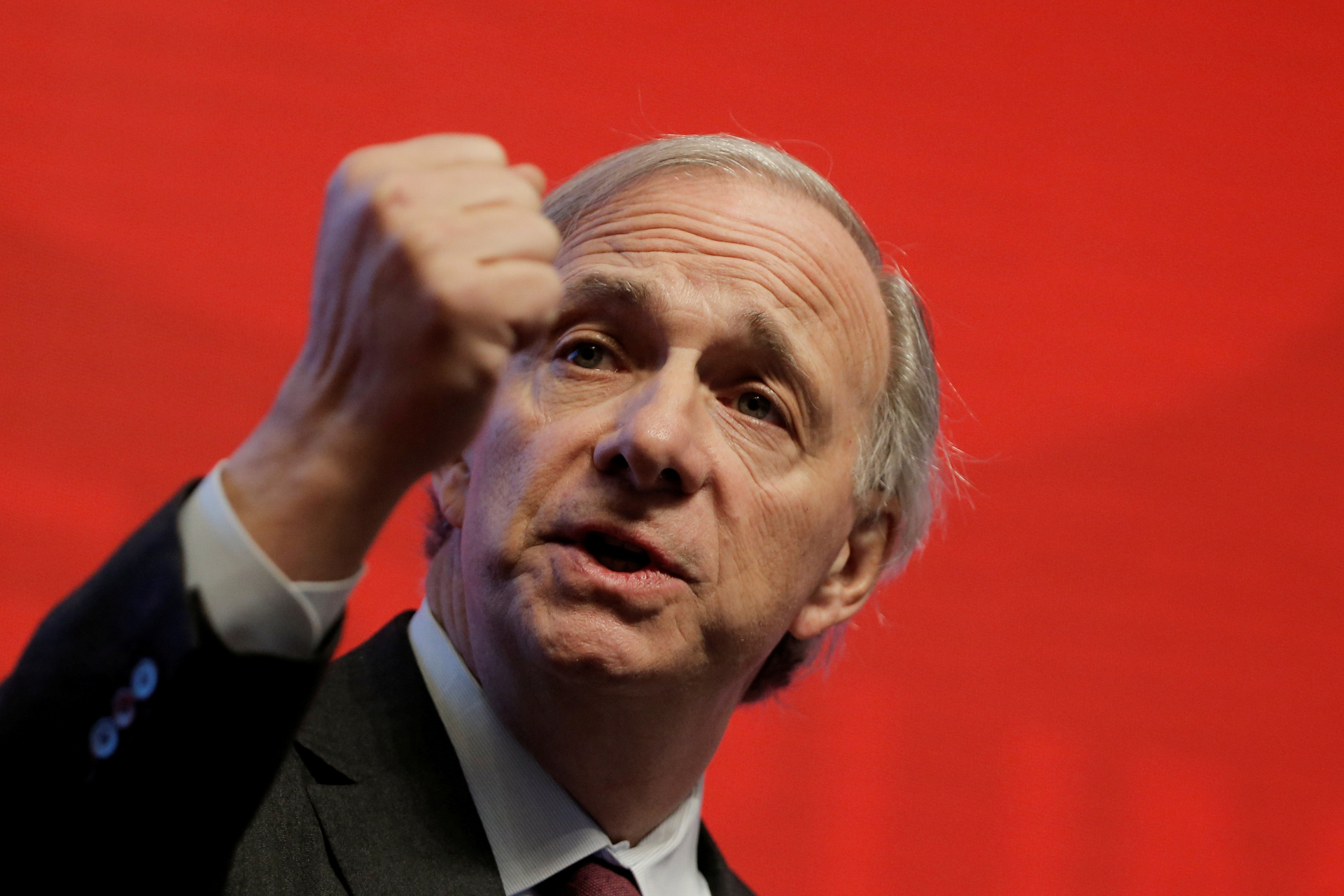

Ray Dalio, Warren Buffett’s right-hand man, Charlie Munger, Ken Fisher, former U.S. vice president Al Gore, and five other notable investors and their funds “potentially saw $1.4 billion wiped off the combined value of their Alibaba holdings.”

- Dalio and Fisher seem unfazed: Both have recently published opinion pieces affirming their faith in their China investments, with Fisher blaming “hysterical Western pundits” for the sell-off, and Dalio saying China’s crackdown is “confusing to people who are not close to what’s happening.”

- Dalio has been publicly sanguine about the crackdown since it began with the Ant Group fiasco last year.

Meanwhile, search giant Baidu has sold $1 billion of bonds. “It was the first major debt fundraising by a Chinese tech firm since the latest onslaught of regulatory actions that began in July, and its success should give other issuers confidence there is still significant global investor interest in Chinese deals, bankers said,” reports Reuters.