Adidas just can’t do it in China anymore

As Adrian Siu attempts to save Adidas’s business in China with data analysis and cultural promotion activities, the company with the faded reputation is trying to swim against the (red) tide.

On November 9, global sportswear brand Adidas announced its financial results for the third quarter, and it’s clear that there is a big China-sized hole in the company’s performance.

In euro terms, overall revenue in the third quarter grew by 11% year-on-year to 6.40 billion euros ($6.66 billion or 46.77 billion yuan). In fact, Adidas reported revenue growth across the globe, except in “Greater China” (which it defines as China, including Hong Kong and Macao, plus Taiwan):

- In Europe, the Middle East, and Africa (EMEA), the region with the highest revenue at 2.46 billion euros (17.97 billion yuan), revenue grew by 7.4% despite the loss of revenue in Russia of more than 100 million euros (729.88 million yuan).

- Revenue in North America grew by 8.2%, Asia Pacific grew by 14.6%, and Latin America grew by a full 50.6%.

- Greater China, however, was the fly in the ointment, with revenue decreasing by 26.6%, from 1.15 billion euros (8.43 billion yuan) a year ago to 937 million euros (6.83 billion yuan).

Adidas ascribed the poor performance in China to the “challenging market environment,” mainly related to COVID restrictions, but the company also mentioned a high amount of product takebacks in China that significantly reduced revenue. This refers to old products being returned to the manufacturing process because they have not sold or for other reasons. Adidas is also facing very high inventory levels “due to the pressure on the passenger flow trend in Greater China,” where the inventory in the third quarter increased by 63% year-on-year.

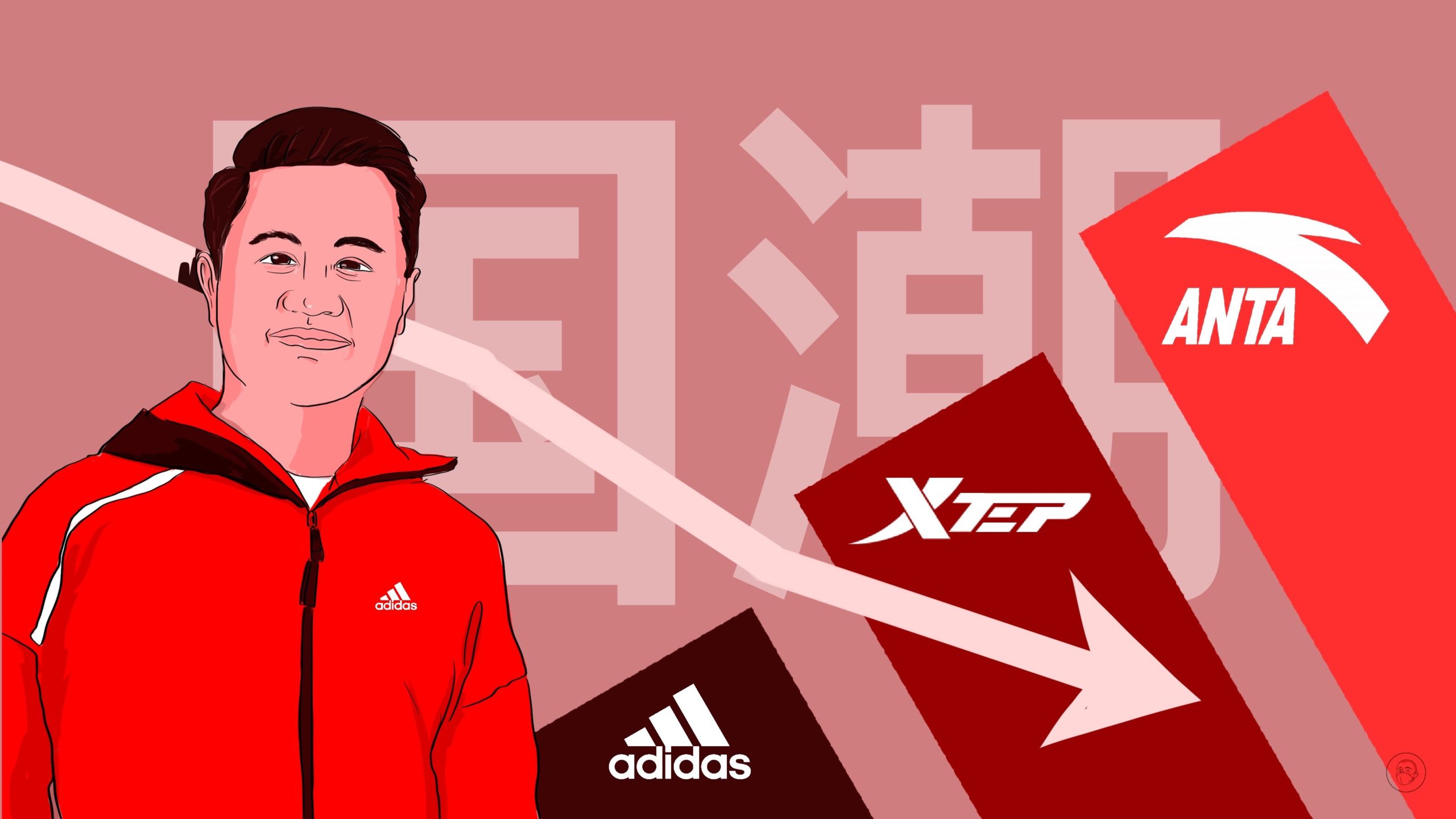

In fact, in China, Adidas is simply no longer on the winners’ podium. In August, local champion Anta Sports became the biggest sportswear brand in China when it reported revenue of 25.96 billion yuan ($3.79 billion) for the first half of the year, an increase of 13.8% year-on-year, for the first time surpassing Nike’s revenue in China of $3.7 billion. Another local brand, Li-Ning, reported revenue over the same period of 12.40 billion yuan ($1.76 billion), while Adidas reported China revenue of 12.19 billion yuan ($1.72 billion). Thus, Adidas has fallen to fourth place in China. Up to the third quarter of 2022, Adidas has had negative sales growth in China for six consecutive quarters.

Much of the explanation for Adidas’s gradual regression in China rests on the company’s own head. Adidas entered China in 1997, and for most of the time since then, was seen as a trendy and often difficult to get brand, best known for sneakers such as the Nomad (NMD) series, which launched in late 2015. But with the increase in production and inventory, and wider distribution in China, these shoes have lost much of their cachet.

In China, up to the end of 2019, everything seemed to be going well for Adidas: The company had achieved 23 consecutive quarters of high sales growth, formed partnerships with various local art and design companies, and regularly launched new products for the China market.

From 2020, however, Adidas ran out of steam in China. One factor is that the company reduced its overall investment in research and development: From a peak of 187 million euros (1.36 billion yuan) in 2017, accounting for 0.9% of total revenue, research and development costs have fallen year by year, reaching 130 million euros (94.88 million yuan) in 2021, accounting for 0.6% of total revenue.

If you can’t beat ’em, join ’em

Nevertheless, Adidas in China has a man with a plan. In April, Adrian Siu (萧家乐 Xiāo Jiālè) became the managing director for Greater China. From the time he first joined Adidas in 2002 as sales director in Hong Kong, Siu has steadily risen through the ranks: In 2009, he was promoted to managing director in Hong Kong; in 2011, he became regional manager for southern China; and in 2016, he became deputy director for Greater China. But then, in September 2019, Siu left Adidas to become CEO at Cosmo Lady, China’s largest underwear manufacturer.

Now he’s back, and he’s ready to turn the ship around. His comments to the Chinese media recently have been replete with sporting analogies. According to Siu, the development of Adidas in China is a marathon, not a sprint, and there are times when the company needs to take a rest, slow down, adjust, and prepare for the next race. The important thing is to keep improving and to do better next time, and take a better road.

Siu has a plan, and he has already started to implement it. It essentially comes down to localization and better integration in the Chinese market, and a better understanding of local consumers:

- Over the next few years, according to Siu, the proportion of “Made in China” products will account for a third of all Adidas’s products in China. In the context of China’s “national fashion culture,” as Siu put it, he conceded that Adidas’s products have not properly absorbed these fresh elements.

- To improve the company’s understanding and engagement of local consumers, Adidas has just launched a partnership with the China Literature and Art Foundation, with the signing ceremony taking place in Beijing on November 5. By means of this partnership, Adidas will carry out cultural activities for the development of sport in China, and “tell Chinese stories to the world.” Importantly for Adidas, with this partnership, the company will gain access to Chinese campuses and young people.

- Siu also revealed that Adidas has established a data center in China “with a lot of big data” that can provide the company with deeper insights into consumer needs, such as “what colors they like, and what materials and fabrics they like.”

- Under Siu’s leadership, Adidas is also planning to expand online and offline sales channels: Online, the company is implementing an “omni-channel layout” with channels on Tmall, Taobao, JD.com, Douyin, and other platforms; offline, Adidas is planning to expand its various flagship stores in first- and second-tier cities to third- and fourth-tier cities.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Swimming against the (red) tide

Yet Adidas’s biggest problem in China is that it’s not Chinese, and there’s nothing Adrian Siu can do about that. With the rise of the “national tide” or “national fashion” (国潮 guócháo) trend in recent years, which emphasizes Chinese culture and support for domestic businesses, Chinese sportswear brands have risen relentlessly, while foreign brands like Adidas and Nike have declined inexorably.

The national tide was amplified by the fracas surrounding Xinjiang cotton in March 2021 when Western countries imposed sanctions on China over alleged human rights abuses in Xinjiang, which triggered a backlash and partial boycott of Western clothing brands in China that did real damage to Adidas.

On October 27, JD.com released data showing that from 2018 to 2021, the number of “national tide” merchants on its platforms in China increased by 240%, and the number of users who purchased “national tide” products increased by more than 90%, with sales increasing by 411% and the transaction value increasing by 284%.

If Adidas is in China for the long haul, as Siu stated, it might yet ride out the “national tide” storm, but the company’s prospects in China right now look bleak.