Electric flying cars are finally happening, but only for the few

Full commercialization of flying cars is finally set to become a reality with eVTOL aircraft, and EHang, Geely, and XPeng are at the head of the pack in China. But widespread adoption of the technology is still a long way off.

On Saturday, Hú Huázhì 胡华智, CEO and founder of the world’s first publicly traded flying car company, EHang 亿航智能, delivered his company’s results for the third quarter:

- Revenues were 8.22 million yuan ($1.70 million), a decrease of 36.6% year-over-year.

- The company made a net loss of 76.54 million yuan ($10.89 million), compared with a net loss of 72.25 million yuan ($10.28 million) in the same period last year.

- In the third quarter, EHang sold only four units of its EH216 Autonomous Aerial Vehicle (AAV), compared with eight units in the same time last year.

The EH216 is an electric vertical takeoff and landing (eVTOL) aircraft that makes use of electric power to take off, hover, and land vertically. It carries two passengers, has a maximum speed of 100 kilometers (62 miles) per hour, and a range of 35 kilometers (22 miles). It hardly seems to matter much that EHang is not profitable at all, because according to Hu Huazhi, the EH216 has entered the final stage of the airworthiness certification process with the Civil Aviation Administration of China (CAAC), i.e., the stage of Demonstration and Verification of Compliance. And besides, EHang has just received a credit line of 1 billion yuan ($142.31 million) from the Guangzhou branch of the Agricultural Bank of China 中国农业银行.

At the end of the airworthiness certification rainbow is a massive pot of gold: full commercialization. This would herald the start of the era of flying cars, or rather a more practical and affordable solution: eVTOL aircraft. Over the past few years, the EH216 AAV has completed more than 30,000 trial flights, conducted in China but also in Japan and Spain. And as Hu Huazhi pointed out in a speech at a CAAC forum in August, there has not been a single safety incident in all the test flights of the EH216.

In April 2021, EHang also released a plan with 100 air traffic routes, with an initial focus on the Guangdong, Hong Kong, and Macao area, and gradually expanding to other regions in China. EHang has reportedly already received 210 foreign orders for the EH216 and its two variants, the EH216F for firefighting, and the EH216L for logistics.

Flights of fancy

The EH216 eVTOL is the closest China has come to an actual fully certified flying car, but flying cars have always been the subject of wild economic projections. As long as there have been cars, there has been the idea of a flying car, but outside of fiction, these have usually elicited a fair amount of derision. Nevertheless, the latest economic projections for the flying car industry, or rather the urban air mobility (UAM) industry, is just as wild. In 2018, the bank Morgan Stanley projected that the UAM/eVTOL industry could be worth $1.5 trillion by 2040, or even as much as $2.9 trillion. In 2020, management consulting firm Roland Berger projected that there will be 160,000 commercial air taxis in the air by 2050, when the UAM passenger industry will generate revenue of almost $90 billion per year.

Certainly, the UAM market is now flooded by a huge number of new entrants that are basically divided into two groups: startups and traditional aircraft and auto companies. By the end of 2021, there were at least 200 companies around the world developing about 420 types of flying cars. As of September 2022, these companies included Boeing, Airbus, Bell, Embraer, Toyota, Audi, Daimler, Porsche, GM, Tesla, Hyundai, and in China, the auto companies XPeng 小鹏汽车, Geely 吉利, and Great Wall Motor 长城汽车, along with several startups like EHang, Zhuhai Xiangyi Aviation Technology 珠海翔翼航空技术, Accel Flight Simulation 安胜飞行模拟系统, and Volant 沃兰特航空技术. Even the large tech giants have gotten in on the act: Tencent 腾讯 invested in Lilium, a German flying car company, and Google co-founder Larry Page invested in the company Kittyhawk (although this company folded in September 2022).

In 2009, the U.S. startup Terrafugia successfully completed the first test flight of a flying car, and the company was acquired by Geely in 2017. In 2020, Geely launched Aerofugia 沃飞长空, a subsidiary focused on unmanned aerial vehicles (UAVs), and in September 2021, Aerofugia established a joint venture with the German startup Volocopter to develop the UAM industry in China. In June 2020, Terrafugia unveiled a prototype of its TF-2 eVTOL five-seat flying car.

In 2013, electric vehicle (EV) brand XPeng established XPeng AeroHT 小鹏汇天飞行汽车 to develop flying cars, and in October 2021, AeroHT receiving massive financing of $500 million. On its website, AeroHT now describes itself as “the largest flying car company in Asia.” In October, the AeroHT X2, a two-seat eVTOL aircraft with eight propellers, completed its first test flight in Dubai. At the end of October, the AeroHT X3, a two-ton aircraft that has the appearance of a car with four double rotors attached, made its first test flight. In July 2022, AeroHT announced that trial production lines have been completed for the X2 and X3, and the company plans to start mass production in 2024. The X2 will be priced at around $126,000–236,000, while the X3 will have a price tag of less than 1 million yuan ($142,314).

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Hard realities

When the X3 was launched in October, it elicited widespread ridicule on the Chinese internet: If this was what a “flying car” looks like, it appeared to be just a normal car with four huge propellers. Indeed, the flying car industry seems all set for takeoff in the form of eVTOL aircraft, but there are still some basic problems to solve.

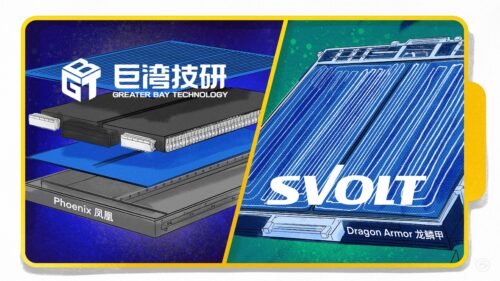

The current level of battery technology is not yet up to the task. Current eVTOL aircraft are very small and can travel only short distances because to produce anything larger would require lithium-ion batteries with an energy density of 400–600 watt-hour (Wh) per kilogram. At the present, BYD’s 比亚迪 most advanced battery has a density of 219 Wh per kilogram, and CATL’s 宁德时代 latest Qilin battery has an energy density of 255 Wh per kilogram. Once the battery’s energy density reaches 400 Wh per kilogram, however, eVTOLs will be able to travel 300 kilometers (186 miles), and with 600 Wh per kilogram, they will be able to travel 400 kilometers (248 miles).

There is also still no clear consensus on the best configuration for an eVTOL. In essence, the question revolves around whether they should be more like cars that can fly or aircraft that can drive. Current eVTOLs are mainly divided into aircraft with a composite wing design, and those with multiple rotors or tilted rotors. Then, of course, there is still the lack of an eVTOL airworthiness certificate, though EHang now claims to be close to getting one in China.

With or without airworthiness certificates, Chinese companies like Geely and XPeng plan to start eVTOL mass production in 2024–2025, along with several foreign competitors. What will they be used for?

Logistics and disaster relief are likely to be the early applications, but soon after that, the flying cars will likely be used for the transportation of small numbers of people over short distances. Large-scale inter-city transportation is still a ways off. In terms of a potential timetable, before 2030, flying cars will mainly be operated in preliminary demonstrations; from 2030 to 2050, they will gradually enter the era of commercial operation; after 2050, the urban air mobility (UAM) industry will come into its own.

By that time, the battery technology will have reached the stage of facilitating larger eVTOLs, and flying cars will be a practical reality. Until then, however, large-scale adoption of the technology remains the stuff of dreams.